Chinese automakers and chip companies are racing to replace products from Nvidia and other foreign chip leaders for automotive applications amid fears further US export restrictions could derail development of self-driving and other technologies.

Xpeng and Nio, two emerging car companies supplied by Nvidia, are cutting their reliance on the US artificial intelligence titan by developing their own chips for smart driving. Both companies used in-house chips—the Turing for Xpeng and the Shenji NX9031 for Nio—in their latest models.

Chinese chip developers like Horizon Robotics, Huawei’s HiSilicon, Black Sesame, SemiDrive, and SiEngine Technology are also gaining traction, winning over more domestic automakers as customers, according to industry executives. At least ten emerging and established chipmakers in China have identified the automotive market as their primary focus, according to Nikkei Asia‘s analysis of government documents and interviews:

- Chongqing Xinlian Microelectronics, commonly known as XLMEC, is focused on specialty microcontrollers and power management chips for the automotive industry and says it is building a “world-class car chip maker.”

- United Nova Technology said its power discretes, used to regulate power supplies, are already internationally competitive and the company is already one of the leading players in Asia by capacity.

- Guangzhou CanSemi Technology, whose investors include GAC Motor, is also targeting automotive-grade chip production.

- Shanghai Dingtai Jiangxin Technology, known as WingSkySemi, said its automotive semiconductor production line meets global standards and is qualified by Bosch.

China’s top contract chipmaker, Semiconductor Manufacturing International Corporation (SMIC) is also benefiting from the trend. Making chips for automotive and industrial applications now accounts for 10% of its revenue, compared with less than 3% in 2020. The country’s second largest contract chipmaker, Hua Hong Semiconductor, is expanding its plant in Wuxi to make automotive-grade chips.

At the same time, more and more Chinese carmakers, including BYD, GAC Group, FAW Group, Great Wall Motor, and Geely, are investing in chip development, manufacturing, and packaging.

The accelerating domestic efforts from automobile makers to chip companies are in line with Beijing’s ambition to 100% homemade chips for the automobile industry, as Nikkei Asia reported earlier.

Ming Hsun Lee, head of greater China automotive and industrial research at BofA Global Research, estimates local brands accounted for around 9% of total automotive chip supply in 2024, and will be around 15–20% in 2025. That figure could reach 50% in five years, however, if in-house chips developed by automakers are included.

Lee expects adoption of local solutions to rise, despite some initial teething problems.

“When some car brands use local chips, they may also encounter certain problems or challenges currently. System integration is one example. Nvidia is very open-ended, it’s compatible with almost any type of algorithm or software. In contrast, Chinese in-house chips might not integrate as well with third-party users at the initial stage,” he said.

“But some auto brands in China … may need to cut costs as much as possible for their lower-end models. Sometimes, the features or performance may not be as good as Nvidia’s, but we believe that they would still choose to switch to use their in-house chips,” he added.

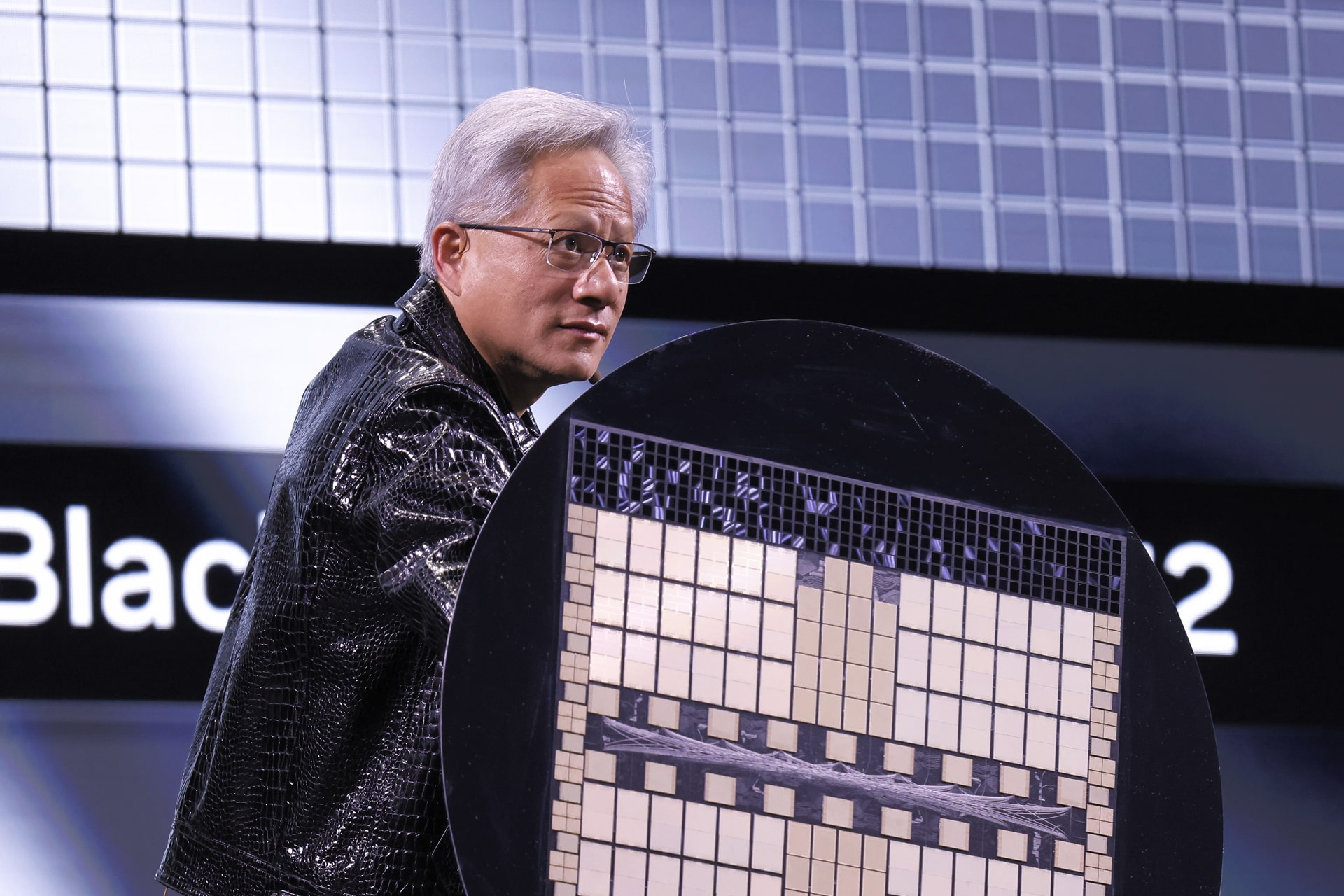

The rise of Chinese smart driving and automotive chip developers could deal another blow to Nvidia, which is already dealing with changeable US restrictions and, more recently, an investigation by China over alleged security risks. Jensen Huang, founder and CEO of Nvidia, recently traveled to China and touted the country’s strength in innovation. But US lawmakers raised concerns about continuing to ship any AI chips.

Other developers of automotive chips, such as NXP, Renesas, On Semi, Infineon, and Texas Instruments, could also be impacted by the emergence of Chinese rivals.

Horizon Robotics is one of Nvidia’s key challengers in the Chinese market for intelligent driving. It offers optimized AI chips, algorithms, and autonomous driving software, and already serves more than 40 automakers, including BYD, Geely, and Li Auto, covering more than 310 models.

Horizon designs its own chips and outsources the manufacturing to TSMC, Nikkei Asia has learned.

Multiple sources from China’s automotive sector said companies are using Horizon’s chips in mid- to lower-end vehicles and using Nvidia for their higher-end and premium models. BYD, which introduced its DiPilot system for intelligent driving in February, is using a mix of Nvidia and Horizon chips in its vehicles, people familiar with the situation told Nikkei.

“The capability of Horizon’s autonomous driving chips has increased a lot in recent years. Its performance is not far away from Nvidia now,” said a senior executive with a chip substrate supplier that counts Nvidia, AMD, Cambricon Technologies, and Horizon among its customers.

The source added that Horizon is capable of designing seven-nanometer designs for autonomous driving chips whose computing performance and energy efficiency are competitive with Nvidia and cheaper. “It is becoming an important customer to us due to its gaining share in the Chinese market,” the source said.

According to Shenzhen-based consulting firm Gaogong Intelligent Automobile, the Level 0–2 smart cars solutions segment, the biggest in China by vehicle numbers, was led by Horizon in 2024, with a 33.97% share, followed by Mobileye at 20.35%, and Nvidia at 14.71%.

Eugene Wang, general manager at Beijing-based SemiDrive, said the company is currently offering 16-nm chips but will start mass producing its next-generation four-nm chips next year.

Last year, the US government restricted Taiwan Semiconductor Manufacturing Company (TSMC), Samsung Electronics, and other contract chipmakers from shipping seven-nm and more advanced chips for AI applications to China. Earlier this year, it tightened controls by banning the export of slightly less advanced chips that met various criteria. Those regulations also limit Chinese chip developers’ options for chip packaging services.

“We are actively seeking what IPs we can develop in-house, not only for supply security, but also for cost control,” Wang said.

The high-end market for smart cockpits—the controls, displays and sensors that surround a driver—is dominated by Qualcomm, with a market share of around 70%, but Wang said Chinese companies are working hard to grab the middle of the market. “The real question is whether chasing after Qualcomm is the smartest move. The market is big enough, but for most companies, trying to reach Qualcomm’s level could end up being far too costly,” he said.

An executive from SiEngine Technology, an automotive chip company under Geely, told Nikkei that the company’s advanced seven-nm chip for autonomous driving, the Xingchen-1, entered mass production this year and boasts a neural processing unit computing power of up to 512 tera operations per second (TOPS) per chip, compared with Nvidia’s Orin X, which delivers up to 254 TOPS of AI performance.

Given the ongoing tensions between China and the US, the company is in talks with SMIC about potential cooperation. Currently, its chips are manufactured by TSMC and then shipped back to Suzhou for packaging, the person said.

Donnie Teng, a semiconductor analyst at Nomura Securities, said China is already capable of producing most of the mature-node semiconductors used across a wide range of applications. “It’s clear that the direction going forward is toward self-sufficiency. Increasing the localization rate of automotive semiconductors is an ongoing trend,” Teng said.

He added that China has already achieved a meaningful level of self-sufficiency in power discrete components, followed by sensors, other analog chips, and microcontroller units. However, for more advanced technologies such as smart cockpit and autonomous driving chips, China still faces production capacity constraints due to the need for more advanced chipmaking processes.

According to estimates by IBS, China’s self-sufficiency in microcontroller (MCU) chips is expected to rise rapidly, from just 19% in 2024 to 67% by 2030. Its domestic production of silicon carbide power switch chips is projected to grow from 5% to 74% over the same period. Microcontrollers are used to control a wide range of electronic functions, including seat and window movements, airbags, cameras and radar systems.

Eugene Hsiao, head of China equity strategy at Macquarie Capital, said China is already very successful in the end-to-end supply chain for mature-node MCUs and power chips used in cars. Players like BYD’s semiconductor division are already able to produce leading high-end power chips for fast EV charging, he said.

In other areas, Hsiao said, the rapid electrification and digitalization of Chinese cars is providing a tailwind for new players focused on designing logic chips used for infotainment systems and autonomous driving functions.

“We have seen several startups and newly listed companies, including Horizon Robotics, Black Sesame, and Ecarx, that are all involved in this space. Given the rapid adoption of digital features in Chinese cars, there is a large and growing market especially in the mass market which provides a window of opportunity for new entrants,” he said.

This article first appeared on Nikkei Asia. It has been republished here as part of 36Kr’s ongoing partnership with Nikkei.