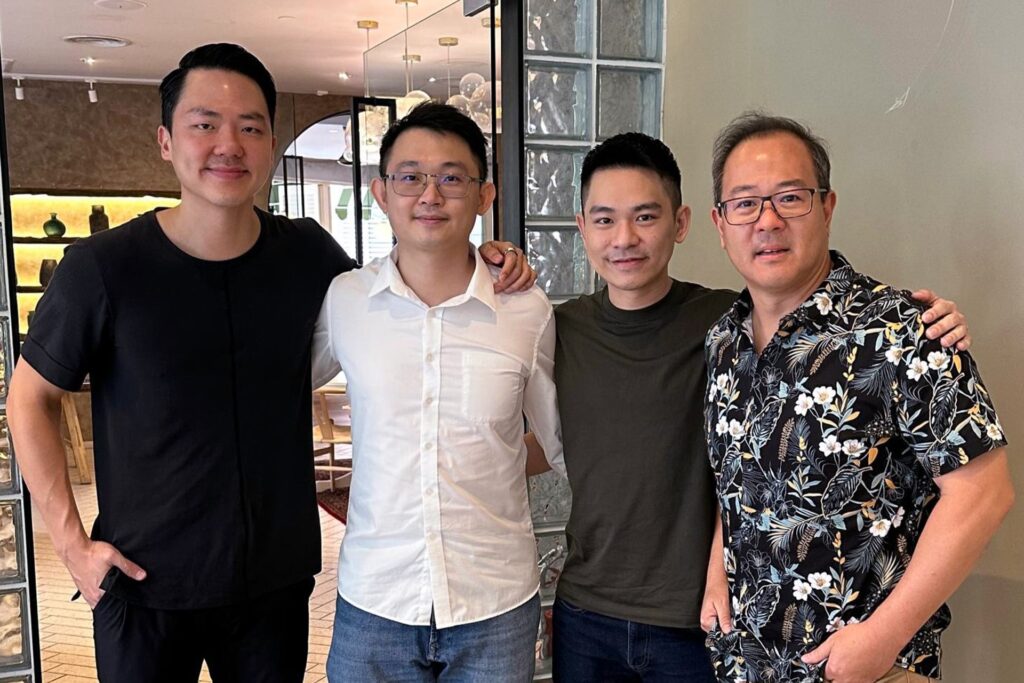

SleekFlow bags USD 7 million in Series A+ round led by Atinum Investment

SleekFlow, a Singapore-based provider of an omnichannel customer engagement platform, has bagged USD 7 million in a Series A+ funding round led by South Korea’s Atinum Investment. This round also saw participation from existing investors AEF Greater Bay Area Fund, managed by Gobi Partners GBA and Transcend Capital Partners, along with new investor Moses Tsang, former general partner at Goldman Sachs.

The investment brings SleekFlow’s total funding to USD 15 million. The company plans to deploy the capital toward expanding its global footprint across Southeast Asia, the Middle East, and Europe, while accelerating tech innovation and enhancing its omnichannel capabilities, including voice and email integrations.

SleekFlow counts global brands like Delonghi, Hilton Dubai, and L’Occitane among its clients. The company is gearing up for a Series B round within the next 12 months to further solidify its market position.

Food Empire receives USD 40 million investment from Ikhlas Capital

Singapore-based Food Empire Holdings, a F&B manufacturing and distribution enterprise, has received a USD 40 million capital injection from Ikhlas Capital, setting the stage for accelerated growth in Southeast Asia and South Asia. The funding will fuel capital expenditures and M&A activities in these two regions, where Food Empire has seen revenue spikes of 34.8% and 36.0%, respectively, in the first half of 2024.

The investment will be facilitated through the issuance of redeemable exchangeable notes, with net proceeds directed toward future expansion plans.

Compass secures investment from EQT to accelerate growth

Compass, a provider of K12 education software solutions, has secured an investment from EQT to drive growth and innovation. The financial details of the transaction remain undisclosed.

Founded in 2010, Compass is said to serve over 3,000 schools and 4 million users across Australia, the UK, and Ireland. With EQT’s backing, Compass plans to enhance its platform, focusing on analytics, learning, assessment, and timetabling, while also pursuing international expansion and strategic M&A opportunities.

Advent Partners will exit its investment in Compass as part of this transaction, which is subject to customary regulatory approvals.

First Move and Gobi Partners affiliate back FinKnight

FinKnight, a rebranded financial advisory firm formerly known as Beetle Knight Advisory, has secured an undisclosed sum of investment from First Move and a Gobi Partners affiliate.

Led by former CFOs of EasyParcel and Signature Market, FinKnight provides end-to-end financial support, from growth strategies to meticulous bookkeeping and data analytics. Based in Malaysia, the firm said it is focused on addressing the financial needs of high-growth ventures by combining deep expertise with an intimate understanding of the startup ecosystem.

FinKnight plans to use the investment to accelerate its market expansion and deepen its service offerings, particularly in regions where financial expertise is critical to scaling operations efficiently.

Recent deals completed in China:

- TRI Technology, a provider of industrial solutions for the energy sector, has secured RMB 60 million (USD 8.4 million) in a Series A+ funding round led by TopoScend Capital. The company will use the funds to scale production of its wall-climbing robots for thermal and wind power applications. TRI also plans to establish a subsidiary in Jiangxi to focus on R&D, production, and testing of these specialized robots. —36Kr

- Lattice Art Semiconductor, a Shanghai-based integrated circuit design service provider, has completed an equity financing round with investment from Shanghai Xinlian Enterprise. The amount raised was not disclosed. —36Kr

- Deep Blue Aerospace (DBA), a Nantong-headquartered aerospace enterprise specializing in reusable liquid rocket engines, has completed its Series B3 funding round, with Zhengyue Investment’s Zhenghe Yunfan Fund as the primary investor, bolstered by support from the Xiamen government and the Jimei district. The funding will accelerate the commercialization of space technology, particularly in developing and launching reusable rockets. DBA plans to establish a headquarters in Xiamen to target markets in Belt and Road Initiative (BRI) countries. The company is also preparing for a high-altitude vertical recovery flight test of its “Nebula-1.” —36Kr

DiMuto, Finture, Nexus Ocean, and more led yesterday’s headlines:

- DiMuto, a Singapore-based startup that provides end-to-end supply chain visibility for businesses, raised USD 5.9 million in a Series A funding round led by The Yield Lab Asia Pacific. The round saw participation from SiS Cloud Global Tech Fund 8, Gold Sceptre, and Dave Chen, as well as existing investors Seeds Capital (SG Growth Capital), SGInnovate, and PT Great Giant Pineapple.

- Finture, the operator of Southeast Asian digital bank Yup, raised over USD 30 million in its Series B funding round. The round was led by Hong Kong-based venture capital firm MindWorks Capital, with participation from XVC, SWC Global, Richen Pioneer, and Antao Capital.

- Nexus Ocean AI, a Singapore-based provider of generative AI-powered efficiency solutions for the maritime industry, raised USD 400,000 in angel funding from Tradeworks.vc.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].