Xiaomi has revamped its smart driving team, merging its perception unit and its planning and control division into a new department focused on end-to-end (E2E) algorithm and function development. This restructuring marks a crucial step as Xiaomi accelerates the development of its smart driving solutions, aiming for mass production.

By shifting away from traditional modular methods and embracing E2E large model technology, Xiaomi is entering a new phase—one centered on rapid deployment and broader applications for its smart driving tech.

As electric vehicles flood the market, Xiaomi faces stiff competition, especially in the fast-evolving urban smart driving space. To stand out and maintain sales momentum, the company needs to close the gap in its autonomous driving capabilities. This organizational shake-up signals that Xiaomi is ramping up its efforts to compete.

At the same time, Xiaomi has elevated its team responsible for pre-research into autonomous driving, shifting their focus to developing Level 3 and Level 4 autonomous products. It’s a critical move as the company aims to push the boundaries of what’s possible in smart driving.

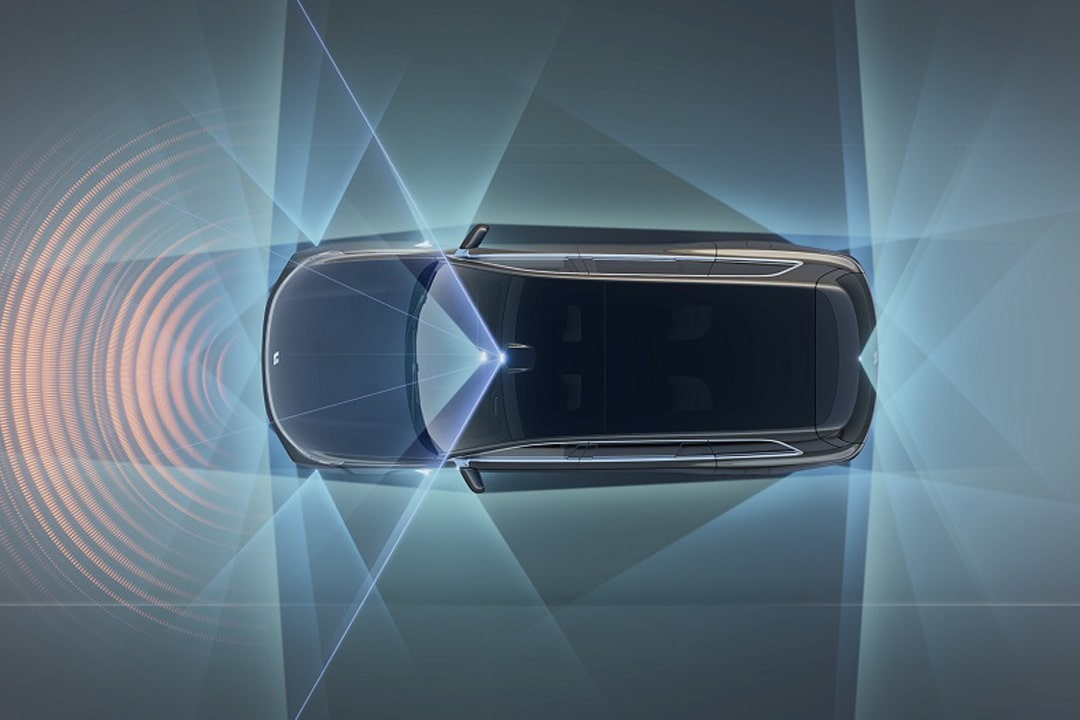

Xiaomi’s smart driving teams now span across Beijing, Shanghai, and Wuhan, employing around 1,200 people. This newly formed department will handle both light detection and ranging (LiDAR)-based and non-LiDAR-based systems, under the leadership of Ye Hangjun, chairman of Xiaomi’s technical committee and head of its autonomous driving division.

The urgency behind this restructuring comes as competition in the smart driving sector heats up. Xiaomi is determined to accelerate its path to market.

Since announcing its entry into car manufacturing in 2021, Xiaomi has moved fast. By August 2022, it had rolled out a Level 2 assisted driving system capable of navigating urban roads, highways, and parking scenarios. Just two years later, in June 2023, Xiaomi introduced its urban driving assistance feature to select users. By the end of August, this system was available nationwide, and after its fourth over-the-air update in September, users in cities like Beijing, Shanghai, and Guangzhou, who had logged at least 1,000 kilometers of safe driving, could activate the feature.

Xiaomi’s trajectory—from building the team to launching the urban navigate-on-autopilot (NOA) feature—took just three and a half years. For comparison, rivals like Huawei and Xpeng Motors took five years to achieve similar results. Xiaomi’s pace shows it’s catching up quickly.

Still, Xiaomi trails behind the market leaders. Huawei has introduced its full-scope navigation control assistant (NCA) feature in its new Aito M9, and Xpeng has launched a nationwide solution in its Mona 03, offering unrestricted adaptability across cities, routes, and roads. Xiaomi’s urban NOA, on the other hand, is only available for LiDAR-equipped models in ten cities, with slower progress.

Xiaomi’s newly reorganized department has been tasked with accelerating the expansion of urban NOA while developing both high-end and more affordable configurations. CEO Lei Jun has set an ambitious goal: to push Xiaomi into the top tier of the smart driving industry by year’s end.

Another outcome of this restructuring is the formation of a dedicated team focused on advancing Level 3 and Level 4 autonomous driving technologies.

While Xiaomi is keeping pace with the industry in mass production, the company has a real opportunity to lead in the emerging Level 3 and Level 4 autonomous space.

The industry is increasingly recognizing that E2E smart driving solutions outperform traditional modular systems. By leveraging massive datasets, cloud computing, and large models, automakers are unlocking new levels of smart driving capabilities.

Xiaomi isn’t the first to dive into E2E technology. Earlier this year, Nio consolidated its smart driving teams into a large model group, and Li Auto formed its own E2E autonomous driving department. Xpeng has also reorganized its divisions into E2E development and AI application teams. While Huawei has yet to announce a similar reorganization, it’s already released the third iteration of its advanced driving system, with even more upgrades in the pipeline.

Traditional automakers are also playing catch-up. BYD has partnered with Huawei to develop advanced smart driving features, and Great Wall Motor has teamed up with DeepRoute.ai to accelerate E2E solutions. E2E technology is no longer just a trend—it’s becoming a defining factor in shaping automakers’ technological leadership, brand perception, and commercialization of smart driving.

Li Auto offers a clear example of how smart driving can impact sales. In its Q2 earnings call this year, the company revealed that nearly 70% of orders for models priced over RMB 300,000 (USD 42,000) were for its AD Max smart driving versions. The company sees E2E solutions, powered by AI, as a direct driver of sales.

For Xiaomi, the stakes are high. With fierce competition in the smart driving space, the company needs to fully embrace the E2E wave to maintain its image as a tech innovator and fuel continued growth.

If Xiaomi can continue refining its E2E smart driving system, the vast amounts of data it collects will drive continuous improvements. By reorganizing its resources around this effort, Xiaomi could significantly extend the capabilities of its E2E solutions. Meanwhile, pre-research into autonomous driving will remain a crucial step toward unlocking the next levels of smart driving.

With Xiaomi all-in on smart driving, the race to scale E2E solutions across the industry is about to get even more intense.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Xu Caiyu for 36Kr.