There has been a wave of startups in Singapore that hope to emulate the successes of Sea, a global internet consumer company with a market capitalization of more than USD 200 billion, and Grab Holdings with its food delivery and digital payments app.

Singapore offers many advantages beyond its central location and easy access to other Asian markets and English-speaking economies. Government efforts to lure foreign capital—including tax breaks—have made the island-state a haven for tech startups.

TDCX provides business process outsourcing, including customer service structures and advertising strategies, mainly to Asian and European companies. It is only the second Singaporean company after Sea to list American depository receipts on the NYSE, where it debuted on Oct. 1. TDCX raised USD 350 million in its initial public offering, and now has a market capitalization of USD 3 billion.

In the first six months of 2021, startups raised a total of SGD 5.3 billion (USD 3.93 billion), up 1.5 times from SGD 3.4 billion in the same period in 2020, according to Enterprise Singapore, a government agency that supports entrepreneurs.

“In addition to English communication, Singapore has the advantage of attracting a large amount of capital, making it easy for foreign investors to invest,” said Avi Naidu, the co-founder and managing partner of Taronga Ventures, an Australian venture capital company that invests primarily in Southeast Asian tech companies. “Singapore has a clear and consistent tax system, making it simple and attractive to foreign investors.”

Singapore’s startups hope to replicate Sea’s “10 bagger” status—an investment that appreciates to 10 times its purchase price—despite some of the headwinds generated by the COVID-19 pandemic.

“Our mission is to transform the way people grow their money and make managing wealth a part of everyone’s life, regardless of their investment goals and life stage,” said Dhruv Arora, founder and chief executive of Syfe, a robo-advisory platform for asset management.

Singapore is teaming with avid investors. According to Franklin Templeton, a US global investment company, 80% of Singaporeans aged between 18 and 35 manage their assets. For its robo-advisory service, Syfe offers four different portfolios—global equities, bonds, gold exchange, traded funds—as well as other instruments. A robo-advisor provides digital financial advice based on mathematical models and algorithms.

Average annual returns on investment logged by Syfe since April 2013 include 14.7% up to June this year from the Core Equity 100 portfolio, which is entirely allocated to equity in exchange-traded funds (ETFs). Even Core Defensives, a low-risk portfolio that invests mainly in high-quality bond ETFs, yielded nearly 5% in that period.

When managing their assets, people need an idea of how much money they will require over their lifetimes. BetterTradeOff is a tech company that provides financial planning solutions to give an answer.

BetterTradeOff offers Up, a life-planning platform, to asset management advisors and others, enabling them to simulate asset management online. When a client’s information, including income, family structure, and asset conditions—such as home ownership—are entered, the platform creates simulations and a graph that shows when the client will run out of assets and their balance at the age of 90. The client can then visualize how assets are built up and run down.

“Only wealthy people can get access to such a service,” said Laurent Bertrand, BetterTradeOff’s chief executive and founder. “We want to democratize it.”

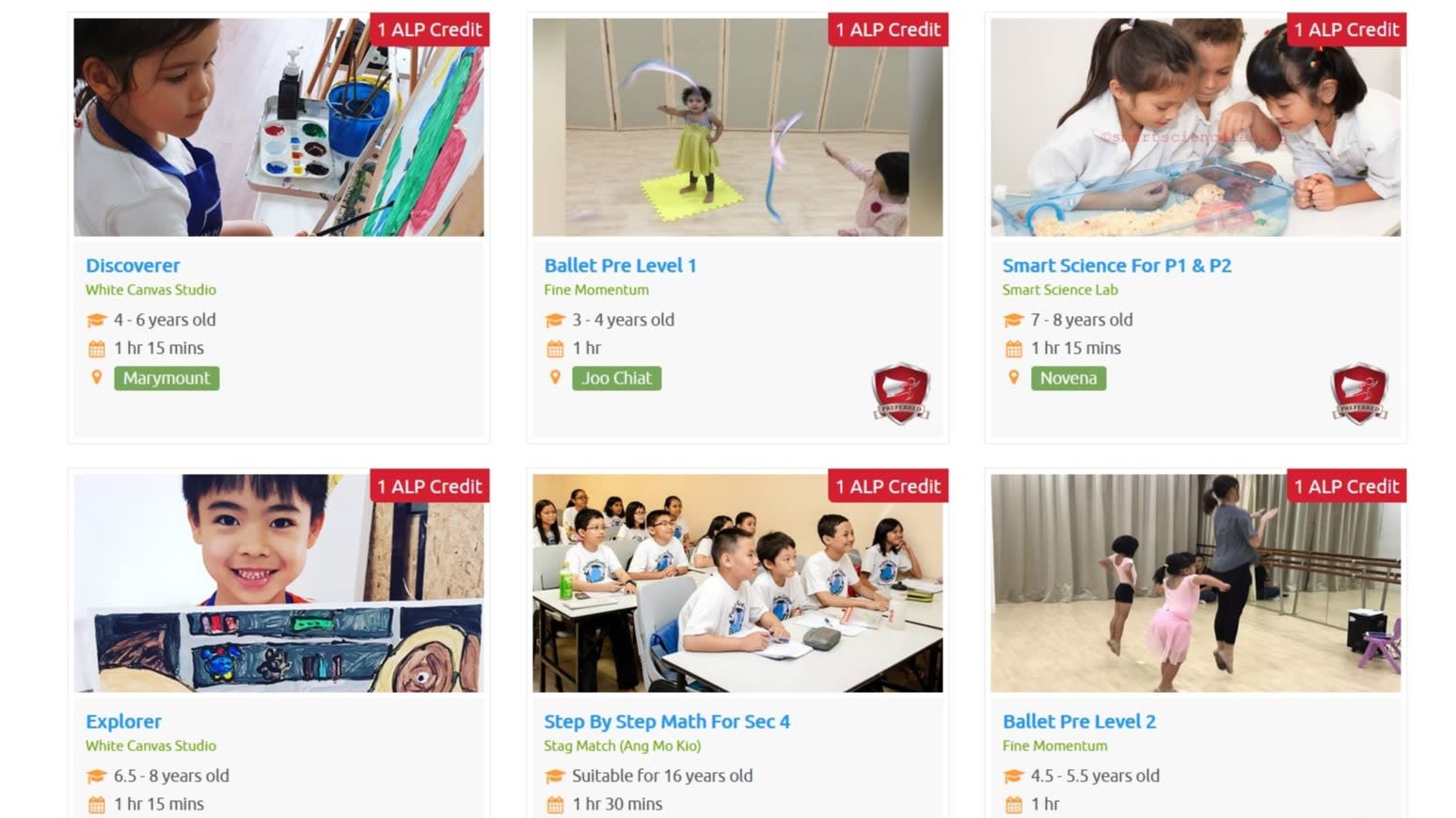

Startups have also increased in non-financial sectors. Launched in 2015, Flying Cape is a rapidly growing educational tech company. It offers services that combine real classrooms with information technology. Thousands of classes are conducted by some 1,000 service providers, including dancing lessons and exam cramming. These are listed on the company’s “marketplace” website where bookings can be made.

Flying Cape uses artificial intelligence to make recommendations based on basic information visitors enter, such as age and topics that interest them. Classes designed for adults include robotics and finance.

The company uses a feedback loop to improve understanding of its clients, explains chief executive Jamie Tan, who founded the company after working 15 years in information technology.

“Before COVID-19, there was no urgency to see how technology impacts education,” said Tan. “[The pandemic provided] an opportunity for tech companies to demonstrate their capabilities.”

The pandemic’s curtailment of face-to-face teaching has made online lessons mushroom in all directions—even piano lessons in Singapore can be taught by a teacher in London these days.

UnaBiz, a developer of end-to-end internet-connected solutions grabbed opportunities the pandemic created. For example, demand for building management sensors to track visitors has greatly increased.

“The Internet of Things industry has become too fragmented, and it is our mission to simplify it and eradicate frictions,” said chief executive Heri Bong. On Oct. 12, UnaBiz announced that it will raise USD 25 million from SPARX Group, a Japanese asset management company, and others.

Historically, California’s Silicon Valley has been the main magnet for startups and venture capitalists. “There are now ‘centers of gravity’ all over the world,” said Tarponga’s Naidu.

“In the past two decades, China has grown with its huge market, and India has created its own startup ecosystem,” he said. “Singapore is different in that the government is a major driving force, making it an important destination for both startups and venture capitalists.”

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.