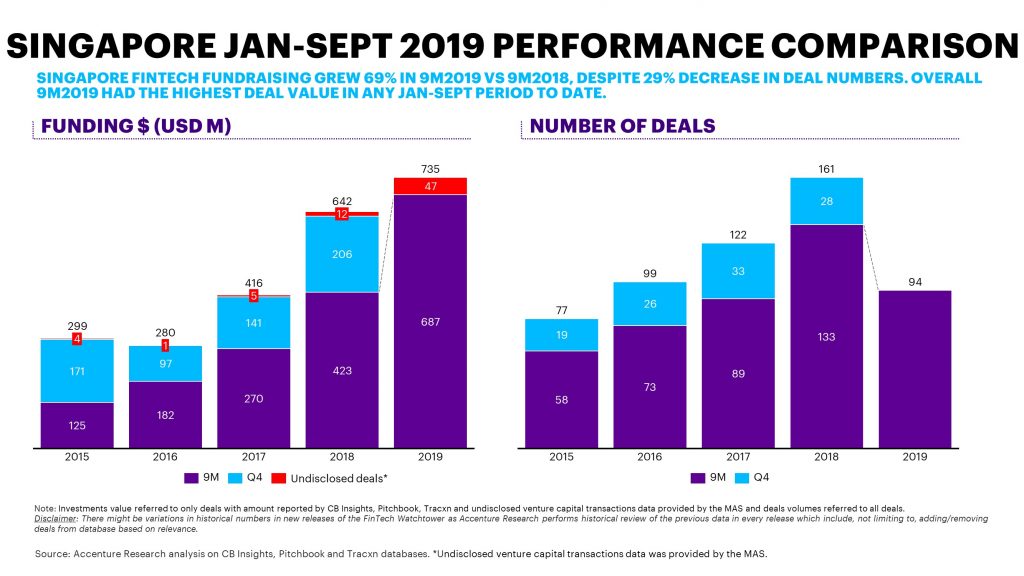

Singapore’s fintech investments surged to USD 735 million in the first 9 months of this year, a 69% increase from USD 435 million during the same period last year.

Investments in payment startups and those in lending drove the increase, accounting for 34% and 20% of the total, respectively, while insurtechs raked 17%.

These insights were gleaned from research by professional services firm Accenture, analyzing data from CB Insights, Pitchbook, and Tracxn.

According to Accenture, there has also been a shift into financing more mature startups, as angel and seed funding that focuses on the earliest stage of capital raising dropped 56% to USD 54 million. In addition, the number of those deals declined 46% to 29 cases.

The firm noted that series funding, which typically targets companies looking to grow their business with external capital as they mature, rose 66% to USD 442 million, although the number of deals was relatively unchanged.

It also said that the number of fintech deals fell by almost one-third (29%) in the first nine months of 2019, to 94 from 133 during the previous year, showing that investors made larger bets into fewer deals as startups grew their businesses.

Divyesh Vithlani, managing director at Accenture and head of financial services for the ASEAN region, said in a statement that “fundraising is shifting to support the scaling up of challenger and collaborative fintech, which will cause lumpiness in some rounds as the market becomes more mature.”

Vithlani also noted that “the upcoming unveiling of virtual banking licenses will bring even more opportunities for fintech startups and traditional banks to partner and cooperate.”

In June, Singapore’s central bank, the Monetary Authority of Singapore (MAS) announced it could issue up to five virtual banking licenses in a move to liberate and also potentially further disrupt the island nation’s banking sector.