Shopee continued to lead as Vietnam’s most popular e-commerce platform in the fourth quarter of 2019, with 33.6 million monthly web visits, according to a recent report published by e-commerce aggregator iPrice along with market searchers SimilarWeb and App Annie.

Behind Shopee were Thegioididong (Vietnam’s major mobile phone retail chain), Sendo, Tiki, and Lazada.

According to iPrice’s analysis, Shopee has competed well on all fronts, with financial backing from its parent company Sea Group fueling its competitiveness.

Recent earning reports from Sea show that despite achieving 1.2 billion orders in 2019 across all markets in the region, the popular e-commerce marketplace still posted a total EBITDA loss of USD 1 billion in 2019. The platform said it will focus on maximizing market leadership across the region. It expects its adjusted revenue in 2020 to be USD 1.7–1.8 billion.

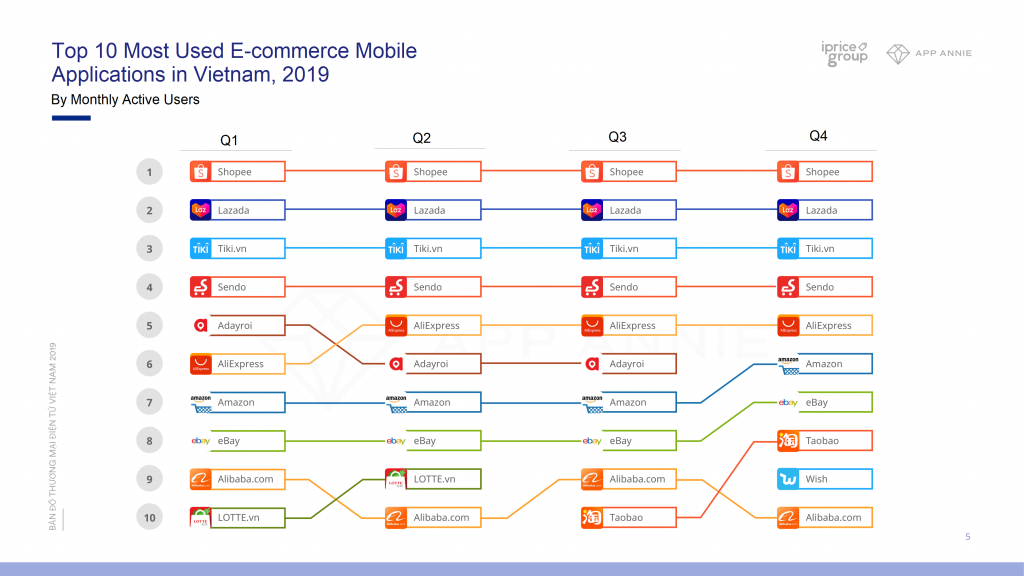

iPrice’s report also ranked the most used e-commerce apps in Vietnam in 2019. Among them, the top four were Shopee, Lazada, Tiki, and Sendo. According to the aggregator, these platforms performed consistently throughout the year, implying that Vietnamese consumers are very loyal to their favorite shopping apps.

Additionally, up to 45% of Vietnamese customers access e-commerce marketplaces by typing the URL directly into their browsers, rather than searching for them on Google or clicking on ads.

The report suggests that Vietnam’s e-commerce market has shown some signs of maturity, meaning that platforms now have to compete for ways beyond offering discounts to retain consumers in the long run.

Vietnam’s e-commerce sector is expected to be worth USD 23 billion by 2025, according to the e-Conomy Southeast Asia 2019 report by Google, Temasek Holdings, and Bain & Company. However, the competition has been increasingly centered around burning cash to acquire consumers, and the sector is being held back by issues such as logistics and a lack of consumer trust.

Smaller players have been knocked out in the past several months, including Vingroup’s Adayroi, Lotte’s online marketplace lotte.vn, and Vietnam-based e-commerce startup Leflair. The latter, which raised USD 7 million in Series B funding from Belt Road Capital Management and South Korean retailer GS Shop in January 2019, reportedly owes USD 2 million to suppliers.

Industry insiders are also waiting to see whether a merger between the country’s top local e-commerce platforms Tiki and Sendo might happen, following rumors that surfaced last month. If this happens, the new entity could pose a significant threat to regional rivals Shopee and Lazada.