Songshu Pinpin, a new and rising community group-buying platform, has laid off two-thirds of its staffers after a failed acquisition move derailed its plan to raise fresh funds for expansion, the China-Venture reported.

Launched in last August, Songshu Pinpin, which reads “Squirrel Group Buy” in Chinese, had more than 2,000 employees at its peak. Company founder Yang Jun even declared in May that the firm would beat Pinduoduo, China’s largest social e-commerce retailer, over the long term, the business news outlet reported on Sunday.

The retrenchment comes after rife market speculations surfaced early this month that Songshu Pinpin had disbanded its teams in cities including Guangzhou and Chengdu, with a large number of buyers’ groups ceasing operations.

Different from the general “social + group buying” model adopted by the Nasdaq-listed Pinduoduo, community group purchase refers to a more localized type of bulk buying. It allows residents living in close proximity to buy groceries and daily necessities for an ultra-low price.

Buyers are usually gathered by a community leader, either a stay-home mom or a shop owner, through a WeChat group. When the number of buyers reaches to a certain level, the leader then can place orders at the bulk price from merchants. Members then pick up their orders from the community leader.

Despite being a latecomer, Songshu Pinpin has quickly gained a foothold. Within six months after its launch, it had already expanded services to over 30 cities and reported a gross merchandise volume (GMV) of USD 14 million in a single month, 36Kr reported in February.

In February, Songshu Pinpin raised USD 31 million in a Series B round led by Hillhouse Capital Group and MSA Capital. It previously closed a USD 30 million Series A.

The company recently aborted a plan to acquire a rival site, but it had helped repay some of the latter’s debts, landing it in a liquidity crunch, the China-Venture reported, citing company insiders. The setback hindered its intention to raise fresh funds.

Songshu Pinpin didn’t immediately respond to KrASIA’s request for comments.

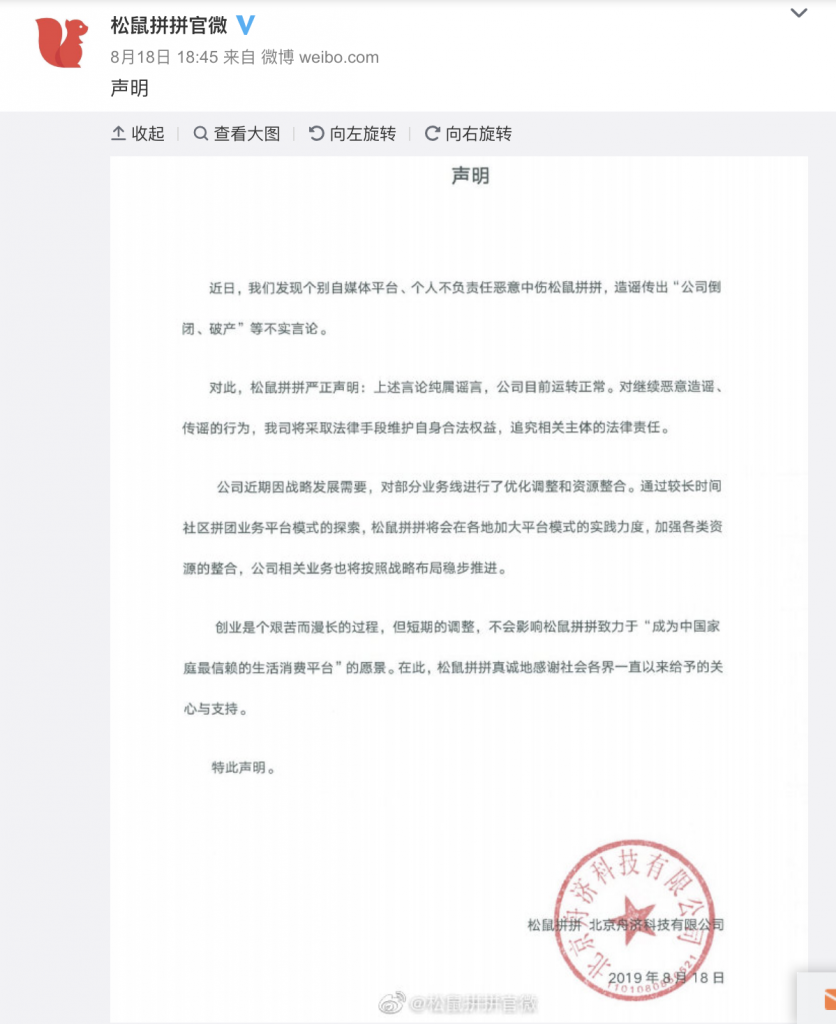

However, the company denied it’s on the brink of bankruptcy in an official Weibo account post on Aug. 18, saying that it’s in the middle of “optimizing resources to align with company’s strategic developments.”

In China’s flourishing community group-buying sector, Songshu Pinpin currently lags behind Xingsheng Youxuan, whose GMV hit USD 100 million in June alone, an increase of 133% compared to December. Investment firm KKR reportedly led a USD 40 million financing in the Hunan-based e-retailer in July.

36Kr is KrASIA’s parent company.