Like Baidu, Didi Chuxing has also altered its car manufacturing plans.

On August 28, Chinese electric vehicle manufacturer Xpeng Motors announced its acquisition of Didi’s smart car arm for HKD 5.84 billion (USD 744.63 million) in an all-stock deal. To finance the deal, Xpeng plans to issue new shares at HKD 64.03 apiece. Didi will gain 3.25% of Xpeng’s outstanding shares from the deal. Both parties have also entered a valuation adjustment mechanism (VAM) agreement which will increase Didi’s stake in Xpeng if delivery targets are met.

This deal will relieve Didi of recent financial woes stemming from steep investments into its smart car venture while retaining insights it has gained.

For Xpeng, this partnership offers the opportunity to develop a second brand and opens a pathway to introduce more price-competitive models by tapping into Didi’s existing mass-market A-class EV model. This will potentially enable it to make good on its technological framework agreement with German automotive manufacturer Volkswagen.

Didi’s withdrawal may also reflect the broader trend of Chinese tech giants scaling back their ambitions for the car manufacturing industry. Their waning enthusiasm comes amid slowdowns in the growth of their core businesses, and vehicle manufacturing requires significant investment.

Was Didi’s vehicle-making dream an illusion?

As a ride-hailing company, Didi shared synergies with the automotive industry and was one of the first tech giants in China to partner with automakers. Notably, the company established the Didi Auto Alliance in 2018, joining hands with 31 local automotive companies in hopes of building a one-stop platform that would offer an on-demand alternative to car ownership.

2018 also saw Didi and Li Auto launch Beijing Judian Travel Technology, a smart EV joint venture. With Li Auto responsible for vehicle development and manufacturing, Didi led in the areas of technology, smart solutions, and operations. An electric multi-purpose vehicle model coded D01 was eventually developed but it was never launched due to a lack of investment. In August 2022, the venture filed for bankruptcy, bringing the partnership to an end.

Didi also agreed to a similar partnership with BYD which yielded some results, as they launched the BYD D1 ride-hailing vehicle in November 2020. But the vehicle saw lackluster sales and received little interest from retail customers, ultimately falling short of expectations.

Despite the two unsuccessful ventures, Didi began a solo effort in 2021, which it named Da Vinci. The company hired around 1,700 employees and offered competitive salaries to attract talent from major automakers. This project was expected to introduce new vehicles this year. However, with the announcement of the new tie-up with Xpeng, Didi has seemingly decided to exit the market and focus on providing support within its core expertise.

Are qualifications the roadblock?

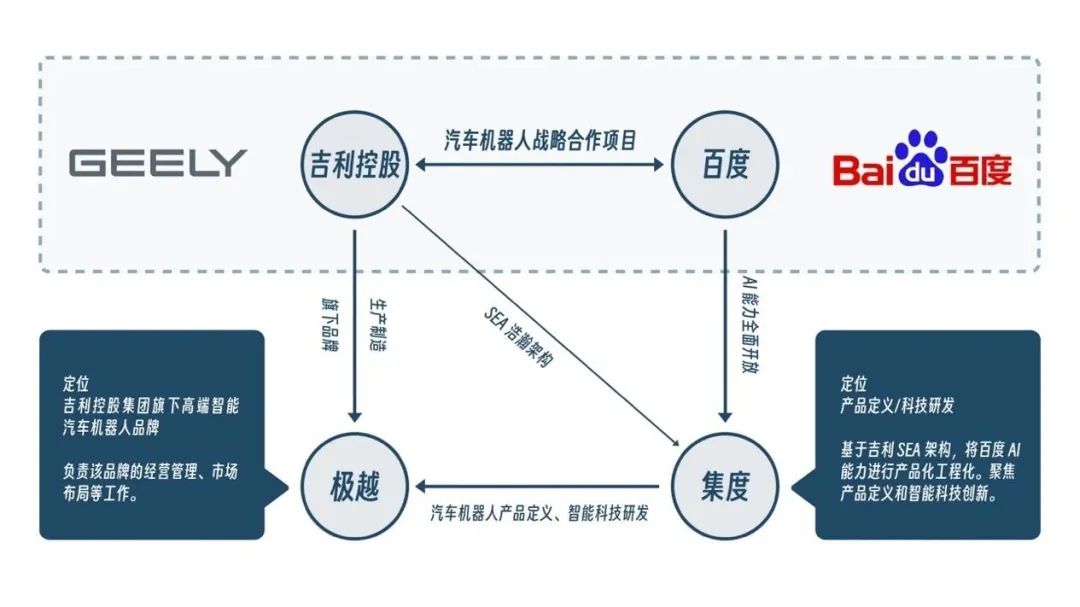

Didi isn’t the only tech giant to face challenges breaking into the industry. For example, Baidu, once touted for its self-driving ambitions, has found itself wanting in the face of fluctuating market dynamics. In 2021, the company formed Jidu Auto in partnership with automotive manufacturer Geely, with Baidu holding 55% of the joint venture. It’s said that even the name Jidu Auto was given by Baidu’s artificial intelligence. Two years later, however, Jidu Auto has quietly transformed into Jiyue Auto.

Although the renamed entity remains jointly managed by Baidu and Geely, their stakes have changed, with the latter now holding 65%—a majority. Baidu’s role in this collaboration has therefore shifted from leader to technology provider.

It is said that Baidu’s move may represent the existence of licensing issues that have become prevalent across the industry, and which may have similarly affected Didi too. According to regulations introduced in 2022, all companies involved in car manufacturing, including not just the entrusting companies but also the original equipment manufacturers (OEMs) they outsource to, are required to hold the corresponding licenses.

In today’s market, the stringent regulations make it difficult for large companies like Baidu and Didi to obtain the necessary licenses and qualifications, let alone smaller ones. For example, Zotye Auto had to cancel orders after encountering licensing issues, leading founder Li Yinan to apologize to over 20,000 potential customers. BAIC Motor-owned new brand Jishi Automobile, which has officially launched its Jishi 01 model, also had to maintain a low profile after facing similar issues.

From the perspective of Baidu, if it is unable to assert control over the new car brand, then it can only temporarily retreat behind the scenes and participate in vehicle manufacturing as a technical service provider. In time, there may be opportunities to utilize equity transfers and similar mechanisms for it to regain control of the brand’s overall manufacturing operations.

Nonetheless, even if Baidu had to resign to providing technical support, commercial prospects may still exist. Last year, Huawei and Seres collaborated to produce various EV models, including the Aito series which has garnered positive feedback from the market. The relative success of these two companies may offer new ideas for other players to take note of.

Giants can turn the ship around

Although licensing issues are difficult to resolve, they are not insurmountable. Instead, the rapidly changing market is driving the giants to take a more proactive approach.

Tech giants that have dipped their toes into automotive manufacturing have consistently emphasized technology and smart solutions as their competitive edge. However, this supposed advantage may not be as pronounced as initially expected, as other companies are also investing heavily in R&D. Currently, no single player holds a definite lead in the field of autonomous driving.

Moreover, having the backing of a large company does not necessarily guarantee business success. Substantial investment has to be made across several key areas including product quality, after-sales services, pricing, and more, to influence sales performance and business outcomes.

The automotive industry also involves a complex supply chain, particularly in the development of new technology including autonomous driving. This necessitates continuous and significant cash investment, which may be challenging for companies to realize as short-term returns are not easily achievable.

To illustrate, as of 2022, Didi has invested about RMB 35 billion (USD 4.78 billion) in autonomous driving, with RMB 9.5 billion (USD 1.29 billion) invested in 2022 alone. In the same year, Didi’s total revenue was about RMB 140.8 billion (USD 19.26 billion), incurring a net loss of RMB 23.8 billion (approximately USD 3.26 billion).

Didi was once considered a frontrunner among the players because of its scale of business—which had high barriers of entry—and massive amounts of ride-hailing data which can offer insights for sales and R&D.

Additionally, with its current ride-hailing fleet comprising tens of millions of vehicles, replacing even a small portion with its own vehicles would already generate significant momentum.

However, now that Didi has handed over the car manufacturing initiative to its partner, it becomes unclear how many other tech giants will be willing to invest in the industry. Even Alibaba-backed IM Motors and Qihoo 360-backed NIO have been struggling to meet expectations.

Moreover, with the investment trend now shifting to favor the development of large language models (LLMs), it might be strategic for companies to consider focusing elsewhere instead of being too heavily invested in car manufacturing.

This article was adapted based on a feature originally written by Mu Ge and published on Spiral Lab (WeChat ID: spiral_lab). KrASIA is authorized to translate, adapt, and publish its contents.