An e-wallet user in Vietnam performs 1.6 to 2 transactions on digital platforms per day, with an average spending of VND 230,000–274,000 (USD 10–12) per transaction, according to a survey by Vietnam-based market research company Cimigo.

The firm’s researchers polled 505 users who have used at least one e-wallet in Ho Chi Minh City and Hanoi, concluding that Momo, Moca, and ZaloPay are the three most popular e-wallets in Vietnam’s two main cities, accounting for more than 90% of mobile payments.

Vietnamese fintech company Momo is one of the most well-funded firms of its kind in Asia, having raised more than USD 133 million since it was founded in 2013. Moca has enjoyed steady popularity after forming a partnership with Grab in 2018. ZaloPay is part of VNG, Vietnam’s only unicorn.

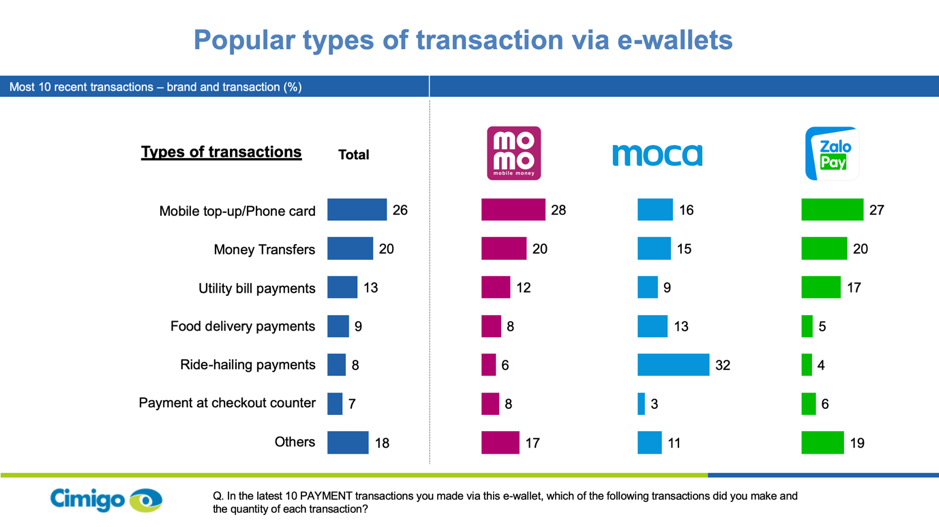

In addition, the result also shows that e-wallets are mostly used for mobile top-ups, money transfers, as well as payments for utility bills, food deliveries, and ride-hailing. Phuong Le, associate director at Cimigo, said that demand for using e-wallets in the country is still very high, as Vietnamese consumers have become accustomed to the convenience of using e-wallets to settle daily expenses.

Vietnam is among the ASEAN countries with the lowest cashless transaction volume. However, the COVID-19 pandemic is changing consumer habits. For instance, the State Bank of Vietnam has advised people to limit cash usage and and utilize digital payments to reduce the risk of infection.

To date, the State Bank of Vietnam has licensed 32 companies that provide e-payment solutions. The government has mapped out a national financial strategy to increase the number of non-cash payments by 20–25% by 2025.