Investible leads Yume’s AUD 2 million seed round

Yume, a Melbourne-based startup that mitigates food waste by redistributing surplus food from manufacturers to businesses and charities, has secured AUD 2 million (USD 1.31 million) in a seed funding round led by Investible’s Climate Tech Fund.

This round witnessed participation from both new and existing investors, including LaunchVic, Goodrich Group, Veolia, and angel investor Pitzy Folk. Investible’s Early Stage Fund 2 and its Club Investible syndicate were also contributors.

The newly raised capital positions Yume to solidify its presence in Australia and bolster its technological capabilities in anticipation of international expansion. According to a statement released by the startup, the funding will facilitate a doubling of its headcount by the end of 2024, with 75% of this growth dedicated to its technology and product teams..

Following the completion of this round, Yume has raised a total of AUD 7 million (USD 4.59 million) to date.

“Australia has a food waste problem, in fact, it’s a 7.6 million ton problem. The amount of land used to grow wasted food in Australia covers more than 25 million hectares, a landmass larger than the state of Victoria. … Yume was founded to eradicate this problem and our platform has grown rapidly as large food manufacturers have been able to utilize our technology to connect surplus food to Australian businesses and charities, reducing waste and increasing their revenue,” said Katy Barfield, founder and CEO of Yume.

Zora Health snags SGD 1 million to launch fertility care platform

Zora Health, a startup offering fertility-related programs and services, has snagged SGD 1 million (USD 745,700) in funding to launch its integrated fertility care and financing platform in Singapore.

With initial backing from Antler, this round saw participation from angel investors including Cheryl Goh (Grab), Prajit Nanu (Nium), Alan Jiang (beam), Lisa Enckell (Antler), and Asa Liden (formerly from Pitch.com).

Zora Health offers a comprehensive ecosystem that seamlessly integrates virtual and in-person consultations, medical concierge services, fertility education workshops for corporations, and fertility financing. The platform’s initial services encompass egg freezing, in-vitro fertilization (IVF), fertility testing, and consultation services. In later stages, fertility financing becomes available. Additional offerings comprise programs designed for corporate clients aiming to foster fertility-friendly work environments and facilitate meaningful fertility discussions.

“The fertility treatment landscape is daunting to women and couples seeking fertility care due to the multitude of service options and providers, complicated regulations and confusing pricing structures. Zora Health’s integrated approach addresses these issues head-on, simplifying the process for patients, healthcare providers and corporations in a fragmented market,” said Anna Haotanto, founder and CEO of Zora Health. —e27

BlokID secures USD 1.25 million in seed round

BlokID, a Vietnam-based developer of blockchain-based privacy protection solutions for the digital advertising industry, has secured USD 1.25 million in a seed funding round jointly led by Ascend Vietnam Ventures and AppWorks.

The company will utilize the capital to expedite product development, acquire users, and expand into new markets. Its plan is to officially launch by Q2 2024, rolling out Google Analytics plugins and privacy-focused financial identity features for users.

Antler leads pre-seed funding for 37 startups in Southeast Asia

The Singapore-based early-stage venture capital firm has announced the completion of its latest round of pre-seed investments, committing USD 5.1 million to invest in 37 startups in Southeast Asia. This marks ostensibly the highest number of pre-seed deals completed in a single round in the region and represents Antler’s initial commitment and footprint in Malaysia as part of its strategic partnership with Khazanah Nasional Berhad, the sovereign wealth fund of Malaysia.

According to the statement released by Antler, the 37 startups hail from a diverse range of sectors, including artificial intelligence, B2B software-as-a-service, fintech, and healthcare, among others. The firm emphasized that these investments were made based on its conviction in current regional trends, including the emergence of hyperlocal solutions and Industry 4.0 technologies, as well as the shift toward “verticalized AI.” Notably, this occurs amidst an ongoing hype cycle initiated by the inception of OpenAI’s ChatGPT.

“As a multi-stage investor, we recognize the immense potential of early-stage startups in Southeast Asia. In this dynamic and challenging climate, we are especially drawn to pre-seed investments, particularly in verticalized AI and Industry 4.0 startups that address deep-seated pain points and revolutionize how models and data translate into tangible products,” said Jussi Salovaara, co-founder and managing partner of Antler in Asia.

South Korea’s Rebellions completes USD 124 million Series B round

Rebellions, an artificial intelligence chipmaker, has completed its Series B funding round, securing USD 124 million to become what it claims to be South Korea’s most funded semiconductor startup, having raised over USD 200 million to date.

The latest round was led by KT and included participation from a myriad of investors, including KT Cloud and Shinhan Venture Investment, which are both subsidiaries of KT. In addition, Pavilion Capital (Temasek), Koreyla Capital, DGDV, Korea Development Bank, Noh& Partners, KB Securities, KB Investment, SV Investment, Mirae Asset Venture Investment, Mirae Asset capital, IMM Investment, KT Investment, Seoul Techno Holdings (Seoul National University), Oasis PE, Gyeongnam Venture Investment, and SDB Investment also took part in this round.

The newly raised capital will enable Rebellions to acquire talent and expedite the development of Rebel, the company’s next-generation AI chips designed for running large language models (LLMs) with Samsung Electronics.

The company is also gearing up for mass production this year amid plans to expand its customer base both locally and internationally.

Recent deals completed in China:

- Muxin Technology, a Shenzhen-based technology company specializing in the development of medical chips, has secured an eight-figure RMB sum in a Series A funding round from Huang Jiang, chairman of Junsheng Runshi Angel Investment Fund and Guangdong Leadyo IC Testing, and Zhuang Huiyang, chairman of Xiamen Vold Mold and Plastic Engineering. Muxin will utilize the funds for product R&D and the iterative development of hearing aid chip products. —36Kr

- Acroview Technology, a Shenzhen-registered company specializing in chip testing and automatic programming equipment, has recently completed its Series B funding round, securing a nine-figure RMB sum. Shenzhen Co-stone Asset Management, Gree Financial Investment, and GF Xinde Investment took part in this round. Acroview intends to use the capital to intensify its product R&D efforts and expedite its international market expansion. —36Kr

- Yunban AIGC, a Hefei-based AI solutions provider, has raised an undisclosed amount of Series A funding from Longyin Group. The funds, intended for product and technology development as well as team building, will support Yunban in providing its solutions to small and medium enterprises. —36Kr

- Weizhi Aviation Technology, a startup focused on the development of medium- to large-scale unmanned transportation aircraft, has banked an eight-figure RMB sum of investment in an extended angel funding round. The round was led by GSR United Capital, with participation from China Creation Ventures (CCV) and other unnamed investors. Financial advisory services were exclusively provided by Chao Capital. The capital will be utilized primarily for team expansion as well as prototype manufacturing and testing. —36Kr

Latest deals in India:

- Electrifi Mobility, a Gurugram-registered fleet electrification solutions provider, has secured USD 3 million in a seed funding round. The investment, made through a mix of equity and debt, was jointly led by ADB Ventures and AdvantEdge Founders. The company plans to use the funds to expand its presence nationwide, scale up asset deployment, and enhance its infrastructure. —VCCircle

- Optimizers, an eyewear retail chain, has bagged an undisclosed amount of investment in a seed funding round led by Finvolve. The round also saw participation from Brew Opportunities Fund and Recyclean Infotech. The company intends to utilize the funds to expand its presence in key markets across India. A portion of the funds will also be allocated to improving its training academy, advancing resource planning, and acquiring inventories to support its expansion. —VCCircle

- Bajaj Finserv Health, a subsidiary of non-banking finance company (NBFC) Bajaj Finserv, has agreed to acquire insurance claims processor Vidal Healthcare Services and its two subsidiaries for INR 3.25 billion (USD 39.1 million). The two subsidiary units, Vidal Health Insurance TPA and VH Medcare, will become indirect subsidiaries of BFC Health and Bajaj Finserv. The acquisition is anticipated to conclude by the end of March. —VCCircle

Mesh Bio, ProcurePro, Alt.Leather, and more led yesterday’s headlines:

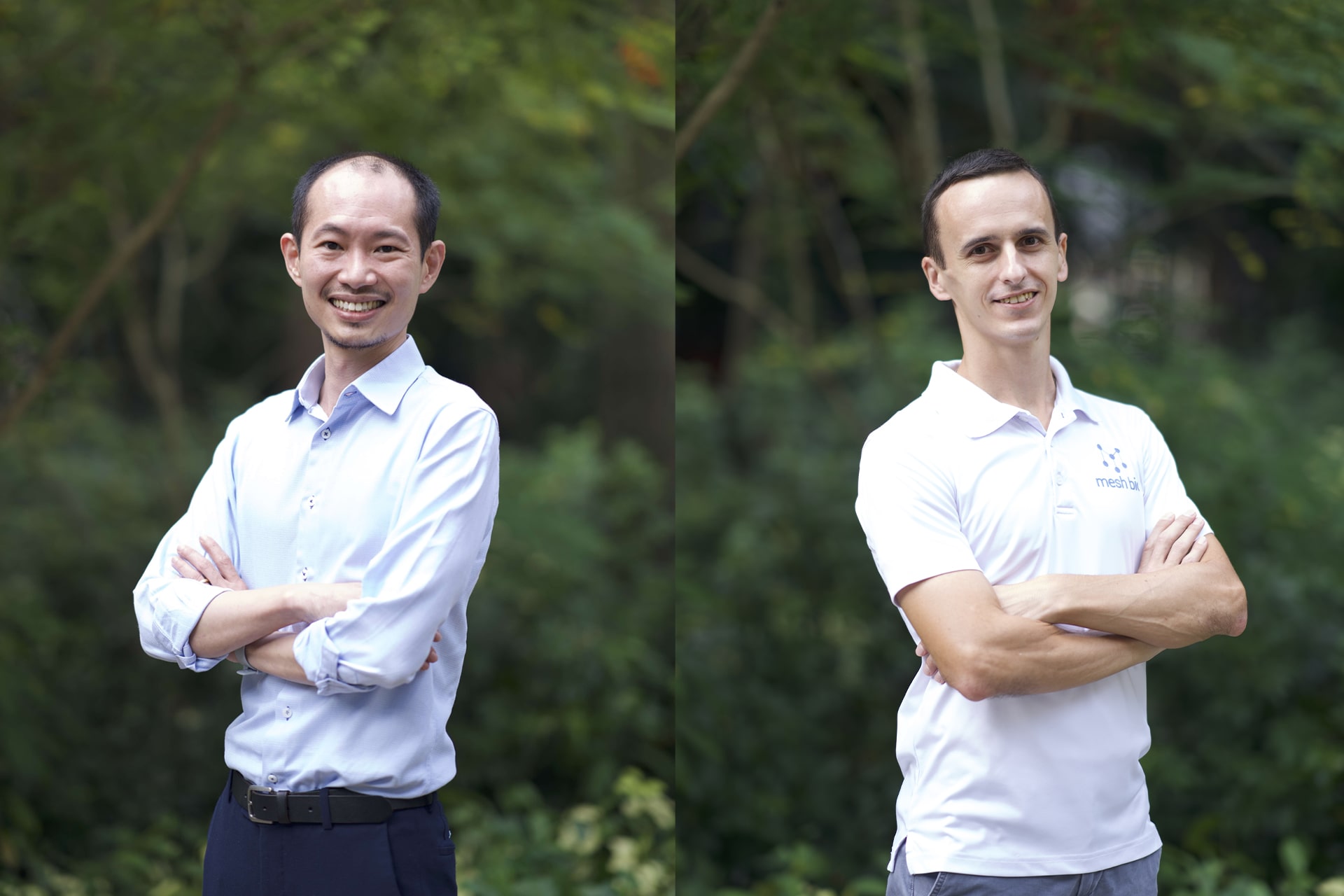

- Mesh Bio, a Singapore-based health tech startup, confirmed in a statement that it raised a total of USD 3.5 million in a Series A funding round led by East Ventures. This round also saw participation from Elev8, Seed Capitals, and the startup’s existing investors.

- ProcurePro, a Brisbane-based construction software startup, secured AUD 6.15 million in a funding round led by AirTree Ventures and Saniel Venture.

- Alt.Leather, a plant-based leather startup based in Melbourne, banked AUD 1.1 million in seed funding from Wollemi Capital Group and LaunchVic’s Alice Anderson Fund. Other participants in this round include Startmate, the Austin Group, and angel investors.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].