Tabby raises USD 200 million, attaining unicorn status

The Riyadh-based fintech startup, which offers buy now, pay later services to consumers in the Middle East, has secured USD 200 million in its Series D funding round, propelling its valuation to USD 1.5 billion.

The round was led by Wellington Management with participation from Bluepool Capital as well as existing investors STV, the Mubadala Investment Company, Arbor Ventures, and PayPal Ventures.

This round follows Tabby’s USD 58 million Series C funding round which was concluded less than a year ago, led by Peak XV Partners (formerly known as Sequoia Capital India and Southeast Asia) and STV. —TechCrunch

Funding Societies secures USD 7.5 million from Norfund

Digital finance platform Funding Societies, also known as Modalku in Indonesia, has secured USD 7.5 million in debt funding from Norfund, an investment fund owned by the Norwegian government.

This is the first debt transaction by Norfund with a fintech lender in the region. The funds will enable Funding Societies to further tailor its financing solutions to small and medium enterprises operating in the markets it serves, including Singapore, Malaysia, Indonesia, Thailand, and Vietnam.

“We have been impressed with how Funding Societies has been able to serve Southeast Asia’s underserved businesses with its broad range of financing solutions and solving cash management challenges faced by these SMEs. We are pleased to be able to support Funding Societies as the company expands its reach and increases financial inclusion further,” said Fay Chetnakarnkul, regional director of Norfund for Asia.

SPH Media acquires Tech in Asia

The Singaporean media organization has released a statement confirming its acquisition of Tech in Asia, an Asian technology media company.

This acquisition is aimed at marrying Tech in Asia’s regional reach and capabilities with the value proposition of The Business Times, a financial newspaper managed by SPH Media.

The deal is subject to customary closing conditions and is expected to close by the end of 2023.

Recent deals completed in China:

- Seahi, a Suzhou-based water robotics company, has secured an eight-figure RMB sum in an angel funding round led by Kunshan Angel Investment Fund. The round also saw the participation of Shengjing and Jade Capital, with additional credit support from the Industrial and Commercial Bank of China. The company will utilize the funds for product R&D, the construction of its production platform, and the establishment of its team. —Cyzone

- Engipower, an energy systems development company, has announced the completion of its Series A+ funding round, raising a nine-figure RMB sum. This round was led by Golden Ant Investment and saw participation from an alumni fund of Zhejiang University. The funds will primarily be used for product R&D and market expansion. —36Kr

- Yuntu Semiconductor, a Jiangsu-based semiconductor company, has secured a nine-figure RMB sum in a Series B1 funding round. Dioo Microcircuits, Qiandao Fund, and JX Capital Management jointly invested in this round. It will allocate the funds toward the R&D and mass production of high-performance automotive chips. —36Kr

Latest venture capital deals in India:

- Sugar.fit, a Bengaluru-based health tech startup, has secured USD 11 million in a Series A funding round led by MassMutual Ventures. Existing investors including Cure.fit, Tanglin Venture Partners, and Endiya Partners also participated in this round. The funds will be used to finance Sugar.fit’s expansion plans, broadening its portfolio of products, establishing an offline presence, and enhancing its R&D efforts. —VCCircle

- Kaabil Finance, a Jaipur-based financial services company, has raised USD 3 million in a pre-Series A funding round led by 2Point2 Capital. A group of undisclosed high-net-worth individuals also participated in the round. The capital will be used to accelerate the company’s growth, specifically focusing on enhancing its credit, risk, and collection facilities, and scaling its technology team. —VCCircle

- Infurnia Technologies, a Bengaluru-based architecture design software company, has raised USD 1.2 million in a funding round from a consortium of angel investors, with Yogesh Choudary (Jaipur Rugs) leading the investment. The funds will be allocated toward the company’s product development and market outreach initiatives. —VCCircle

- Fresh Bus, a Bangalore-based bus services provider, has received INR 75 million (USD 900,000) in a seed funding round, jointly invested by several angel investors including Kunal Shah (Cred), Sudarshan Venu (TVS Motors), and Deepak Garg (Rivigo). It will use the funds to enhance its technology infrastructure and expand its pool of talent. The capital will also be utilized to improve its operational efficiency. —VCCircle

- Klassroom Edutech, a Mumbai-based edtech startup, has secured USD 450,000 in a funding round led by ah! Ventures. The round also drew participation from other investors including Hem Angels, Meteor Ventures, and Startup Angels Network, among others. —VCCircle

- API Holdings, the parent company of online pharmacy chain PharmEasy, has secured USD 420 million through an oversubscribed rights issue, albeit at a reduced valuation. Among the investors include Temasek, TPG, Prosus, CDPQ, Eight Roads, LGT, ADQ, Amansa, OrbiMed, and the family offices of Sunil Kant Munjal and Ranjan Pai. —VCCircle

Engine Biosciences, Talino Venture Studios, Clay Capital, and more led yesterday’s headlines:

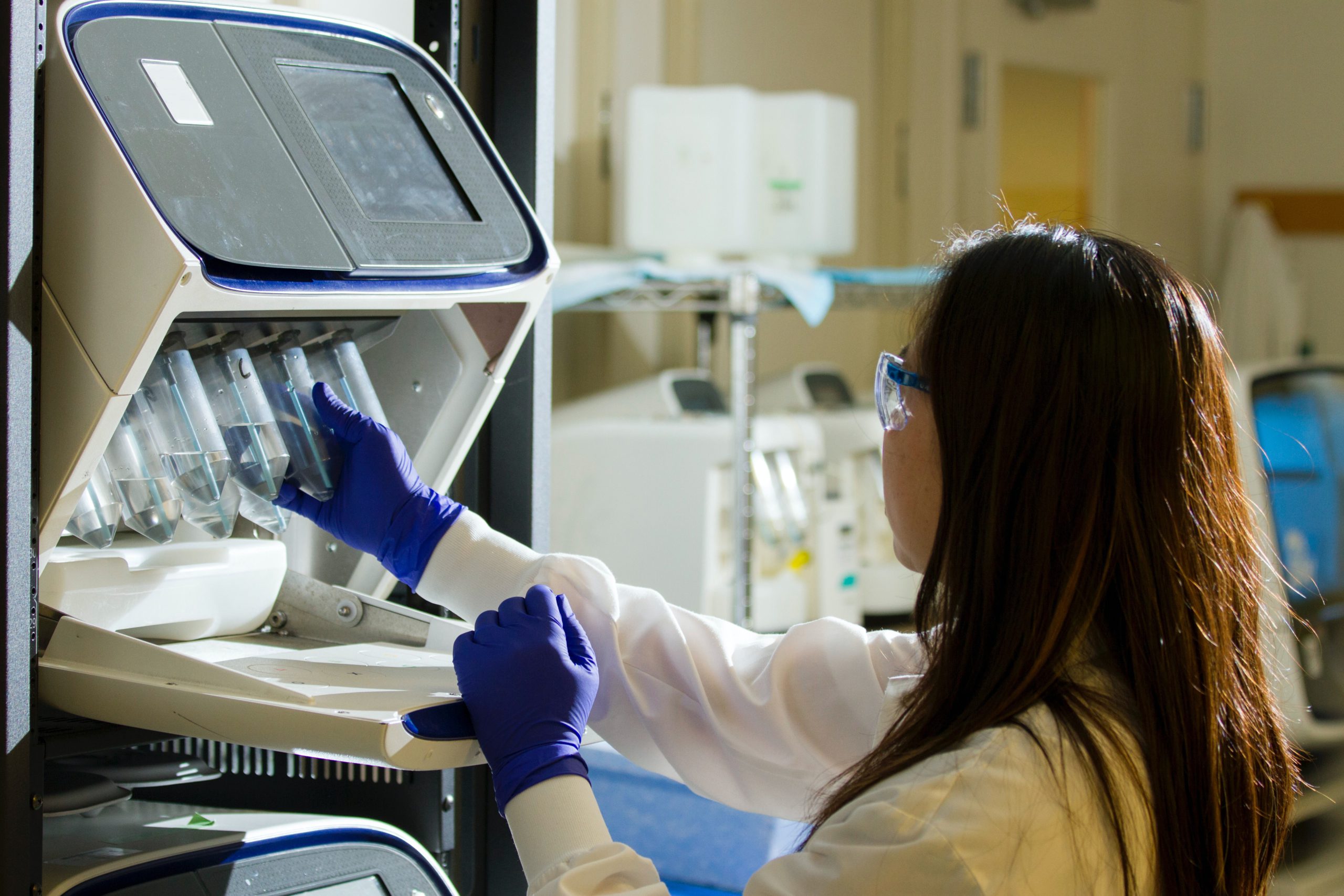

- Engine Biosciences, a Singapore-based biotech startup, raised an additional USD 27 million in an extension of its Series A round. The round was led by Polaris Partners and had participation from new investors such as Coronet Ventures and SEEDS Capital (Enterprise Singapore), along with existing investors ClavystBio (Temasek), Invus, and EDBI.

- Talino Venture Studios, an international venture studio, received a USD 5 million investment from Chemonics International. This investment coincided with the announcement of a partnership between both entities, which aims to utilize their collective expertise to address barriers to financial inclusion in developing economies.

- Singapore-based agrifood tech investor VisVires New Protein has rebranded as Clay Capital, concurrently announcing the closure of its second fund, totaling USD 145 million.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].