Nika.eco secures seed funding to expand climate tech offerings

Nika.eco, a Singapore-based climate tech company, has closed an oversubscribed seed funding round led by Silverstrand Capital, with additional backing from Timbul Ventures, DMV Investments, Orvel Ventures, and Ascend Network. This fresh influx of capital will enable Nika.eco to extend its geospatial infrastructure solutions beyond the carbon markets to other sectors where climate modeling is crucial.

The company’s audit-grade models, already utilized by financial giants like Carbon Growth Partners and major European banks, simplify complex processes such as prospecting, due diligence, and monitoring carbon stocks. Designed for accessibility, these solutions cater to users regardless of their technical expertise, making it easier to navigate and monetize carbon credits through precise geospatial data.

FMO provides debt financing to Validus to support Indonesian MSMEs

FMO, a Dutch entrepreneurial development bank, has deepened its partnership with Validus Group, providing USD 15 million in debt financing to bolster support for micro, small, and medium-sized enterprises (MSMEs) in Indonesia.

This funding will be routed through Validus’ Indonesian arm, Batumbu, to address the significant financing gap faced by small local businesses.

Airs Medical closes USD 20 million Series C round

Airs Medical, a healthcare-focused AI company, has closed a USD 20 million Series C funding round. This investment was co-led by BSK Investment and Shinyoung Securities.

The company is dedicated to democratizing access to top-tier medical diagnostics and prognostics. SwiftMR, its proprietary solution, utilizes deep learning to significantly speed up MRI scans by up to 50% compared to standard practices. According to Airs Medical, radiology centers and hospitals integrating SwiftMR can see a 38% increase in patient throughput and a 22% reduction in business hours by cutting patient wait times and reducing diagnosis delays.

With this fresh capital, Airs Medical said it is poised to accelerate its growth, invest in R&D, and expand its international footprint, continuing its commitment to improving patient outcomes.

Recent deals completed in China:

- Xinyi Technology, a Hangzhou-registered developer of smart towel dispensers, has raised RMB 30 million (USD 4.1 million) in an angel funding round from HCS. —36Kr

- Yinergy, an energy solutions provider, has completed a Series A funding round led by Puhua Capital. The funds will be used for R&D of distributed energy storage products and expanding its global market reach. —36Kr

- Kuajing Mofang, a foreign customer acquisition software provider, has raised tens of millions of RMB in a pre-Series A round of financing. SuperBrowser led the investment. The funds will go toward market expansion and R&D. —36Kr

- Huayi Ningchuang, a manufacturer of mass spectrometers, has secured nearly RMB 100 million (USD 13.7 million) in pre-Series A and Pre-Series A+ rounds from Oak & Acorn Capital. The funding will support R&D of high-end instruments for public safety, medical testing, and food safety, as well as the industrialization of unique mass spectrometry technologies. —36Kr

- Nsynu, a provider of semiconductor solutions, has raised hundreds of millions of RMB in a Series A funding round. The investors include a CICC-managed fund, E-Town Capital, Gobi Partners GBA, Infaith Group, SND Hi-tech Industrial, and SND Financial Holdings. Winsoul Capital served as the exclusive financial advisor for this round. The funds will be used for R&D and mass production. —36Kr

- Leiden Cryogenic Technology, a company specializing in low temperature and superconducting technologies for the production, storage, and transportation of hydrogen energy, has completed an angel round of financing, raising tens of millions of RMB from Shenzhen Qifu Angel Fund and Ningbo Angel Guidance Fund. —36Kr

- Bitoo Biotechnology, a provider of virus filtration solutions for the biopharmaceutical industry, has completed a Series A funding round. Lingang Blue Bay Fund was the exclusive investor. The funds will be used for the industrialization of existing products, scaling production, and market promotion. —36Kr

- DST, a Shenzhen-based operator of new energy vehicle (NEV) fleets, has completed its Series E+ round, adding Twin Towers Ventures (TTV), the corporate venture capital arm of Malaysian state energy giant Petronas, to its list of blue-chip shareholders. This extension round, which included existing shareholders, brings DST’s overall Series E financing to about USD 100 million. The USD 80 million main tranche was completed in December 2023. The funds will support DST’s overseas expansion strategy. —DealStreetAsia

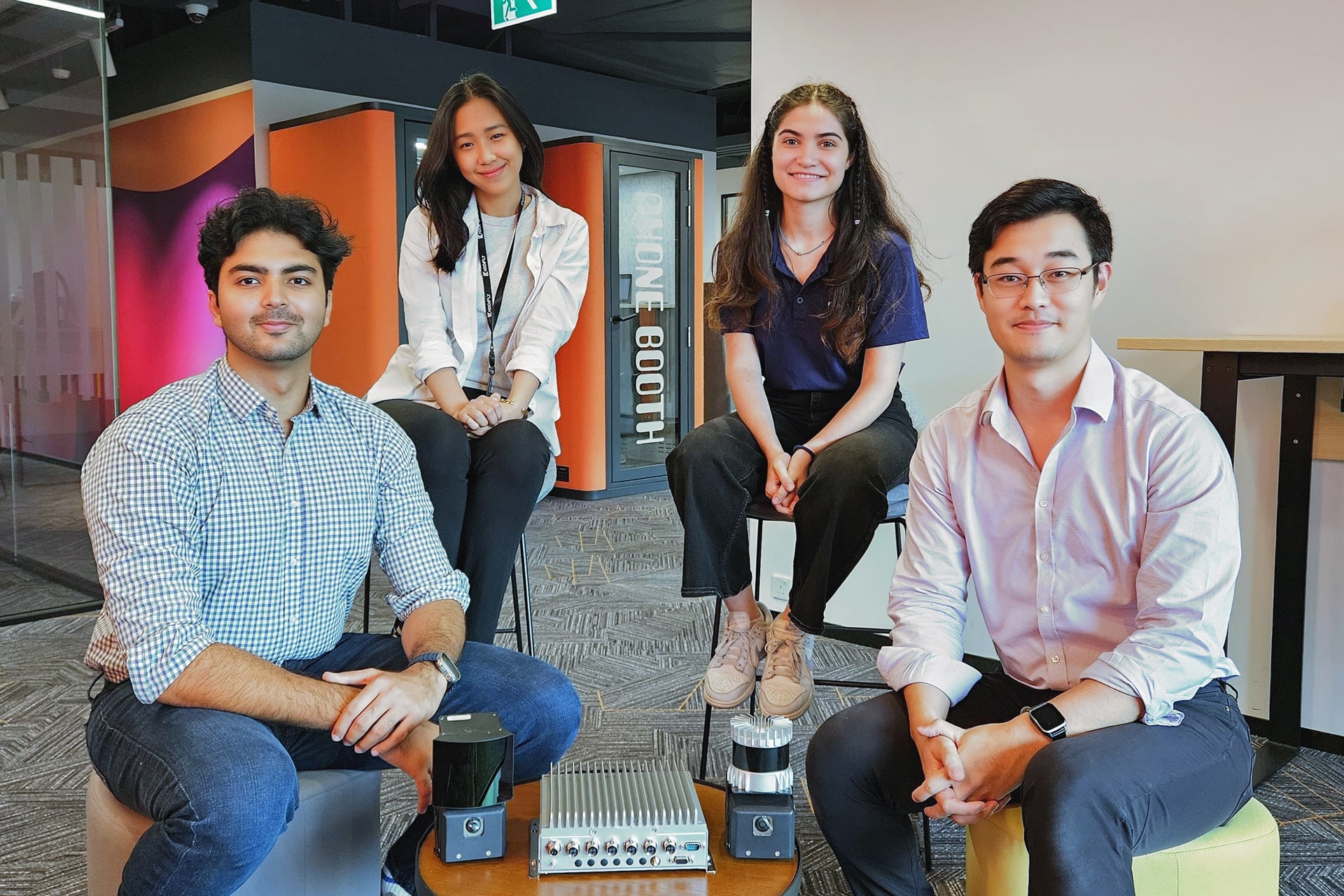

Kodifly, LongRiver Investments, Nami, and more led Tuesday’s headlines:

- Kodifly, a provider of infrastructure solutions for the mobility and transportation sector, announced a USD 750,000 investment from Laidlaw Scholars Ventures.

- LongRiver Investments, a venture capital firm specializing in the healthcare and technology sectors, announced the closure of its first venture capital fund, raising USD 50 million.

- Nami Distributed Energy, a clean energy company based in Ho Chi Minh City and Hanoi, received a USD 10 million investment from Clime Capital’s Southeast Asia Clean Energy Fund II (SEACEF II).

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].