Chinese bubble tea brands Mixue Bingcheng and GoodMe file prospectuses for Hong Kong IPO

Mixue Bingcheng and GoodMe, two of China’s major bubble tea brands, filed prospectuses for Hong Kong listings on January 2, 2024, with the aim of bolstering their finances through share sales to sustain growth in an increasingly competitive industry. This comes after ChaPanda submitted its IPO application in August last year, making a total of three Chinese beverage retailers seeking to list in Hong Kong over the past five months, indicating their determination to expand despite China’s delayed economic recovery.

Both Mixue and GoodMe, much like ChaPanda, already have a substantial presence in China. Mixue reported 32,180 stores across China by the end of Q3 2023, totaling at least 36,000 stores worldwide. GoodMe, focusing mainly on lower-tier cities, opened 9,001 stores by the end of the previous year.

According to their prospectuses, Mixue and GoodMe generated revenues of RMB 15.39 billion (USD 2.16 billion) and RMB 5.57 billion (USD 783.6 million) respectively in the first three quarters of 2023, primarily from selling raw materials and equipment to franchisees.

It’s noteworthy that Mixue initially considered listing in mainland China but shifted toward exploring a Hong Kong IPO due to a lack of progress in its application to list on the Shenzhen Stock Exchange in 2022. This move may signal Chinese regulators’ reluctance to permit the listing of companies heavily reliant on franchising-centric business models.

UniFAHS raises over USD 1.4 million in seed round

UniFAHS, a Thailand-based biotechnology company specializing in phage technology for sustainable agriculture and food safety, has raised at least USD 1.4 million in its seed funding round. The round was led by A2D Ventures with participation from ADB Ventures and InnoSpace Thailand.

“We are thrilled to lead and syndicate this strategic investment opportunity in UniFAHS, recognizing the synergies between [its] technology and the founders’ scientific prowess. This investment underscores our confidence in Thai founders and Thailand-based startups’ potential to redefine and recreate industries, offering solutions that can be exported to global markets and achieve substantial growth quickly,” said Ankit Upadhyay, founder and CEO of A2D Ventures.

Singapore’s Silicon Box secures investment from TDK Corporation

Silicon Box, a Singaporean company specializing in semiconductor integration solutions, has secured an undisclosed amount of investment from TDK Corporation through TDK Ventures, its subsidiary.

The company is focused on addressing challenges related to energy efficiency and performance in the semiconductor industry, utilizing innovative chiplet-based semiconductor packaging designs to offer scalable and energy-efficient alternatives to traditional monolithic chips.

Perplexity AI raises USD 73.6 million to reimagine the future of search engines

Perplexity AI, an artificial intelligence-powered search engine developer, has raised USD 73.6 million in a funding round led by IVP with the support of investments from Nvidia, NEA, Databricks Ventures, Elad Gil (formerly from Twitter or X), Tobi Lutke (Shopify), Nat Friedman (formerly from GitHub), and Guillermo Rauch (Vercel). Jeff Bezos, founder of Amazon, also took part in this round. —TechCrunch

Recent deals completed in China:

- Minova Pharmaceuticals, a Nanjing-based developer of mental health and disfigurement treatments, has secured close to RMB 100 million (USD 14 million) in a pre-Series B funding round jointly led by Bishuiquan Private Equity Fund Management and Jointown Medical Investment. Existing investor Wenzhou Capital contributed to this round. —36Kr

- Convalife Pharmaceuticals, a pharmaceutical R&D company specializing in the formulation of anti-tumor and anti-aging drugs, has banked over RMB 100 million (USD 14 million) in a Series C funding round. The round saw participation from various investors, including the company’s existing backers and listed companies. Convalife will utilize the funds to expedite the development and commercialization of its products. —36Kr

- Sington Technology, a Shenzhen-headquartered integrated computational materials engineering (ICME) company, has raised an eight-figure RMB sum following the completion of its Series A+ funding round. The round was led by Shanshan with the support of Qingke Capital and existing investors. Sington will use the funds to develop new materials and upgrade its manufacturing center. —36Kr

- Yesen, an elder care electronics brand, has bagged RMB 10 million (USD 1.4 million) in angel funding from Cloudwalk Technology as well as new and existing investors. Yesen will use the capital for several purposes including production, marketing, and R&D. —36Kr

- Wiserscope, a Guangzhou-based provider of imaging modules for endoscopy devices, has completed the first close of its Series A funding round, raising an eight-figure RMB sum from Shanghai-based Green River Capital. It will utilize the funds to expand its production capacity, consolidate its capabilities, and conduct R&D. —36Kr

- Shengwu Technology, a Shenzhen-based biowaste solutions company, has secured a seven-figure RMB sum of seed funding from the Alibaba Entrepreneurs Fund and Gobi Partners GBA. The company will allocate the newly raised capital toward technology R&D, team building, and the construction of its factories. —36Kr

- AutraTech, an autonomous driving solution provider for logistics and trucking operations, has extended its pre-Series A funding round, securing debt and equity financing from E-Town Capital, IDG Capital, Cathay Capital, and the Silicon Valley Bank. The total sum secured is believed to be over RMB 100 million (USD 14 million). —36Kr

- Pixso, a product design and collaboration platform, has raised an undisclosed amount of Series A funding from Shenzhen HTI Group, Fosun Capital, Kingdee, and JAFCO Asia. The company’s founder also took part in this round. The funds will be used primarily for product R&D. —36Kr

- Zhejiang Zhongning Silicon Industry, a Quzhou-based manufacturer of silane gas and electronic-grade polysilicon for the integrated circuit industry, has secured RMB 800 million (USD 112.3 million) in a funding round led by Phoenix Tree Capital Partners. The round saw the participation of Quzhou State-owned Capital Operation, Hengxu Capital, and China Cinda Asset Management. Zhongning Silicon will use the funds to expand its production capacity and expedite its product iteration. —DealStreetAsia

- Full-Life Technologies, a radiotherapeutics company, has received USD 47.3 million in a Series B funding round jointly led by Prosperity7 Ventures and an unnamed life science-focused investment fund. The capital injection also includes a credit line of USD 16 million, as the firm seeks to accelerate the R&D and commercialization of its research. Other investors that participated in this round include Sky9 Capital, Chengwei Capital, HongShan (formerly known as Sequoia Capital China), and Junson Capital. —DealStreetAsia

- Jiangsu Vcare PharmaTech, a contract research organization (CRO), has raised RMB 450 million (USD 63.2 million) in a Series C funding round from China Life Private Equity Investment Company (China Life Insurance), Dyee Capital, as well as existing investors Nanjing Innovation Capital Group and Huadian Investment. —DealStreetAsia

Latest deals in India:

- Wiz Freight, a Chennai-based digital freight forwarding company, has raised INR 933 million (USD 11.2 million) in a Series B funding round led by SBI Investments. The round also drew the participation of Tiger Global, the Nippon Express Fund, the Axilor Technology Fund (Axilor Ventures), Arali Investments, and Unikon Shipping Ventures. Wiz will use the proceeds for growth, market expansion, and as working capital for general corporate activities. —Entrackr

- OneCard, a Pune-based company offering credit cards “reimagined for the mobile generation,” has raised INR 950 million (USD 11.4 million) in debt funding from Alteria Capital. —Entrackr

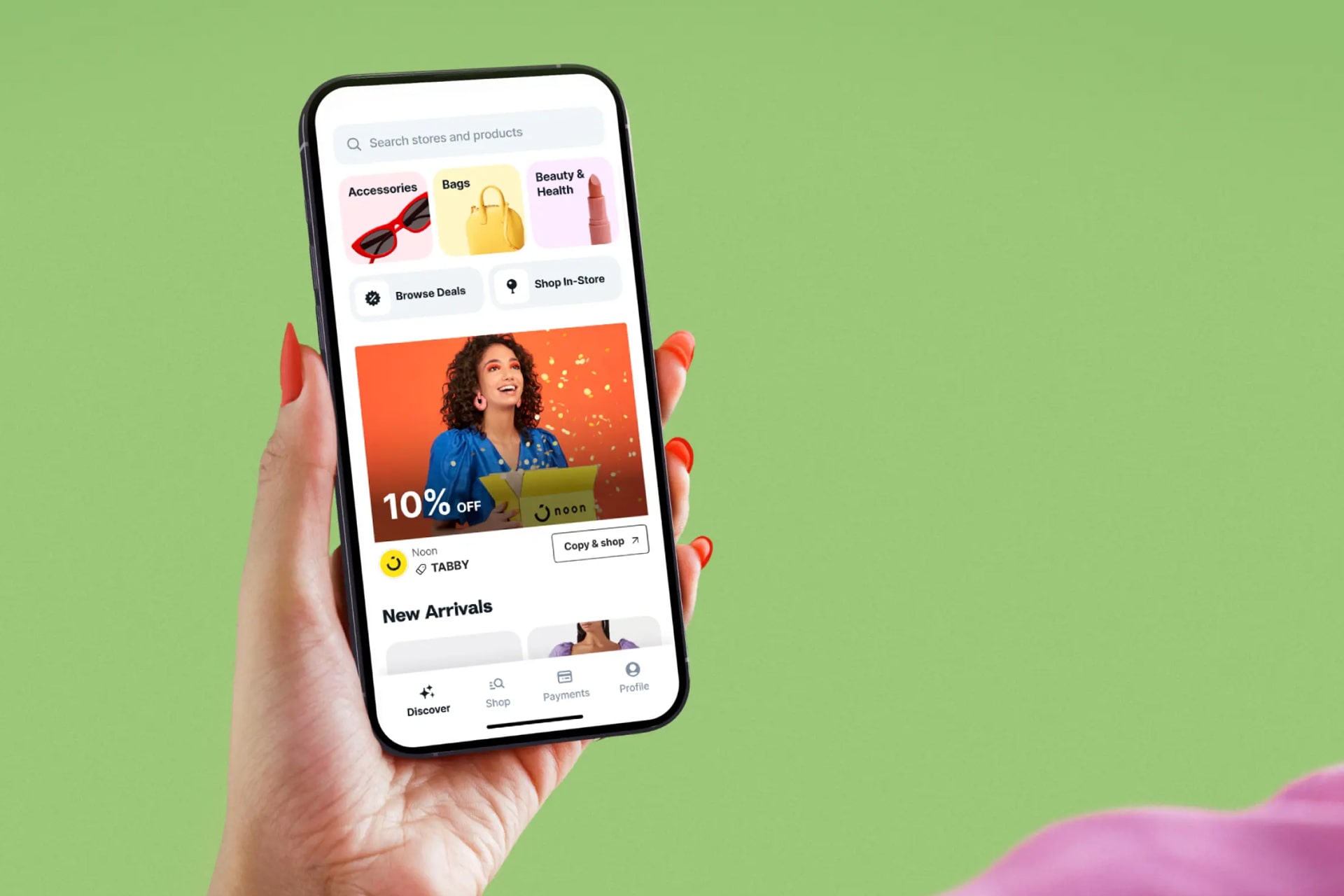

Tabby, Swap Energy, Konvy, and more led yesterday’s headlines:

- Tabby, a Riyadh-based fintech startup offering buy now, pay later services to consumers in the Middle East, secured up to USD 700 million in receivables securitization from JP Morgan. The startup also extended its Series D funding round to close at USD 250 million with participation from Hassana Investment Company, Soros Capital Management, and Saudi Venture Capital (SVC).

- Swap Energy, an Indonesian electric vehicle battery swapping startup, is reportedly planning to use the USD 22 million in capital from its recent Series A funding round to increase its market share in Indonesia, leveraging on its qualification for a subsidy policy implemented by the Indonesian government.

- Konvy, a Bangkok-based online beauty retailer, raised at least USD 11 million in its latest funding round.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].