Grab acquires Cambodia’s Nham24 to expand digital services in the region

Grab has acquired the operations of Nham24, a leading food delivery platform in Cambodia, following regulatory approval. This merger aims to bolster the region’s digital economy by expanding services, including food and grocery delivery as well as ride-hailing.

Nham24 is set to integrate Grab’s technological offerings, such as artificial intelligence-driven tools, to streamline merchant operations and improve delivery logistics. Merchants will gain access to Grab’s advertising solutions and benefit from a subsidized onboarding process. Drivers will also enjoy productivity enhancements through Grab’s mapping and batching technologies.

Both apps will operate independently during the transition, ensuring seamless service continuity for users, merchants, and riders.

Alibaba to sell majority stake in Sun Art, forms JV with Shinsegae to compete in South Korea

Alibaba Group has announced the sale of its 78.7% stake in Sun Art Retail Group, the operator of RT-Mart hypermarkets, to private equity firm DCP Capital for HKD 12.298 billion (USD 1.6 billion), according to Reuters. This marks a shift in strategy after Alibaba acquired a controlling stake in Sun Art in 2020 for USD 3.6 billion to expand its digital footprint in retail.

The move follows Alibaba’s sale of Intime Retail as the company sharpens its focus on core e-commerce operations for greater efficiency and profitability.

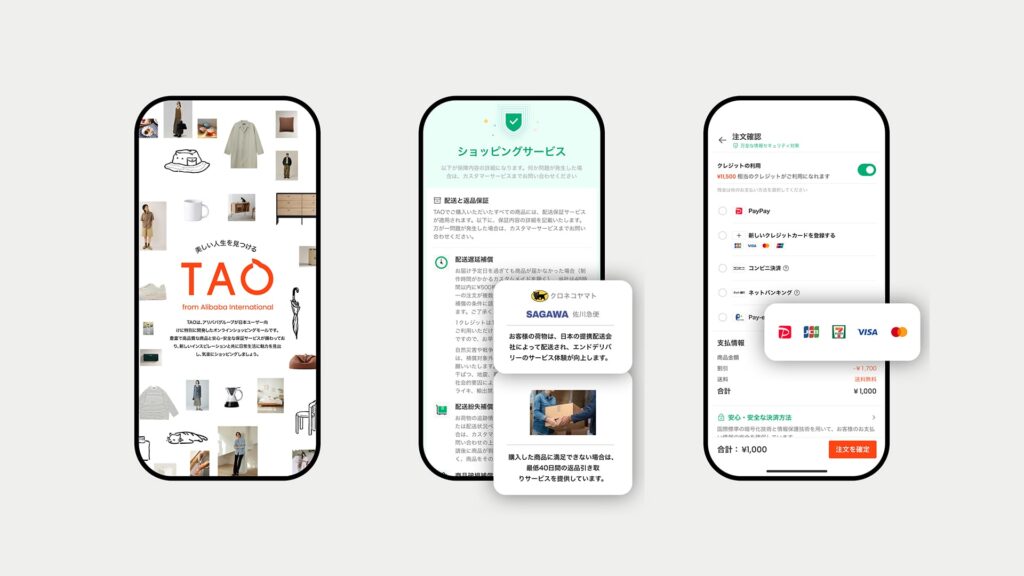

Simultaneously, the Korea Economic Daily has reported that Alibaba is partnering with Shinsegae Group to form Grand Opus Holdings, a joint venture aimed at South Korea’s e-commerce market. The collaboration will merge Shinsegae’s Gmarket and Alibaba’s AliExpress to better compete with local leaders like Coupang and Naver Shopping. Last month, Alibaba took a 5% stake in Ably Corporation, a South Korean apparel app, and recently launched Tao, a cross-border e-commerce platform targeting Japan, reflecting its growing interest in East Asia’s digital economy.

Malaysia’s Khazanah invests in Cambrian Fund and Syntiant through Dana Impak

Khazanah Nasional Berhad, Malaysia’s sovereign wealth fund, has made strategic investments in the MYR 100 million (USD 22.3 million) Cambrian Fund and California-based AI company Syntiant under its Dana Impak initiative.

The Cambrian Fund will focus on developing emerging technologies with industrial applications, such as robotics and machine vision, to support Malaysia’s small and medium enterprises and bolster its semiconductor sector. Syntiant, with Khazanah’s support, plans to establish an AI R&D center in Malaysia to foster local innovation.

Calo raises USD 25 million in Series B funding to expand meal customization and enter global markets

Riyadh-based meal subscription startup Calo has raised USD 25 million in Series B funding, led by Nuwa Capital, with participation from Khwarizmi Ventures and STV, according to TechCrunch. The funding values the company at USD 250 million and brings its total capital raised to USD 51 million.

Calo specializes in customizable ready-to-eat meals tailored to health goals, such as weight loss, muscle gain, and dietary restrictions. With the new funding, it plans to expand into new markets, including the UK in 2025, through a local acquisition. The company is also exploring retail kiosks and on-demand delivery to diversify its offerings. Calo aims to achieve profitability and go public on the Saudi stock market within the next few years.

EQT and Temasek sell O2 Power to JSW Neo Energy for USD 1.5 billion

Global investment firms EQT and Temasek have sold O2 Power, their renewable energy joint venture, to JSW Neo Energy for USD 1.5 billion. Launched in 2020, O2 Power has grown into one of India’s largest renewable energy platforms, with a 4.7-gigawatt portfolio of solar, wind, and hybrid energy projects.

This sale highlights India’s rapid ascent as a global renewable energy hub, with the nation targeting 500 gigawatts of capacity by 2030. JSW Neo Energy plans to leverage O2 Power’s infrastructure to further its renewable energy ambitions and support India’s transition to clean energy.

Recent deals completed in China:

- SJ Semiconductor Corporation (SJSemi), a leader in advanced semiconductor packaging and wafer technologies, has raised USD 700 million in a funding round jointly led by Wuxi Chanfa Science and Technology Innovation Fund, Jiangyin Binjiang Chengyuan Investment Group, and Fortera Capital, with participation from Shanghai International Group, Lingang Xinxin Fund, and the Social Security Fund Zhongguancun Independent Innovation Fund. SJSemi will use the funds to enhance its 3D multi-die integration capabilities and further its journey toward an IPO.

- Mooe Robot, a robotics firm specializing in automation solutions, has completed its Series B3 equity funding round. Wutong Capital led the round, and the company has cumulatively raised several hundred million RMB across its funding efforts. The latest capital infusion will support overseas market expansion, a new factory to scale production, and improvements in product quality. —36Kr

- Mingxin Shuzhi Technology, an artificial intelligence service provider targeting cross-border e-commerce, has secured RMB 200 million (USD 28 million) in a Series B funding round led by Bai Rui Capital. The company is focused on leveraging large language models to offer solutions for customs declarations, tax refund filings, and financial services. This funding will enable the firm to double down on R&D, expand its product offerings, and deepen its market penetration in e-commerce pain points. —36Kr

- Trugo Tech, an automotive technology innovator, has announced the completion of its RMB 400 million (USD 56 million) Series B funding round, backed by investors such as FAW Equity Investment and Blue Lake Capital. —36Kr

- Wisdom Horse, an AI infrastructure company, has raised a seven-figure RMB sum in an angel funding round. The investor details remain undisclosed. Wisdom Horse said it has earmarked the funds for product development and innovation. The company focuses on AI data centers, leveraging expertise in GPU clusters and IB networks. —36Kr

- Nasn, a specialist in autonomous chassis systems, has completed a RMB 500 million (USD 70 million) Series D round of financing. SDIC Juli and CMG-SDIC Capital co-led the investment. Nasn plans to use the proceeds to enhance its production line, develop next-generation chassis technologies, and scale its industry footprint. —36Kr

- MetaLenX, a metamaterial lens manufacturer, has raised over RMB 100 million (USD 14 million) in a Series A+ funding round. The investors include Yonghua Capital and Seas Capital. The funds will support new product development, increased production capacity, and further R&D into applications spanning consumer electronics, automotive technologies, and industrial inspection. —36Kr

- Infinitrix, an AI startup, has raised over RMB 10 million in an angel funding round led by Leaguer Financial. The funds will be used to develop its AI tutor product that combines multimodal tech, efficient reasoning, and emotional interaction to provide personalized learning experiences. —36Kr

- Infrawaves, a Tsinghua University spinoff focused on AI infrastructure, has secured over RMB 100 million through pre-Series A and Series A funding rounds co-led by China Merchants Venture and Huatai Innovation Investment. The capital will drive advancements in distributed computing and accelerate AI deployment in various applications. —36Kr

- X-Origin-AI, an AI robotics company, has completed an angel funding round, raising an eight-figure RMB sum. Alpha Startups led the round, and the company plans to channel the funds into R&D for consumer-grade AI robots designed for human lifecycle assistance, with a focus on children’s educational tools. —36Kr

- Lightstandard, a photon AI chip developer, has announced a new round of financing from a leading Chinese internet firm. The funds will support the company’s efforts to commercialize its advanced photonic computing technology and enhance its applications in AI-driven scenarios. —36Kr

- Fusha Technology, a precision ceramics manufacturer specializing in components for coffee machines, has closed an angel funding round worth a seven-figure RMB sum. The investors include Caye Technology and Yongqi Ceramics. The company will use the funds to scale its manufacturing capabilities and refine its product designs. —36Kr

- Chasing Light, based in Guangzhou, has raised nearly RMB 100 million in a Series A round of financing led by a fund under State Power Investment Corporation (SPIC). The company will use the newly raised capital to scale its organic photovoltaic production line for applications across the internet-of-things, consumer electronics, and smart homes. —36Kr

- PIX Moving, an autonomous vehicle manufacturer, has raised an undisclosed amount in a Series B1 funding round led by Zheshang Venture Capital. The proceeds will support the mass production of its modular vehicle models and international market expansion. —36Kr

Lydia AI, Freshket, Alibaba, and more made recent headlines:

- Lydia AI, a startup specializing in health risk assessments using artificial intelligence, announced an investment from Kickstart Ventures, the venture capital arm of the Philippines’ telecom giant Globe Telecom.

- Freshket, a Thai startup redefining the food supply chain for restaurants, raised USD 8 million in a funding round co-led by Thai President Foods (TFMAMA) and Kliff Capital. Existing investors Openspace and ECG Venture Capital also participated.

- Alibaba unveiled the AEF NextGen Fund through its Alibaba Hong Kong Entrepreneurs Fund (AEF). The new fund is a USD 150 million initiative designed to empower startups leveraging AI to address structural challenges. The fund targets growth-stage companies in key industries such as financial services, healthcare, and consumer retail, offering resources and expertise to help them scale globally.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].