Is our region’s funding landscape in a precarious state?

According to a joint report by Temasek and Bain & Company, private funding in digital economy sectors has regressed to 2017 levels, a significant shift from the highs of 2021. In the first half of 2023, 564 deals were completed, securing a total of USD 4 billion in funding, a sharp contrast to the 2,697 deals that amassed USD 27 billion in 2021. This decline has impacted startups at all stages.

Investors are also grappling with challenges, with 87% reporting increased fundraising difficulties, and 64% observing reduced diligence and top-of-funnel activity.

Despite these hurdles, private equity and venture capital funds committed in 2022 surpassed the previous year, reaching USD 15.7 billion, compared to USD 12.4 billion in 2021. Several new funds were also launched this week, including the Mandiri-Investible Global Climate Tech Fund, the Kenanga Islamic Asia Pacific (Ex Japan) Total Return Fund, and Java Capital’s second fund valued at INR 500 million (USD 6 million).

Could we be on the verge of a turning point? We welcome your insights at: [email protected].

That’s all for this week. If there are any news or updates you’d like us to feature, you can also get in touch with us via the email above.

East Ventures invests in Compawnion

Compawnion, an Indonesian pet food company, has concluded a new funding round led by East Ventures, securing an undisclosed investment. The company operates under two brands, Pawmeals and UGO.

Compawnion will utilize the newly raised funds to expand its distribution channels, advance its R&D efforts, and diversify its range of products.

“We create wholesome fresh diets for pets to promote a healthier, happier life, prioritizing their well-being and happiness above all else,” said Valerie Amintohir, co-founder and chief product officer of Compawnion.

“As the pet industry continues to grow and evolve, Compawnion’s dedication to quality, innovation, and pet wellbeing stands out. We believe Stephanie, Tania, and Valerie will break new ground and set new standards in the pet food and wellness industry and we are excited to work with them to do so,” said Wesley Tay, principal at East Ventures.

EDBI establishes new multi-stage investment firm

Singaporean investment fund EDBI has established August Global Partners (AGP), a new multi-stage investment firm that will focus on early-stage and growth-stage investments.

AGP presently manages USD 250 million in assets, spread across two funds: the AGP Continuation Growth Fund, and the AGP Healthcare Fund. The former, already closed, focuses on growth equity investments in Southeast Asia, while the latter targets healthcare services and advanced manufacturing companies.

Little Joy completes Series A round

The Indonesian D2C startup, which specializes in mom-and-baby products, has announced the completion of its Series A funding round. The startup did not disclose the investment amount or the participating investors.

Little Joy will use the funds to enhance its offerings for mothers and children, with a specific focus on addressing child malnutrition in Indonesia. —DailySocial

Temus acquires Decision Science Agency, expands to Hong Kong

The Singapore-based digital transformation company has acquired Decision Science Agency (DS), a digital services provider operating in Singapore, Malaysia, and Vietnam. Collin Ang, founder of DS, will assume the role of managing director at Temus following this acquisition.

Temus has also announced its expansion plans by establishing an office in Hong Kong. This move, along with its acquisition of DS and the previous acquisition of Dreamcloud in September of last year, is expected to enhance its capabilities in the Hong Kong market. —TechNode Global

Mitsui acquires stake in Axiata’s digital and analytics unit

The Japanese trading house has agreed to acquire a 12.69% stake in the digital and analytics unit of Axiata Group, a Malaysian telecommunications conglomerate. USD 58 million will be invested into the unit through its holding company, Axiata Digital Services, as part of the deal. —Reuters

Recent deals completed in China:

- Leapmotor, a Chinese electric vehicle manufacturer, has received EUR 1.5 billion (USD 1.59 billion) in investment from Stellantis, an automotive manufacturer formed from the merger of Fiat Chrysler Automobiles and PSA Group. Stellantis will acquire around 20% of Leapmotor as part of the deal. This agreement will also lead to the establishment of Leapmotor International, a joint venture led by Stellantis with a 51/49 ownership split. The new venture will focus on manufacturing, exporting, and selling Leapmotor’s products outside of Greater China.

- Xihuang Technology, an internet technology company specializing in search marketing and branding services, has completed a Series B funding round jointly led by Tiger Global Management and Timing Ventures. The company is valued at USD 1 billion and has filed for an IPO, anticipating its completion in 2025. —36Kr

- Senad, a Shanghai-based robotics and computer vision company, has secured an eight-figure RMB sum in a Series B funding round from Puhua Capital. InvesTarget served as the exclusive financial advisor. —36Kr

Latest deals in India:

- Easiloan, a Mumbai-based fintech startup specializing in home loans, has received an undisclosed sum of investment from Housing.com, a digital real estate platform owned by REA India, a subsidiary of global conglomerate REA Group. This investment aligns with the establishment of a partnership between both entities with the goal of creating a comprehensive digital home loan origination platform. It leverages Housing.com’s reach to expand the accessibility of mortgage products through Easiloan.

- Growcoms, a B2B agritech startup, has secured USD 3.5 million in a funding round led by JSW Ventures and Arali Ventures, with participation from existing investor InfoEdge Ventures. It will use the funds to bolster its portfolio of products and enhance its technological capabilities. —Inc42

- Fibmold, a sustainable packaging startup, has secured USD 10 million in a funding round jointly led by Omnivore and Accel. —Inc42

Tabby, Funding Societies, SPH Media, and more led yesterday’s headlines:

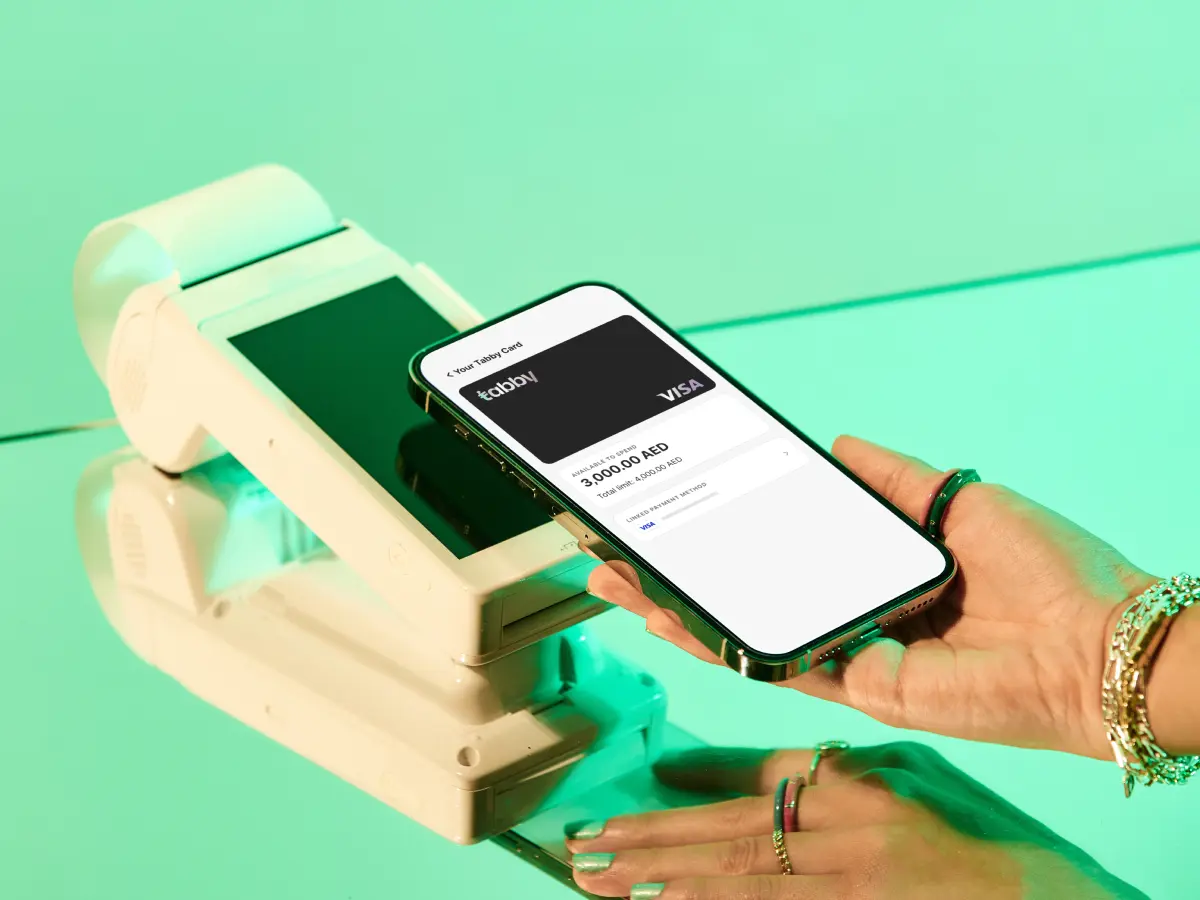

- Tabby, a RIyadh-based fintech startup, secured USD 200 million in a Series D funding round led by Wellington Management. Other participants included Bluepool Capital and existing investors STV, the Mubadala Investment Company, Arbor Ventures, and PayPal Ventures.

- Digital finance platform Funding Societies, also known as Modalku in Indonesia, obtained USD 7.5 million in debt funding from Norfund, an investment fund owned by the Norwegian government.

- SPH Media, a Singaporean media organization, will acquire Tech in Asia, an Asian tech media company. This acquisition is aimed at combining Tech in Asia’s regional presence with the value proposition of SPH Media’s The Business Times.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].