Antler invests USD 110,000 in Nebu

Nebu, an artificial intelligence startup, has received a USD 110,000 investment from venture capital firm Antler as part of the investor’s Malaysia residency program, according to e27.

The startup plans to use the investment to develop its platform, refine its AI model, and execute its go-to-market strategy.

Nebu’s technology automates the detection and remediation of cloud misconfigurations, enabling secure and continuous cloud operations for cloud-native companies in the SaaS and online B2C sectors. By managing cloud infrastructure, Nebu allows businesses to concentrate on delivering value.

SMI Vantage acquires controlling interest in Whisky Cask Club

SMI Vantage, a Singapore-based investment firm, has acquired a controlling stake in Whisky Cask Club (WCC), a brokerage specializing in the investment and trading of rare and ultra-premium whisky casks.

The acquisition is part of SMI Vantage’s broader strategy to diversify into high-growth businesses. With over 50 years of combined experience in the Scottish whisky industry, WCC partners with exclusive suppliers to offer clients access to some of the most sought-after casks.

This acquisition is expected to significantly boost SMI Vantage’s revenue and profitability.

EQT to acquire South Korea’s KJ Environment

EQT, a global investment firm, has announced its acquisition of KJ Environment and its affiliated companies from Genesis Private Equity.

This move will establish a comprehensive waste treatment platform in South Korea, with a focus on plastic recycling and waste-to-energy solutions. Operating primarily in the Seoul metropolitan area, the platform serves more than 50% of the country’s population and GDP.

The acquisition aligns with EQT’s commitment to climate-related infrastructure, promoting resource efficiency and a circular economy. The transaction is expected to close in the final quarter of 2024, pending customary approvals.

Recent deals completed in China:

- Acme Optoelectronics, a manufacturer of perovskite photovoltaic equipment, has completed an angel funding round, raising nearly RMB 100 million (USD 13.9 million) from the Envision-Hongshan Carbon-Neutral Fund and Envision Ventures. The company plans to use the capital to expand its R&D team, accelerate product development, and enhance its mass production line solutions. —36Kr

- Desgeo, a developer of smart appliances for small pets, has raised an eight-figure RMB sum in a pre-Series A funding round led by Ventech China, with Zhuiguang Capital acting as the exclusive financial advisor. The funds will be used for product development and market expansion. Founded in 2015, Desgeo’s “Mijia” smart fish tank, developed exclusively with Xiaomi, has sold around 800,000 units, positioning it as the market leader in China’s smart fish tank segment. —36Kr

- RingConn, a tech company specializing in low-power biosignal acquisition systems, has secured tens of millions of RMB in an extended angel funding round. Investors include Brizan Ventures’ second fund, Future Technology Fund, CWB Capital, Hong Kong X Technology Fund, and Virtu International. The funds will be used for R&D, market outreach, and team expansion. —36Kr

- Tongchao Precision Machinery, a semiconductor technology company based in Wuhu, has completed a new funding round with investments from Bondshine Capital, Camel Equity Investment, Guoyuan Securities Innovation, Guoyuan Securities, Hefei Construction Investment and Holding, and Guohe Investment. Founded in March 2016, Tongchao manufactures critical components for display panels and integrated circuits, including upper and lower electrodes and heaters, along with surface treatment solutions for metal, high-purity silicon, and quartz parts. —36Kr

Latest funding deals in India:

- Fresh Bus, an electric bus service operator, has raised INR 875 million (USD 10.4 million) in a Series A funding round led by Maniv, with participation from Shell Ventures, Alteria Capital, and existing investor Riverwalk Holdings. The company will use the funds to add new routes, deploy more buses, enhance technological capabilities, and strengthen its team. —Entrackr

- Innoviti, a Bengaluru-based provider of integrated payment solutions, has secured INR 700 million (USD 8.3 million) in equity and debt as part of the second tranche of its Series E funding round. The round was led by Random Walk Solutions, with participation from Bessemer Venture Partners, the Patni Family Office, and Alumni Ventures. The funds will be used to prepare for an IPO within the next 12 months. —Entrackr

- Neo, a Mumbai-based wealth and asset management firm, has raised INR 4 billion (USD 47.6 million) in a Series B funding round co-led by MUFG Bank and Euclidean Capital, with participation from existing investor Peak XV Partners. Neo plans to use the funds to expand its wealth management division and support its asset management business. —Entrackr

- Oyo, a Gurugram-based hospitality company, has raised INR 14.57 billion (USD 173.5 million) in a Series G funding round from investors including InCred Wealth, Patient Capital, J&A Partners, and ASK Financial Holdings. The company will use the funds for growth, global expansion, and enhanced business plans. The firm has seen its valuation drop from USD 9.6 billion in 2021 to USD 2.38 billion. —Entrackr

- BiofuelCircle, a Pune-based biomass and biofuel marketplace, has raised INR 450 million (USD 5.3 million) in a funding round led by Spectrum Impact, with participation from angel investors and company promoters. The company will use the funds to expand its supply chain, connecting farmers, storage facilities, refineries, and industrial consumers. —Entrackr

- Metadome.ai, an extended reality (XR) startup, has raised USD 6.5 million in Series A funding jointly led by Siana Capital and Chiratae Ventures, with participation from Alteria Capital, 3to1 Capital, and Manish Choksi’s family office. —Entrackr

- Blitzscale Tech, the parent company of WMall and ShopDeck, has raised INR 652 million (USD 7.7 million) in a Series B1 funding round led by Bessemer Venture Partners, with participation from Chiratae Ventures and Elevation Capital. The company will use the funds for growth, expansion, marketing, and general corporate purposes. —Entrackr

- Aukera, a lab-grown jewelry brand, has raised INR 267 million (USD 3.2 million) in its Series A funding round led by Fireside Ventures. The company will use the funds for expansion and general corporate purposes. —Entrackr

- Visit Health, a telehealth and wellness platform, has raised INR 2.5 billion (USD 29.8 million) through a combination of primary and secondary stake sales. The company plans to use the funds for business expansion and a strategic partnership with health platform TatvaCare. —Entrackr

- Country Delight, a milk and grocery brand, has secured INR 700 million (USD 8.3 million) in debt funding from Alteria Capital. The company plans to use the funds to scale its operations in major Indian cities, offering subscription-based deliveries. —Entrackr

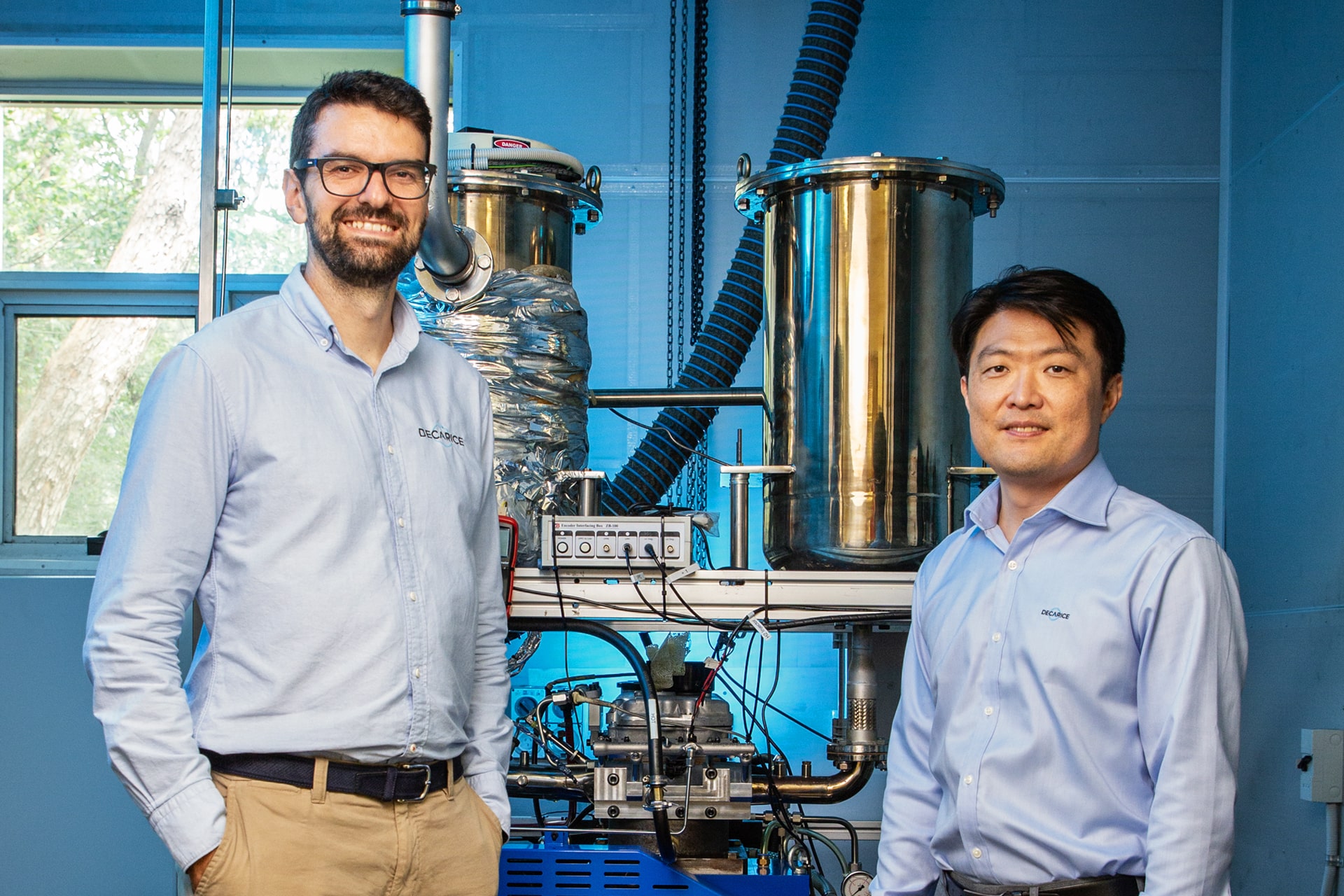

DeCarice, Komerce, Amilo, and more led yesterday’s headlines:

- DeCarice, an Australian startup rewriting the rules for heavy-duty engines, raised an undisclosed amount of capital from Investible’s Climate Tech Fund.

- Komerce, an Indonesian e-commerce enabler, merged with RajaOngkir, a real-time shipping cost calculator, in a share swap deal.

- Amilo, a Singapore-based logistics player with a focus on Southeast Asia, acquired Sivadon Logistics, a logistics operator in Thailand.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].