Alterno secures USD 1.5 million to cut carbon emissions in agriculture

Alterno, a Vietnamese developer of sand batteries, has secured over USD 1.5 million in a seed funding round jointly led by The Radical Fund and Touchstone Partners, surpassing its initial target. The round also saw participation from Antler, Impact Square, and Glocalink, along with grants from international organizations.

Utilizing its sand battery technology, Alterno aims to provide sustainable, efficient energy storage and heating solutions, tailored for the agriculture industry.

The startup was notably one of the three winning teams of Net Zero Challenge 2023, a climate innovation competition organized in Vietnam by Touchstone Partners and Temasek Foundation.

Ant Group pumps another SGD 200 million into Anext Bank

Ant Group, a fintech giant affiliated with Alibaba Group, has injected an additional SGD 200 million (USD 147 million) into subsidiary Anext Bank, a Singapore-based digital bank, according to regulatory filings accessed by Vulcan Post.

Ant Group has previously pumped SGD 250 million (USD 184 million) into Anext Bank. Including the latest injection, Anext Bank has received a total of USD 502 million to date from Ant Group.

Auristone secures USD 4 million in seed round

Auristone, a Singaporean epigenomics startup, has completed a seed funding round led by Elev8, with support from SEEDS Capital and Genedant, securing USD 4 million.

The funding will support Auristone’s efforts to advance precision medicine with epigenomic solutions. Specifically, the capital raised will be used to enhance the startup’s capabilities through clinical collaborations and drive market adoption of its Epi-call product.

Carousell acquires luxury bag reseller LuxLexicon

Carousell Group, a multicategory platform for secondhand goods in Southeast Asia, has acquired LuxLexicon, a Singapore-based luxury bag reseller.

This deal will enable Carousell to expand its premium luxury offerings with LuxLexicon’s supply of resale luxury bags. LuxLexicon will also leverage Carousell’s expertise in e-commerce for future growth and expansion.

This acquisition follows Carousell’s buyout of Laku6, an electronics recommerce platform in Indonesia, in January 2023, and Refash, a Singaporean fashion recommerce retailer, in May 2022.

VentureTech and VentureTech SBI announce joint investment in Bateriku.com

Bateriku.com, a Malaysian roadside assistance solutions provider, has secured MYR 10 million (USD 2.1 million) from government-backed impact investor VentureTech and VentureTech SBI, a fund partnership with SBI Ventures Malaysia. The entities invested MYR 3 million (USD 631,700) and MYR 7 million (USD 1.4 million), respectively.

The funds will provide Bateriku.com with the resources to enhance its technology infrastructure, expand its service portfolio, and scale its operations.

Recent deals completed in China:

- Lonyu Robot, a Tianjin-based manufacturer of automated guided vehicles (AGVs), has secured an eight-figure RMB sum in a Series A+ funding round led by Tonghui Venture Capital, with participation from CRRC (Qingdao) Venture Capital. The company will utilize the funds to expand its production capacity and explore new markets. —36Kr

- Akso Biotechnology, a Suzhou-based company specializing in microfluidics, has raised a eight-figure RMB sum in a pre-Series A funding round led by Delian Capital, with continued support from existing shareholder Vitalbridge. The company plans to allocate the raised capital toward product and technology R&D, establishment of production lines, and commercialization efforts. —36Kr

- MyTwins.ai, a provider of artificial intelligence tools for digital twin creation, has closed an eight-figure RMB angel round of financing. This round was jointly led by The Jiangmen, Yongxi Assets, and XHVC, with Thriving Capital serving as the exclusive financial advisor. The funds will primarily be used for technology R&D, equipment procurement, and market expansion. —36Kr

- Small Eel Technology, an energy management solutions provider, has announced the completion of a new round of equity financing. The company did not disclose the details of this investment. —36Kr

- Danfit, an online fitness platform under Winning Tech, has snagged an eight-figure RMB sum in a Series A+ funding round led by Guizhou Cultural Industrial Investment. —36Kr

Latest funding deals in India:

- M2P Fintech, a Chennai-based digital banking infrastructure company, raises INR 350 (USD 4.2 million) in debt financing from Anicut Capital. According to Entrackr, this is M2P’s first ever debt round.

- Ola Electric, one of India’s leading electric two-wheeler manufacturers, has raised USD 50 million in non-convertible debentures from EvolutionX. The company will reportedly utilize the proceeds to expand its lithium-ion cell manufacturing facility, repay or prepay debts, conduct R&D, and for general corporate purposes. —Entrackr

- Innoviti, a retail-focused payments platform, has raised USD 4.8 million from its existing investors in an ongoing Series E funding round. The round was jointly led by Bessemer Venture Partners and the Patni Family Office. —VCCircle

Ailytics, LinkAja, Hyoshii Farm, and more led yesterday’s headlines:

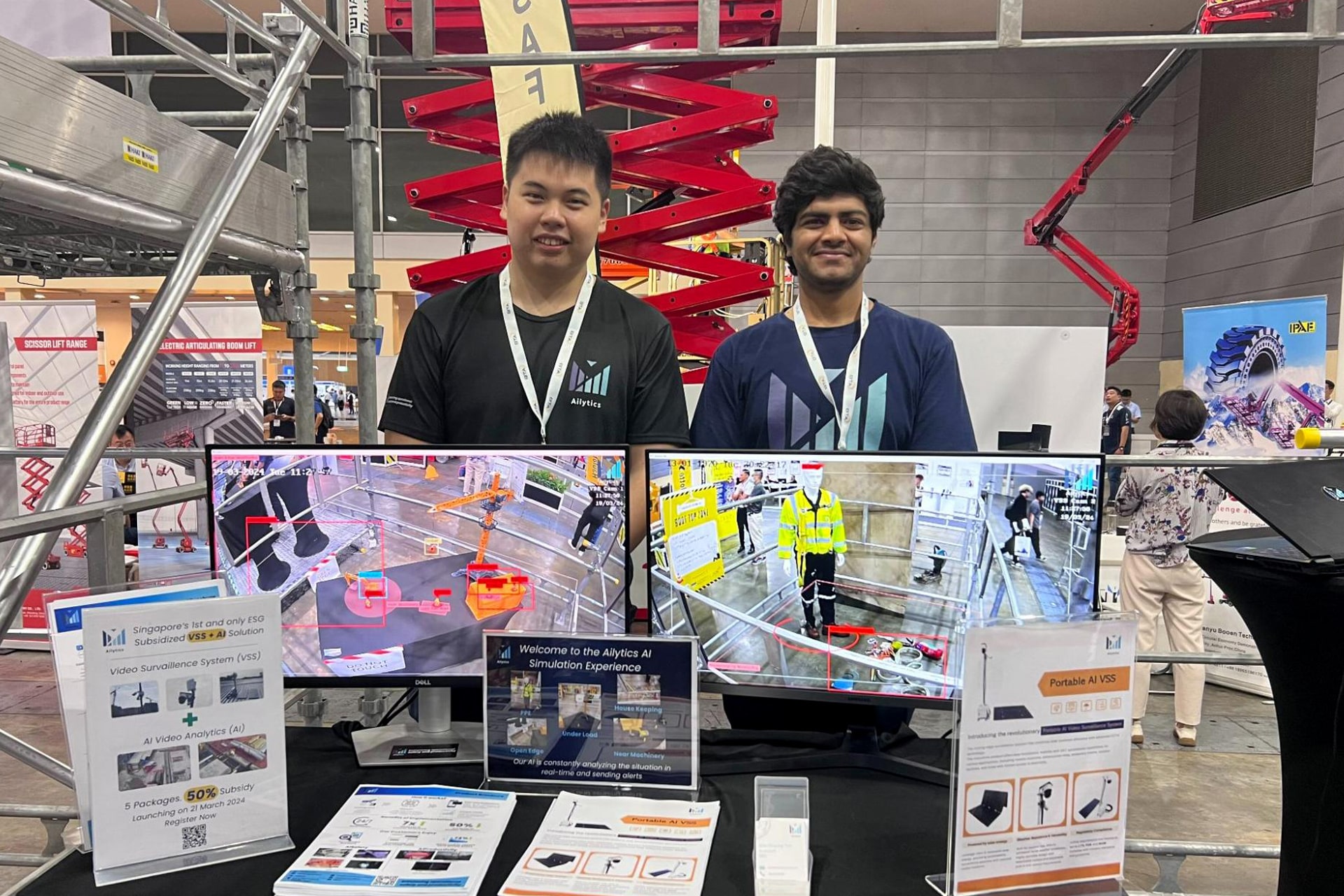

- Ailytics, a provider of artificial intelligence-powered video analytics solutions for operational safety and productivity, secured USD 2.7 million in an oversubscribed pre-Series A funding round. The investment was led by Tin Men Capital.

- LinkAja, an Indonesian digital payment platform, secured an undisclosed amount of investment from Mitsui & Co, marking the inaugural investment by a global entity in the company.

- Hyoshii Farm, a tech-enabled agriculture company, raised an undisclosed amount of pre-seed funding from a consortium of angel investors, comprising private conglomerates from various industries.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].