Alibaba to divest Intime as part of business restructuring

Chinese e-commerce giant Alibaba Group has announced the sale of its department store unit, Intime Retail, to a consortium co-led by Youngor Fashion and Intime’s management team for RMB 7.4 billion (USD 1 billion), according to Reuters. The deal is subject to regulatory approvals and will result in a USD 1.3 billion loss for Alibaba.

Alibaba acquired Intime for USD 2.6 billion in 2017 to expand into offline retail, but the challenging consumer environment and increased competition have driven Alibaba’s decision to refocus on its core e-commerce operations. The sale is part of the company’s broader restructuring plan announced in 2023, which includes integrating domestic and international e-commerce platforms into a single business unit.

Tyme Group achieves unicorn status with Nubank-led Series D round

Singapore-based Tyme Group, a digital banking platform serving customers across Africa and Southeast Asia, has raised USD 250 million in an oversubscribed Series D funding round, achieving a valuation of USD 1.5 billion. Nubank, one of the world’s largest financial services platforms, led the round with a USD 150 million investment, while M&G Catalyst invested USD 50 million. Existing shareholders contributed the remaining USD 50 million.

Tyme’s investor base includes its founders, African Rainbow Capital, Ethos AI Fund, Tencent, Apis Growth Fund II, Gokongwei Group, British International Investment (BII), Norrsken 22, Blue Earth, and Lavender Hill Capital Partners.

The investment from Nubank is expected to bolster Tyme’s expansion in Southeast Asia, leveraging Nubank’s expertise in areas such as data analytics, credit risk management, and product development.

EQT finalizes acquisition of PropertyGuru in USD 1.1 billion deal

Hong Kong-headquartered investment firm EQT Private Capital Asia has finalized its acquisition of Southeast Asian property platform PropertyGuru for USD 6.7 per share, placing the company’s valuation at approximately USD 1.1 billion. The deal, initially reported in August, marks a strategic shift for the real estate tech player.

Following the completion of the transaction, PropertyGuru’s shares were delisted from the New York Stock Exchange.

The acquisition is expected to accelerate PropertyGuru’s technological innovation, broaden its market presence, and streamline operations across its key markets in Singapore, Malaysia, Thailand, and Vietnam.

Other deals completed in China:

- Zhipu AI, one of China’s artificial intelligence unicorns, has completed a new funding round, raising RMB 3 billion (USD 420 million). The round included participation from several private and state-backed investors, with Legend Capital Management among the returning backers. Zhipu will use the capital to further develop its foundational large models, advancing from answering queries to handling complex multimodal tasks. —36Kr

- Wisson Robotics, a developer of robotics solutions, has raised RMB 200 million (USD 28 million) across its Series A, A+, and A2 funding rounds. Starlight Capital led the Series A round, with BlueRun Ventures and Shunwei Capital joining. The Series A+ round was led by the Beijing Robotics Fund, while Meta Green Cooling Technology spearheaded the Series A2 round, with Dehu Capital participating. Glacier Capital China and Millennium Capital Partners acted as financial advisors. Wisson will allocate the funds toward technology R&D and scaling the global deployment of its solutions. —36Kr

- Narwal, a household cleaning robot maker, has completed a new round of funding, securing a nine-figure RMB sum from two state-owned enterprises in Shenzhen and Wuxi. This marks Narwal’s first capital raise in three years. Founded in 2016, Narwal has previously raised funding from notable investors such as CWB Capital, ByteDance, HongShan (formerly Sequoia Capital China), and Future Capital. The company will utilize the funds to bolster its R&D and manufacturing capabilities. —36Kr

- Onetouch, an AI applications company, has raised a USD seven-figure sum in an angel funding round led by WestSummit Capital, with participation from an undisclosed veteran entrepreneur. Tanqi Capital acted as the exclusive financial advisor. Founded in May 2024, OneTouch will use the funds for product development, talent acquisition, and market expansion. —36Kr

- Uroptics, an optical components supplier, has completed its pre-Series A and pre-Series A+ funding rounds, raising close to RMB 100 million (USD 14 million). Moqin Intelligent Technology and Shang Qi Capital, a subsidiary of SAIC Motor, jointly led the rounds, with Jiangyin Talent Fund also participating. Zen Advisory acted as the financial advisor. The funds will be used to develop new product lines and expand Uroptics’ market reach. —36Kr

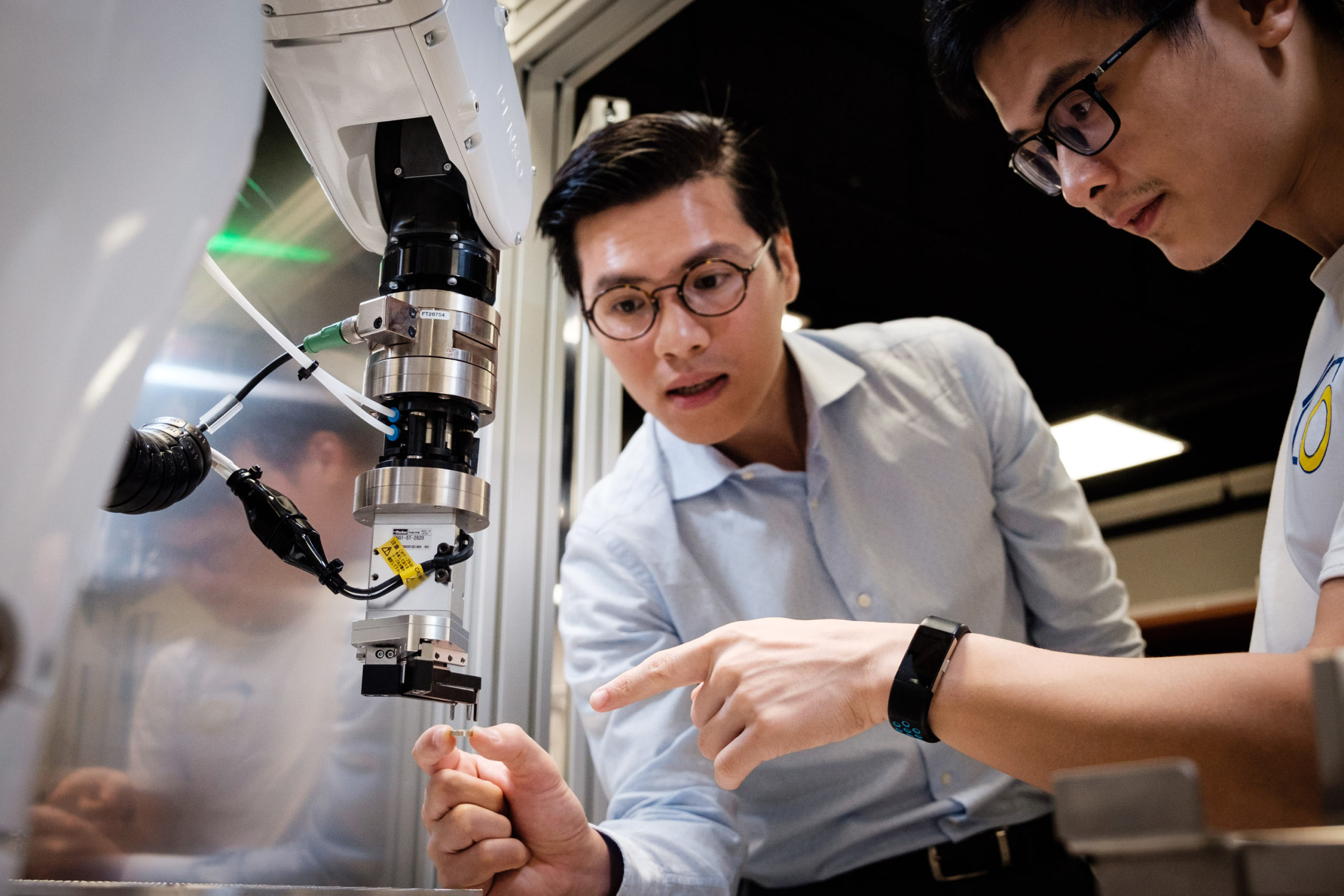

Eureka Robotics, Cove, Laam, and more made recent headlines:

- Eureka Robotics, a Singapore-based robotics company, raised USD 10.5 million in a Series A funding round led by B Capital, with participation from Airbus Ventures, Maruka Corporation, G K Goh Ventures, UTEC, and ATEQ.

- Cove, a flexible living platform, raised USD 4.5 million in its latest funding round, with real estate industry veteran Ashish Manchharam among the investors. Manchharam also joined Cove’s board of directors. Eurazeo and Keppel, existing stakeholders who took a minority stake in 2020, participated in the round.

- Laam, a Lahore-based startup operating a marketplace for South Asian fashion, raised USD 5.5 million in a seed funding round co-led by Disrupt.com and Zayn VC.

If there are any news or updates you’d like us to feature, get in touch with us at: [email protected].