It was nearly impossible to find a quiet corner at this year’s World Artificial Intelligence Conference (WAIC).

Visitors navigating the exhibition floors over the weekend encountered robotic arms sorting snacks and lab samples, humanoid robots delivering comedic performances, and four-legged machines weaving through the crowd with mechanical grace. But while the demos captivated audiences, the bigger story was WAIC’s increasingly international character.

Foreign participation was more prominent than in previous years. English, Korean, and Arabic conversations filled the air, and cross-border collaboration appeared more coordinated. Artificial intelligence companies from Hong Kong exhibited together under one pavilion, and for the first time, Taiwanese firms joined as a unified group.

Organizers said WAIC welcomed 156 procurement delegations from over a dozen countries. National groups from the UK, Singapore, and Malaysia joined for the first time. London sent six fintech startups, while Singapore was on the lookout for smart city technologies.

Interviews conducted by 36Kr pointed to a shared message among exhibitors: international expansion is now a core priority. Some companies already had overseas operations, but many said global growth would take precedence over the next 6–12 months.

An inherently global industry

Founders and industry professionals at WAIC often described AI-driven robotics as global by default. That sentiment has only grown stronger as AI innovation becomes increasingly decentralized. Platforms like GitHub and arXiv make new models and algorithms globally accessible within days. What starts as research in one country is often tested and improved across multiple others.

The problems that these technologies solve are also widely shared. This year’s focus on service and industrial robots reflects common challenges such as labor shortages, aging populations, and the risks posed by repetitive or hazardous tasks.

China is not just trying to keep pace. It is working to establish itself as a central force in the global AI ecosystem. In an interview with the Global Times at WAIC, Jiang Lei, chief scientist of China’s National and Local Co-built Humanoid Robotics Innovation Center, outlined two areas where he believes Chinese companies have an edge over their US counterparts.

Jiang explained that Chinese companies have two main advantages. First is manufacturing strength. Studying embodied AI, such as humanoid robots, requires physical products, and China’s competitive supply chains have made it a preferred source for companies in Silicon Valley seeking training units. The second advantage lies in data. As the collection and use of training data becomes increasingly industrialized, Chinese firms benefit from access to a much larger volume of manufacturing data than their US counterparts.

Morgan Stanley echoed this view in a recent report, stating that China leads in AI-driven robotics and is expanding its lead over the US.

China’s tech exports on the rise

With technology and supply chains reaching new levels of maturity, WAIC has become an important platform linking Chinese solution providers with international buyers. This year’s floor plan grouped exhibitors by industry, with companies targeting end users appearing especially aggressive in pursuing global markets. Their message was straightforward: solve clear problems, automate processes, and deliver efficiency.

Mech-Mind Robotics, for example, demonstrated robotic arms equipped with 3D vision systems that performed sorting and assembly tasks. These could be used in automotive manufacturing, home appliances, industrial inspection, and other sectors.

Robot Era presented an extensive lineup, including logistics robots, components, and commercial service platforms. The company reports that over half of its orders now come from international clients, and claims that nine of the world’s ten largest tech companies are already among its customers.

Export data supports the trend. According to China’s General Administration of Customs, the country became the world’s second largest exporter of industrial robots in 2024. In the first half of 2025, exports rose by 61.5% year-on-year. Nearly 30% of those shipments went to Europe, showing a growing presence in advanced markets.

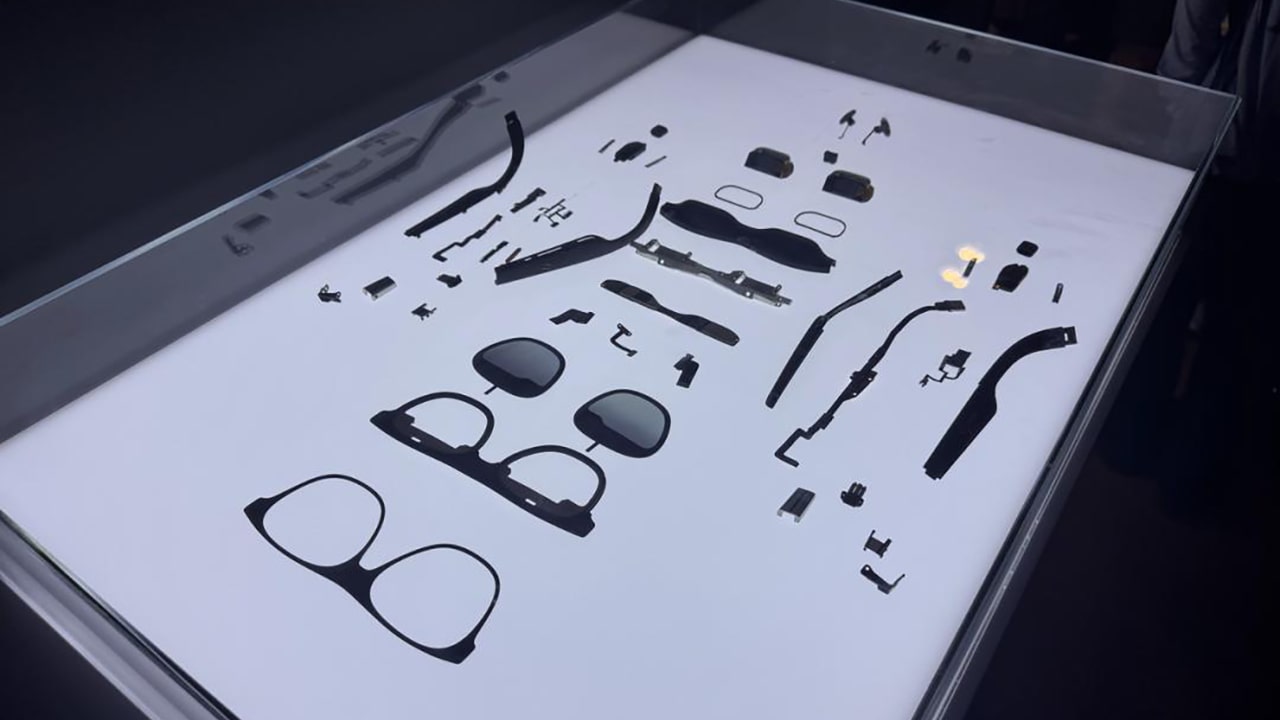

At Xreal’s booth, visitors waited in line to try out the company’s augmented reality glasses, which connect to smartphones and project large virtual displays.

Known for high-resolution visuals and relatively affordable pricing, Xreal is among the few companies leading the global AR market, according to IDC.

Another exhibitor introduced a waist-and-thigh wearable designed for physical support during exercise. Its founder said the device could also aid in rehabilitation, particularly in aging markets like Europe and Japan—two regions the company is targeting for growth.

Whether focused on industrial or consumer applications, Chinese AI companies are applying similar strategies abroad. These include leveraging advanced supply chains, optimizing for cost and usability, and rapidly iterating based on feedback from real-world use cases.

WAIC is no longer just a showcase for cutting-edge algorithms and hardware. It has become a window into China’s evolving approach to tech globalization.

The AI field is flattening, and the demand for efficient, scalable solutions is increasingly shared across borders. With the right mix of capabilities and strategy, China’s emerging AI firms may be better positioned than ever to bring their technologies to the world.