China is one of the largest payment markets in the world. It had an aggregate value of over USD 900 billion in transactions in 2020, accounting for more than 75% of the overall volume in the Asia Pacific. Cross-border transactions are the second largest stream of payment revenue in China, logging over USD 144 billion in 2020, according to a report by consulting firm McKinsey.

Strengthening demand for goods that are made in China led to a trade surplus of USD 573 billion in 2020, the highest level since 2015, according to official government data. Total Chinese merchandise imports and exports surged to around RMB 32 trillion (USD 5 trillion), making cross-border transactions fundamental to many local businesses.

Sunrate was founded by banking and foreign exchange veterans Paul Meng, Joshua Bao, and Michael Dong in 2016 to offer global payment and treasury solutions. It is one company that operates in the cross-border payment sector.

The firm aims to serve small and medium enterprises, importers, and exporters with its suite of cross-border payment solutions, which include virtual card issuance, account receivables and payables, risk and treasury management, as well as banking-as-a-service. Its main revenue is drawn from transaction fees.

The rise of local cross-border payment firms, including Lianlian Pay, PingPong, as well as the entry of global and regional players like Payoneer, PayPal, and Airwallex, has filled the payment gaps between businesses and formal financial institutions—where SMEs are often underserved.

“For China’s import sector, banks are the only players in the market [that facilitate cross-border payments]. If SMEs want to send money overseas, they will need to go to a bank branch, fill out different forms, and only know the exchange rate after they pay,” Sunrate’s head of strategy Wayne Hu told KrASIA.

Sunrate’s payment network covers transfers of 100 currencies between 130 countries. It has garnered local payment transfer licenses from the regulatory bodies across major economies in the world, including Hong Kong, Singapore, Indonesia, the United Kingdom, the United States, Canada, and Australia, according to the company.

In 2021, Sunrate’s total payment volume and revenue increased by 250%, according to Hu. The firm provides services to notable companies such as China’s largest online travel agency by gross merchandise value Trip.com and fast fashion decacorn Shein.

Even though international travel to and from China has been nearly wiped out by the pandemic, Sunrate’s business remains robust because it has been serving exporters since 2018. This links up with the growing e-commerce industry beyond China, Hu said, adding that Sunrate managed to hit profitability in 2020.

In China’s cross-border payment market, the third-party enterprise payments segment is expected to cross RMB 177.2 trillion (USD 27.47 trillion) in transaction volume in 2022, according to consulting firm iResearch. While Sunrate continues to broaden its market reach in China, it is also planning to expand to Southeast Asia, with Singapore and Indonesia as the first targets, Hu said.

One of Sunrate’s competitors in Southeast Asia is Nium, a Singapore-based B2B cross-border payment firm that just landed over USD 200 million in a Series D round in July, taking its valuation above USD 1 billion. The firm processes USD 8 billion in transactions annually and has issued more than 30 million virtual cards since its inception in 2014.

On December 21, Sunrate snapped up an undisclosed amount in Series C funding, led by SoftBank Ventures Asia, Hong Kong-based family office Banyan Pacific Capital (BPC), US-based management investment firm TDF Impact Investment. Sunrate’s existing investors including Redpoint China Ventures, JAFCO Asia, China Growth Capital, and K2 Venture Capital also took part in the investment.

Hu remains unfazed by the intensifying competition at home and in Southeast Asia. “The cross-border payment market is huge. I don’t think any single player could dominate the field. For Nium, they have their own advantages. They may partner with banks to acquire customers,” he said. “For us, we are facing merchants directly, and as an Asia-based firm, we have a smooth network [to facilitate funds] from China to Southeast Asia.”

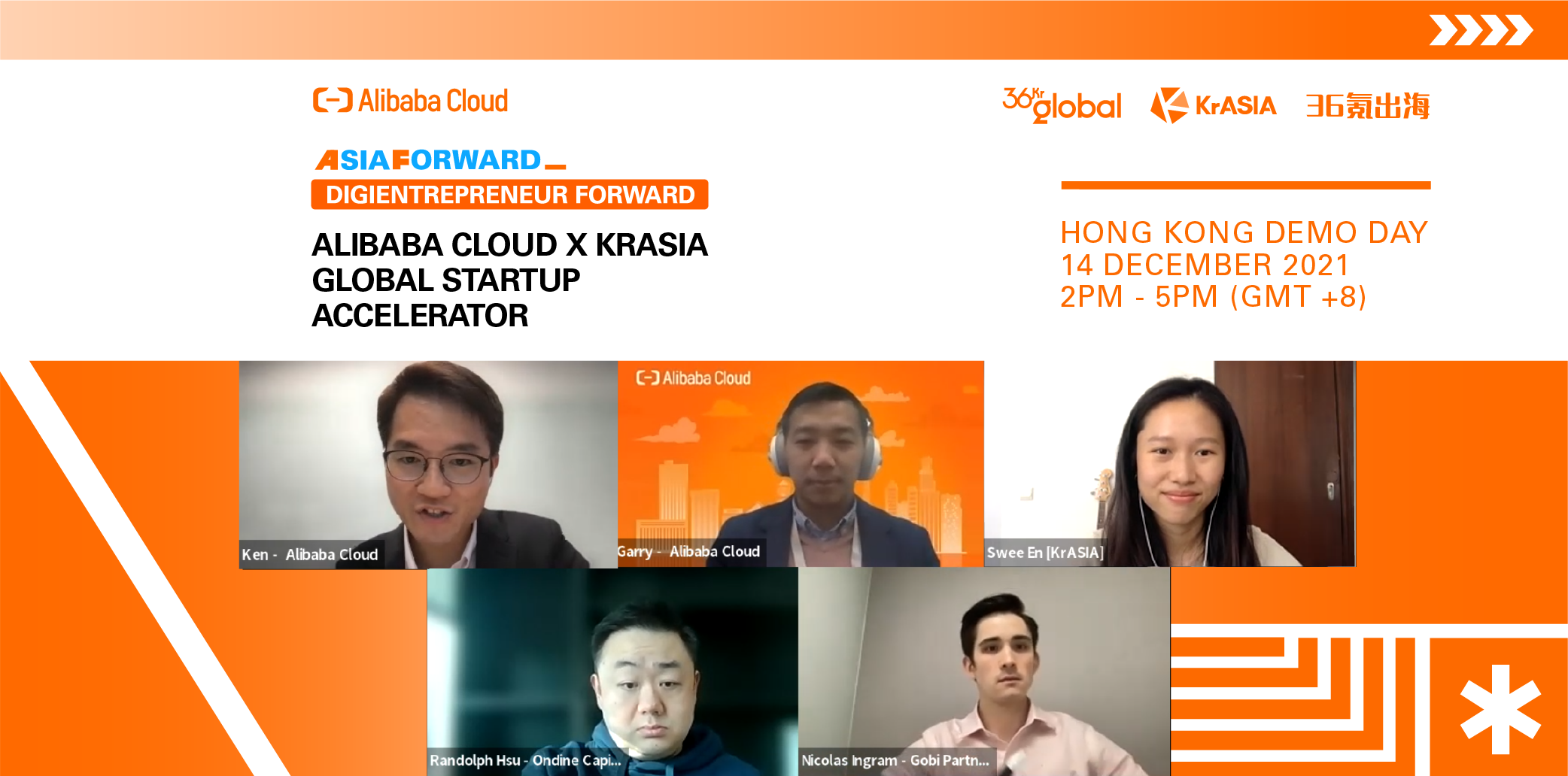

Sunrate was among the ten finalists of the Alibaba Cloud x KrASIA Global Startup Accelerator Hong Kong Demo Day that was held on December 14.