Jul 28, 2023

Across Southeast Asia, China, and India, technology companies raised approximately USD 1.2 billion in total from 14 deals we tracked this week. This excludes four deals with undisclosed funding amounts.

Evidenced by investments in companies like Immuno Cure, MiRXES, Bunker, and Zluri, there appears to be a growing interest among investors in the biotechnology and fintech sectors, hinting at a potential trend.

In Malaysia, GoodMorning Global’s crowdfunding project on MyStartr raised a record MYR 20 million (USD 4.4 million), indicating that despite the venture capital funding downturn, startups have alternative avenues to raise capital.

That’s all from us for this week. If there are any news or updates you’d like us to feature, get in touch with us at: [email protected]

Thanks for joining us.

ICYMI, these deals headlined this week:

- Peak XV Partners led Sunrate’s Series D extension round, providing funds to fuel the platform’s development and expansion plans.

- Web3 cybersecurity startup Zyber 365 has raised USD 100 million from SRAM & MRAM Group via a Series A round, and plans to utilize the funds to expand its operations, enhance technological capabilities, and establish a global presence.

- Geely’s Yuan Cheng Auto has completed its Series A round, raising USD 600 million, and will use the funds to support its R&D efforts and strengthen its market position.

- In tandem with its IPO application in Hong Kong, cancer diagnostics company MiRXES has raised USD 50 million in a Series D round, with participation from both new and existing investors.

- Indonesian aquaculture startup eFishery has raised USD 200 million in a Series D round led by 42XFund. It will utilize the funds to expand its farming community and to increase the volume of transactions on its platform.

Immuno Cure raises Series A funding ahead of its plan to IPO

The Hong Kong-based biotechnology corporation has announced that it has closed the first tranche of its USD 27 million Series A funding round, raising USD 12 million.

Led by the AEF Greater Bay Area Fund that Gobi Partners manages, Immuno Cure will use the funds to accelerate the development of DNA vaccines and antibodies, and to prepare for an initial public offering in Hong Kong.

GoodMorning Global crowdfunds USD 4.4 million to fuel growth plans

The Malaysia-based plant-based meat company has garnered MYR 20 million (USD 4.4 million) in an equity crowdfunding project on the MyStartr platform. It set records for having the highest number of investors and the highest amount raised in a single equity crowdfunding project.

GoodMorning Global will use the funds to support its R&D efforts, cover operational expenses, and optimize its debt structure. —e27

Auxilo Finserve raises USD 57 million in primary equity capital

The Indian non-banking financial company has raised USD 57 million in its latest funding round, led by Tata Capital Growth Fund II, Trifecta Leaders Fund I, and Xponentia Opportunities Fund II. Existing investor ICICI Bank also participated in the round.

Focused on education, Auxilo Finserve will utilize the capital to fuel its growth by expanding its loan base and broadening its product offerings. —VCCircle

Jul 27, 2023

Peak XV Partners leads Sunrate’s Series D extension round

The global payment and treasury management platform has concluded an extended Series D round, with Peak XV Partners (formerly known as Sequoia Capital India and Southeast Asia) as the lead investor. Prosperity7 Ventures and SoftBank Ventures Asia also participated in the Series D2 round.

Sunrate will utilize the funds to fuel its global expansion plans, prioritizing product and technology development, talent acquisition, and exploring other strategic opportunities.

Aethir secures undisclosed pre-Series A funding

The Singapore-based decentralized cloud infrastructure company has raised an undisclosed amount of funding after completing its pre-Series A round. Leading the round were investors including Sanctor Capital, HashKey, Merit Circle, and CitizenX, with participation from others including Mirana Ventures, Animoca Brands, Momentum6, Big Brain Holdings, Builder Capital, Tess Ventures, Arthur Hayes from Maelstrom, and more.

Aethir has raised over USD 9 million to date, and is now valued at USD 150 million. The newly raised funds will be utilized to scale its decentralized cloud infrastructure. —PR Newswire

Zyber 365 bags USD 100 million following completion of Series A round

The Web3 cybersecurity startup has raised USD 100 million in a Series A funding round, from UK-based SRAM & MRAM Group. It intends to utilize the funds to expand its operations, enhance its technological capabilities, and establish a robust global presence.

Zyber 365 was founded two months ago, in May 2023. —The Economic Times

Geely’s Yuan Cheng Auto raises USD 600 million in Series A funding

The Geely-owned new energy automobile brand has announced the successful completion of its Series A round, raising USD 600 million in funding. The round was led by Boyu Capital and Guangzhou Yuexiu Industrial Investment Fund, with participation from a mix of new and existing investors. The funds will be utilized to support its R&D efforts and strengthen its position in the market. —36Kr

TopOlefin Technology raises USD 139 million in Series B round

The Chinese advanced polymer materials maker has raised around RMB 1 billion (USD 139 million) in Series B financing, with both new and existing investors taking part. The funds will primarily be used to finance the construction of its second-phase production facility. —36Kr

Jul 26, 2023

MiRXES files Hong Kong IPO application after securing Series D funding

The Singapore-headquartered cancer diagnostics company has raised USD 50 million in a Series D round, with participation from both new and existing investors including Beijing Fupu, EDBI, A*STAR, Mitsui & Co., and NHH Venture Fund.

The funds will be used to accelerate the delivery of cancer early detection blood tests and preventive healthcare solutions in major markets. In addition to securing the funds, MiRXES has also applied to Hong Kong’s stock exchange for an initial public offering.

MiRXES last raised USD 77 million in Series C funding two years ago, in July 2021.

Bunker raises USD 5 million to help companies make sense of raw financial data

The financial analytics platform has raised USD 5 million over two rounds from investors including Alpha JWC Ventures, January Capital, Northstar Group, Global Founders Capital, and Money Forward, as well as angel investors Chris Lin, Rosemary Hua DeAragon, and Tiger Fang.

The funds will fuel Bunker’s expansion in the Asia Pacific, enabling startups and small and medium enterprises to transform financial data into valuable insights.

Aevice Health secures undisclosed funding

The Singapore-based company specializing in respiratory monitoring devices has secured undisclosed funding from East Ventures. The funds will be used to expand access to its flagship solution, the AeviceMD Monitoring System, in Southeast Asia. —TechNode Global

Kandle raises USD 1.7 million in seed funding

The Singapore-based GameFi project has raised USD 1.7 million in a seed round led by venture capital fund Saama. PointOne Capital, Cloud Capital, Good Capital, Founder’s Room, Seeders Fund, and CoinDCX co-founder and CEO Sumit Gupta also participated in the round. —The Economic Times

The Assembly Place leads undisclosed investment in 2MR Labs

Singapore-based digital assets launchpad 2MR Labs has raised undisclosed funding from co-living operator The Assembly Place, alongside Temasek’s Heliconia Capital and venture capital fund Lucid Blue Ventures.

The investment is part of a plan to leverage 2MR Labs’ community-building expertise. Co-founder and CEO of The Assembly Place, Arthur Lin, intends to launch a Web3 platform using 2MR Labs’ services. This platform will enable members to communicate, share ideas, and access membership benefits with various vendors. —EdgeProp

Jul 25, 2023

GIMO raises USD 5.1 million in Series A round

The Vietnam-based social impact fintech startup has raised USD 5.1 million in a Series A round led by TNB Aura, with participation from both new and existing investors.

The funds will be used to support the company’s expansion plans and foster innovation within its product portfolio. It will focus on product development to introduce more social impact initiatives, enhance customer success and support, and establish strategic partnerships with industry leaders.

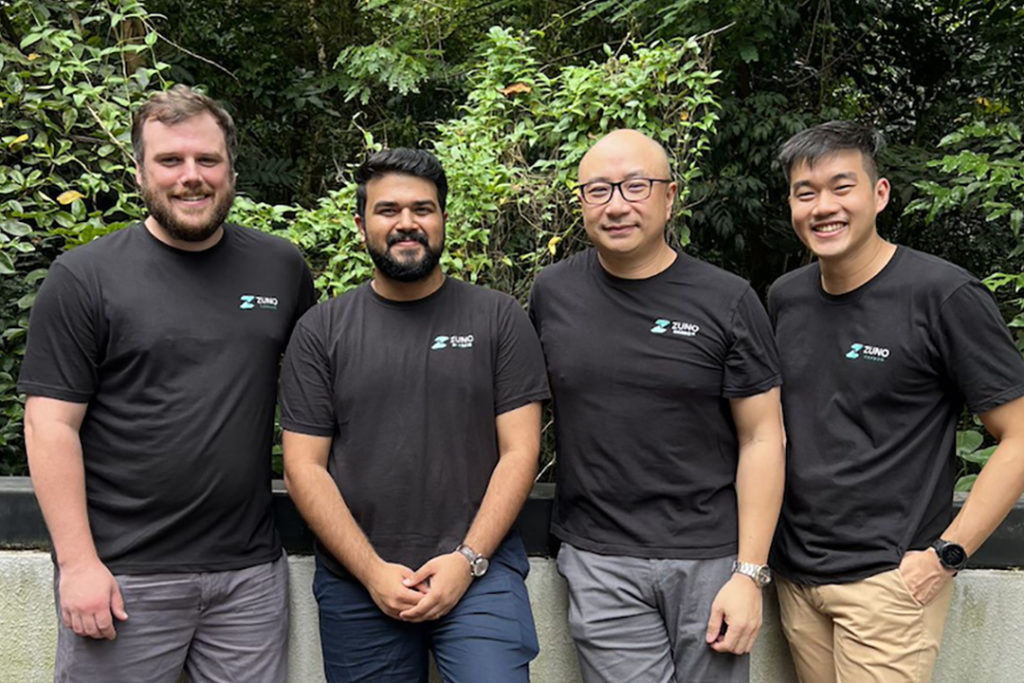

Zuno Carbon raises USD 2.5 million in seed funding

The Singapore-based climate tech startup specializing in carbon management solutions has raised USD 2.5 million in a seed funding round led by Wavemaker Partners.

Zuno Carbon will utilize the funds to enhance its sales and marketing efforts, launch new features to further simplify compliance, and support tangible actions to catalyze decarbonization.

Jul 24, 2023

eFishery raises USD 200 million in Series D round

The Indonesian aquaculture startup has raised USD 200 million in a Series D round led by Abu Dhabi-based global fund manager 42XFund, with participation from a mix of returning and new investors including 500 Global, responsAbility, Northstar, Temasek, and SoftBank. Goldman Sachs served as the exclusive financial advisor for the transaction.

The funds will be utilized to expand eFishery’s farming community, with the goal of engaging more than a million aquaculture ponds in Indonesia by 2025. Additionally, the company aims to increase the volume of transactions involving fish feed and fresh fish on its platform.

Zluri raises USD 20 million in Series B round

The software-as-a-service operations platform has raised USD 20 million in a Series B round led by Lightspeed Venture Partners, with participation from existing investors including MassMutual Ventures, Endiya Partners, and Kalaari Capital.

The funds raised will bolster Zluri’s generative artificial intelligence capabilities, focusing on North America and Europe to strengthen its presence in key markets.

Hydroleap raises USD 4.4 million in Series A round

The Singapore-based wastewater treatment company has raised USD 4.4 million in a Series A round led by Japanese Venture Capital firm Real Tech Holdings, joined by a mix of new and existing corporate investors including Mitsubishi Electric, SEEDS Capital, Wavemaker Partners, New Keynes Investments, and the State Government of Victoria in Australia.

Hydroleap will use the funds to enter new markets such as Australia, Japan, and Indonesia, to assist more companies in various industries to treat wastewater in an efficient and environmentally friendly way.