India startup ecosystem, the third-largest in the world, received USD 10 billion capital—the highest venture capital (VC)-led investment in India to date—from global and local VC firms in 2019, according to a new report by management consultancy firm Bain and Company.

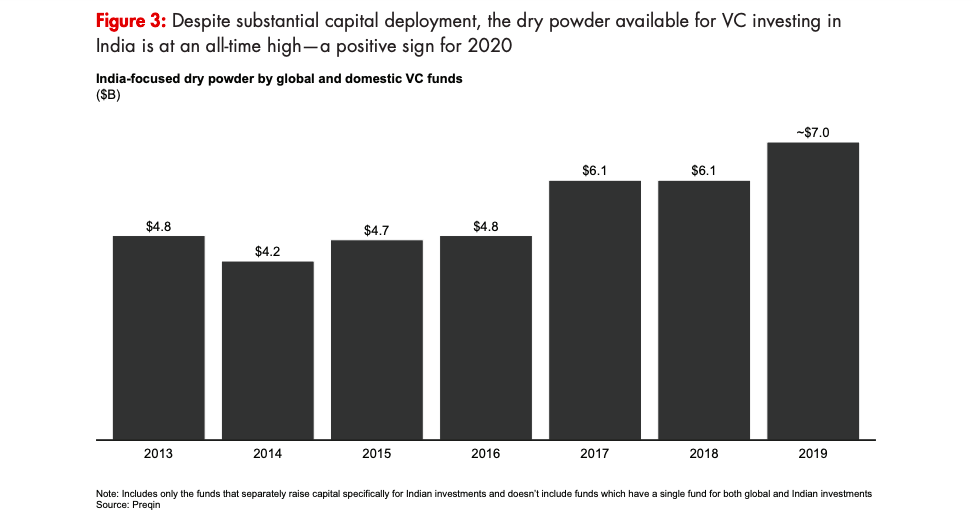

The investment activity that was driven by the rapid rise of fintech and SaaS (Software-as-a-Service) startups and a few marquee exits that renewed investors’ interest in the South Asian nation, is likely to continue this year as VCs still have USD 7 billion capital left in the kitty.

“Despite substantial capital deployment, dry powder availability for VC investing in India was at an all-time high of USD 7 billion at the end of 2019, indicating likely continued investment activity in 2020,” the American firm said in its India Venture Capital Report 2020.

Up until 2018, the lack of clarity regarding exits made investors more cautious, and that shifted the focus to fewer and higher-quality investments, the report noted. Over the past two years, however, “the VC industry in India has been in a renewed growth phase, buoyed by marquee exits for investors; strong start-up activity in new sectors, such as fintech and SaaS; and market depth in e-commerce.”

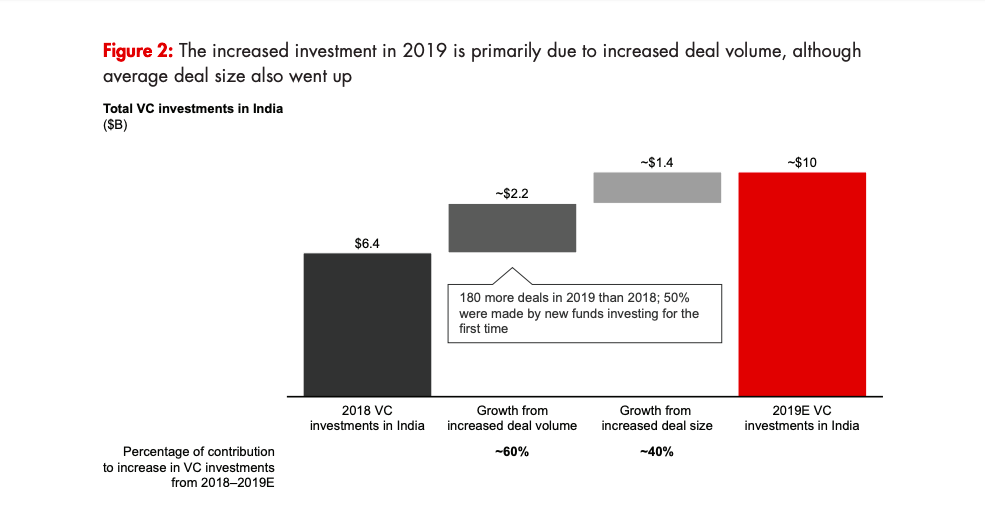

Bain’s report also attributes increased investment in 2019—55% higher than 2018—to increased deal volume and larger average deal sizes. India witnessed a 30% increase in deal volume over 2018, while average deal sizes across all stages rose by 20%. Even Seed and early-stage investment sizes shot up last year “due to rising competition for deals coupled with improving the quality of founding teams.”

Investors and analysts tracking the Indian startup ecosystem believe the improved quality of entrepreneurs and the availability of more capital together are driving up the cheque sizes.

Anil Joshi, managing partner at Unicorn Ventures, said Seed-stage deals, which used to be USD 100,000 to 200,000, have now become USD 500,000 to 1 million.

“Pre-series A is kind of a seed round now, the line between series A and Series B is thinning,” he told KrASIA in an earlier interview. “The dynamics have certainly changed because the founders who have the right value proposition and are able to demonstrate that, are willing to wait for the right numbers before raising money and that is why the cheques are becoming bigger.”

Currently, India is home to 80,000 startups, of which 8% or 6400 are funded, which indicates “room for investments,” the report observed. Moreover, it said, among funded start-ups in India, “typically 25% or more go on to raise subsequent rounds.”

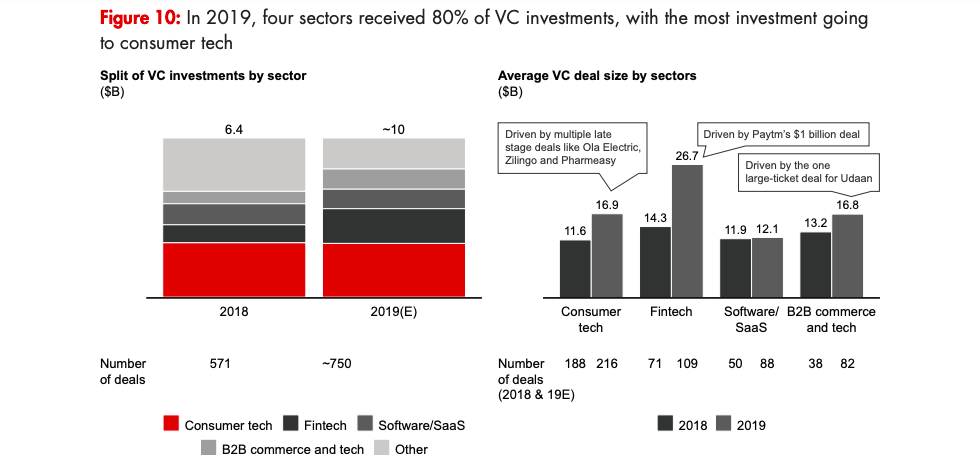

Consumer tech, software/SaaS, fintech, and B2B commerce and tech emerged as the favorites of investors receiving 80% of VC investments in 2019. Consumer tech accounted for about 35% of total investments, the largest chunk of the pie, with sub-segments such as verticalized e-commerce companies, healthtech, foodtech, and edtech attracting the investors’ attention.

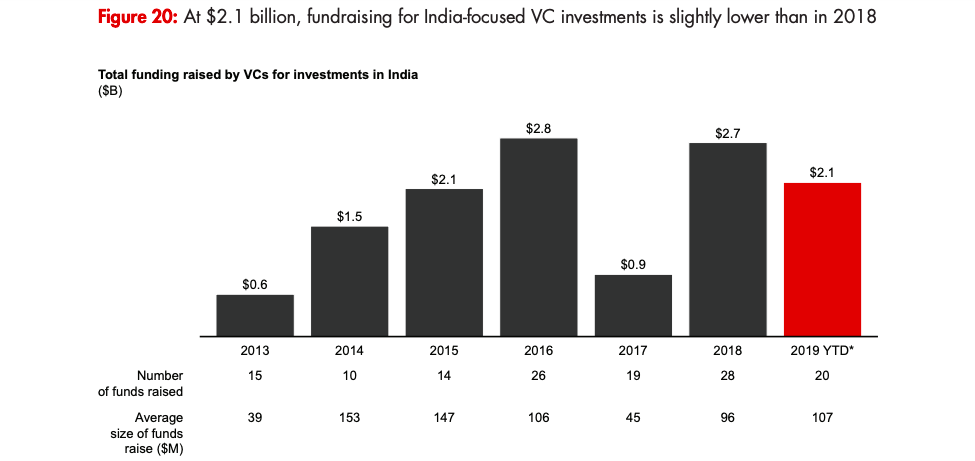

To grab a larger pie of the still-emerging Indian startup ecosystem, India-focused VC funds raised approximately USD 2.1 billion in 2019. Although it was slightly lower than that of 2018.

“The dip from 2018 to 2019 was the result of marquee funds that had already raised large sums and hence did not go to the market in 2019,” the report said.

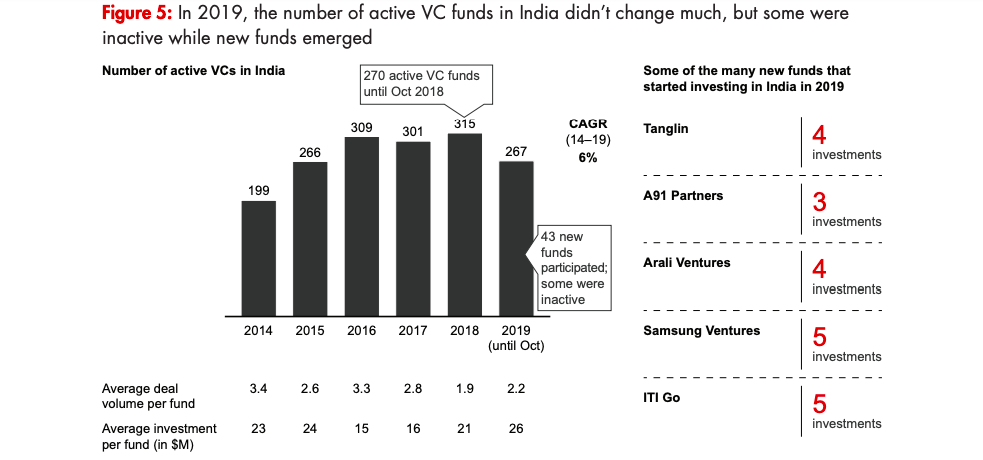

Meanwhile, several new funds including Tanglin, founded by former Tiger Global executives; A91 Partners, founded by former Sequoia partners; Arali Ventures, an early-stage-focused fund; Samsung Ventures, launched by Samsung Corporate Venture Capital; and ITI, an early-stage VC fund by Investment Trust of India, invested in the country.

According to analysts at Bain, the fund-raising outlook for 2020 is largely positive among both limited partners and general partners.

The report noted that most top funds’ portfolios did not reach maturity in 2019, and exit momentum is expected to increase in the next few years. Startups including Oyo, Yatra, Policybazaar, Delhivery, Shopclues GIC, Indiamart, UrbanClap, Dream11, and Lenskart gave exits to their early investors in lieu of secondary investments. The average exit value, as per the report, was USD 39 million.