Nasdaq-listed live-streaming company YY.Inc revealed in its quarterly financial report that the Chinese company seeks to list its game streaming unit Huya (虎牙直播) in the US. The Twitch-like Huya plans to raise over USD 200 million this year to support its expansion in the sector with cut-throat competition.

The game streaming platform is valued at as much as USD 2 billion, people familiar with the matter told 36Kr, China’s biztech media and KrASIA parent.

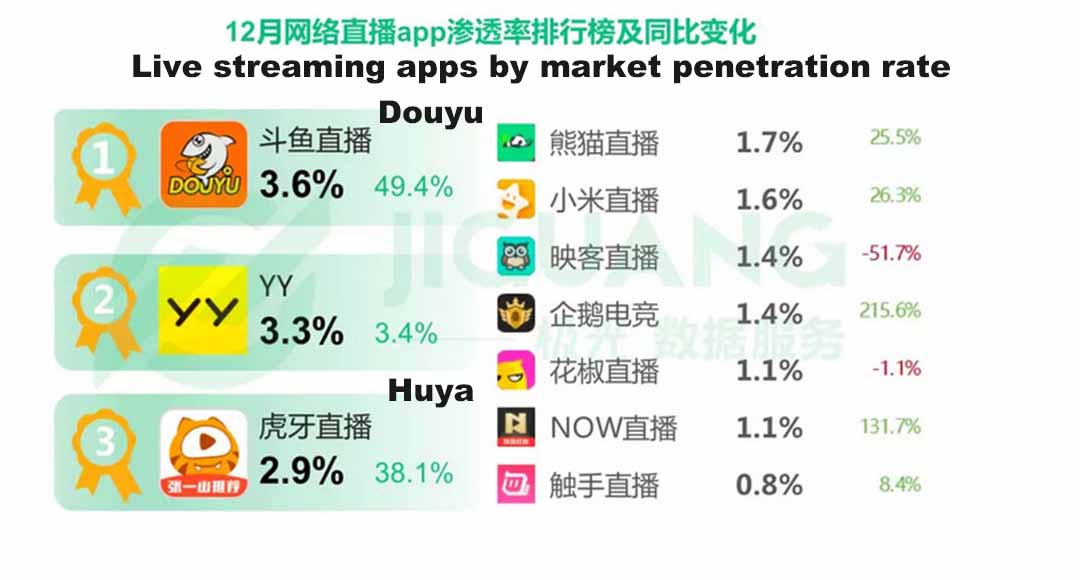

Huya is the second largest game streaming platform in China only after local rival Tencent-backed Douyu (斗鱼), according to data piled by data intelligence service Jiguang. The unit has almost broken even in Q4 2017, reporting RMB 692 million (approx. USD 109 million) in revenue, up 104% compared to the corresponding period of 2016.

China is the largest market for live streaming and the competition among local rivals has always been brutal. In 2018, viewers are likely to reach 456 million, generating USD 4.4 billion in revenue, according to a report by Deloitte.

Game streaming platforms become popular in China thanks in part to hit games such as PlayerUnknown’s Battleground and League of Legends that have amassed a large pool of players community. Apart from YY’s Huya, major players in the local market include Tencent– and Sequoia China-backed Douyu, Qihoo 360-invested Panda TV (熊猫直播), and Chushou (触手直播), which has landed an investment from Google and Shunwei Capital in last December. In the US, Twitch is acquired by Amazon in 2017 for almost USD 1 billion.

Douyu, Huya’s formidable rival in China, is reportedly eying a USD 300-400 million IPO in Hong Kong this year at a valuation of USD 1 billion, as HK is planning to adopt duo-class shares which allows company founders stay in power after the floating.

Platforms like Huya are spending heavily on marking so their content can reach to more viewers, as well as on attracting top content contributors. China’s live-streaming as a whole is facing tighter regulation and the authorities have already banned some of the most popular live-streaming presenters.

Read more: Surviving on Regulatory Shocks: Vloggers Seeking New Ways to Maintain Profits