Foreign direct investment in Southeast Asia is growing rapidly as US and Chinese businesses are lured in by countries’ political stability and large markets. The region’s strategic role as a buffer zone amid intensifying US-China competition also helps attract investment from around the world, with foreign investment reaching a record USD 222.5 billion in 2022.

“Vietnam shows promise as a partner in ensuring the semiconductor supply chain is diverse and resilient,” the US Department of State said in a statement after President Joe Biden visited the nation in September.

As if in response, US companies such as Marvell Technology and Synopsys have expressed eagerness to invest in Vietnam. Amkor Technology has already opened a semiconductor plant in the northern province of Bac Ninh in October. Built at a cost of USD 1.6 billion, the facility is designed to become the U.S. company’s biggest manufacturing base in the world, creating about 10,000 jobs.

In July, Malaysia said the major Chinese carmaker Zhejiang Geely Holding Group would invest USD 10 billion in the western state of Perak to set up an automobile production base. The company is also considering building an electric vehicle plant in Thailand.

US and Chinese companies are also buying up businesses in Southeast Asia. In 2020, Kimberly-Clark, the US manufacturer of Kleenex and other personal care products, announced a plan to acquire Softex Indonesia for USD 1.2 billion. China’s Alibaba Group Holding has invested billions of dollars in Lazada, a Singapore-based major e-commerce company.

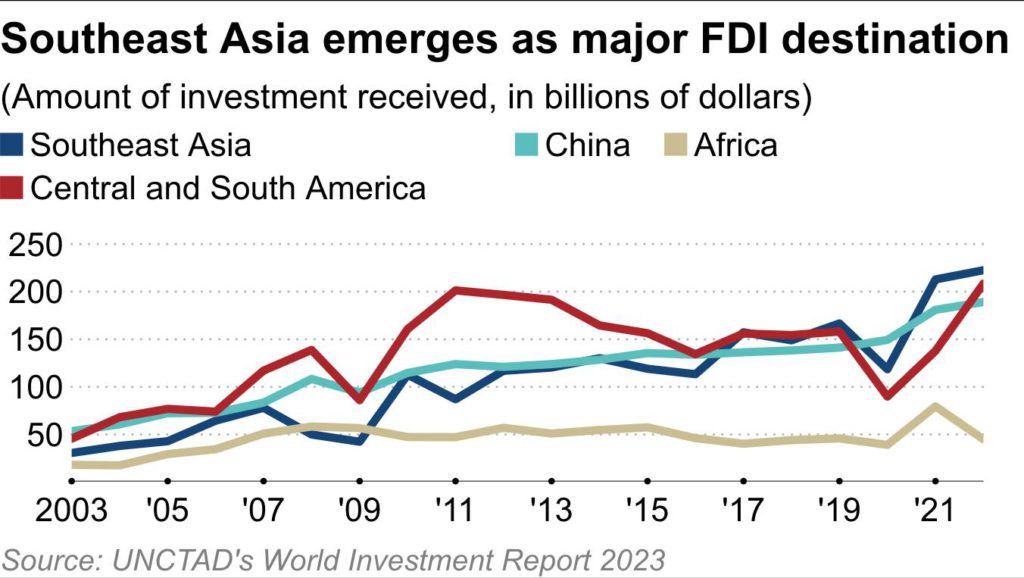

Foreign direct investment in the 11 Southeast Asian countries grew 40% between 2017 and 2022, a period when US-China trade friction escalated, outpacing increases in investment in China, Latin America and Africa, according to the United Nations Conference on Trade and Development.

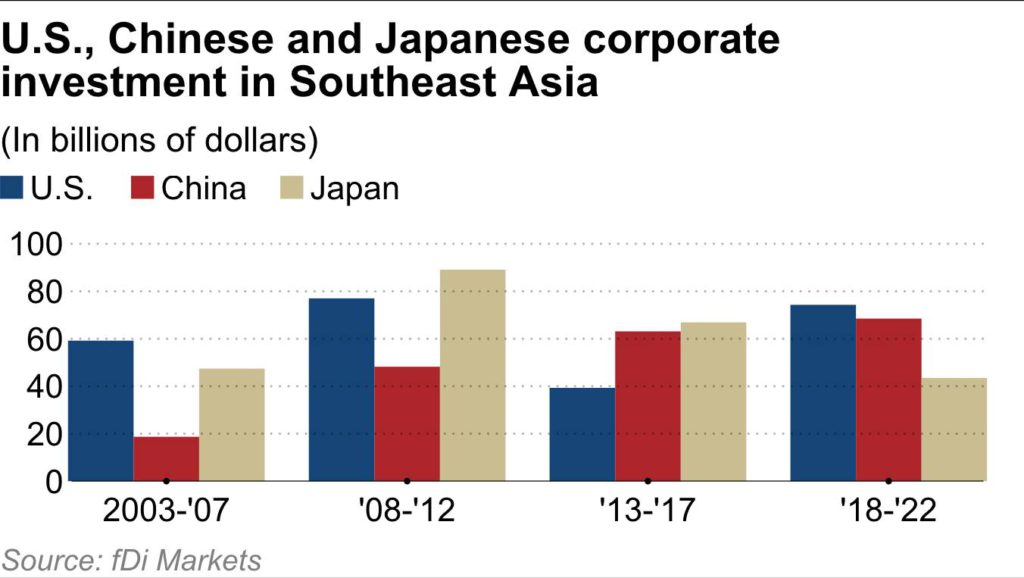

The US is the leading investor in capital projects in Southeast Asia, spending USD 74.3 billion on plant construction and other projects between 2018 and 2022, according to the Financial Times’ fDi Markets tracker of cross-border investment. It is followed by China, which invested USD 68.5 billion in the same period.

US businesses mostly focused on semiconductor-related investments in such countries as Singapore and Malaysia, while Chinese companies invested in projects like EV plant construction in Thailand and mining development in Indonesia.

Behind their active investment is the desire to relocate manufacturing bases. US companies are pushing “friendshoring,” replacing China’s role in supply chains with allies or friendly nations, while Chinese companies are moving plants and other facilities to third countries to facilitate exports to the US and Europe.

Many US companies see Southeast Asia as an ideal place to rebuild supply chains, as it is close to China, a major manufacturing hub, and is relatively stable politically and socially. The region also has large domestic markets, with a total population of more than 600 million.

“Southeast Asia is benefiting from the US-China decoupling by positioning itself as a ‘neutral zone,'” said Ikumo Isono, a senior economist at the Economic Research Institute for ASEAN and East Asia.

With their rivalry growing, political sparring has flared between the U.S. and China.

Upon meeting with Vietnamese President Vo Van Thuong in Beijing in October, Chinese President Xi Jinping told him never to forget the “original intention” of the two countries’ traditional friendship. His comment was seemingly a reaction to Vietnam’s recent move to raise Washington’s designation two notches, from the bottom tier of its hierarchy of bilateral ties to the highest.

Japan had long led other countries in investment in Southeast Asia since the 1970s, but Japanese companies grew more reluctant to invest as host countries began to demand spending in areas the companies did not desire, mainly cutting-edge sectors such as semiconductors, EVs and batteries. As a result, the region attracted only USD 43.5 billion from Japanese businesses in the five years through 2022, the smallest in the past 20 years.

In a 2012 survey by the Japan Bank for International Cooperation, Japanese manufacturers saw Indonesia as the third-most-promising foreign destination over a three-year horizon, but the country’s standing fell to sixth place in last year’s survey. Thailand also fell in the rankings.

While the US and China vie to boost investment in Southeast Asia, Japanese companies are facing a serious need to rethink their strategy in the region.

This article first appeared on Nikkei Asia. It has been republished here as part of 36Kr’s ongoing partnership with Nikkei.