Dating apps in China have become an unexpected necessity in 2020. In the world’s most populous country, people still want to meet, but the coronavirus pandemic has made this no easy task.

Luckily, more than 622 million people used dating apps in China last year, and the market set to hit USD 290 million in revenues by 2024, according to market research site Statista.com, so online dating is not completely foreign to the country.

In fact, as Chinese dating apps continue become more and more mainstream, they have adopted features familiar to anyone who has turned online to find a date: Swiping, chat boxes, and location-based discovery, to name a few. However, Chinese dating apps have also added elements that are not so common, such as matchmaker-mediated chats, voice message speed dating, and more.

The nine largest dating apps in China in 2020 by China iOS app store rank, as of April 27, 2020 are

- Yidui

- Tantan

- Momo

- Soul

- Jimu

- Zhenai

- Hezi

- Blued

- Rela

Foreign major players, like Tinder and Bumble, are not nearly as popular in the country and have fallen far behind local competitors.

1. Yidui

This video-based speed matchmaking app, developed by Beijing Milian Technology in 2017, gained substantial traction in the second half of 2019, specifically targeting singles in lower-tier cities.

Originally launched as a Tinder-like and text-only Chinese dating app, Yidui failed to attract people in its focused market, the company founder Ren Zhe said during an interview with local tech media 36Kr. His team then introduced a “middle person”—a professional matchmaker—in its app and added the livestreaming feature to speed up matches. These online matchmakers mainly function as ice-breakers, helping lubricate the conversation.

The company raised “tens of millions of yuan” from Bluerun Ventures in June 2019. After six months, Yidui closed an A+ round, raking again “tens of millions of dollars”, from Bluerun and XVC Venture Capital. Specific figures for both investing rounds were not provided.

Yidui Features

The app differentiates itself from other Chinese dating apps by providing a livestreaming feature, which allows users to start or join a video chat room, in the presence of a matchmaker. Matchmakers look for potential matches for clients and host video dating to facilitate relationship building.

The app hopes the video-first approach can reduce the number of fake photos and bots on the platform, which is a persistent problem for dating apps. Besides joining livestreaming chats hosted by matchmakers, users can also choose whom to chat by following them after scrolling through an algorithmic list of recommendations.

Its service adopts a freemium model. With a premium account, which costs RMB 30 (USD 4) monthly, users can enjoy features including checking read status and browsing who has visited his or her profile.

Yidui Stats

- 1oth on the iOS store in social apps

- Nearly 50,000 active matchmakers, according to the company

- Around 40 million registered users

- Over 10 million online video dates arranged per month

2. Tantan

Tantan, often referred to as China’s Tinder clone with its nearly identical interface, mechanism, and premium service, was launched in June 2014 and proved to be an immediate hit, claiming to have over 5 million daily active users after just one year.

Investors flocked to the fast-growing platform—the firm raised more than USD 120 million from venture capital firms including Bertelsmann, Genesis Capital, DCM Ventures. In 2018, it was acquired by Momo, the biggest location-based social platform, and a dating app in its own right, in China.

Earlier in 2019, Tantan was scrubbed from Android and Apple app stores, with the reason rumored to be “spreading pornographic content“. It was available again a couple of months later.

Tantan Features

Tantan is extremely similar to Tinder, which is based around uploading photos and swiping on other users.

The main page displays other users’ profiles, consisting of photos and information including a short bio, occupation, and interests. The app also provides some ice-breakers. If two people swipe right on each other, indicating they like the other, they’re given the chance to start a private conversation.

Users can pay RMB 12 (USD 1.7) per month to unlock VIP privileges, such as unlimited swipes per day and the ability to view profiles of users in other locations.

Tantan Stats

- 8th on the iOS store for social apps

- 5 million paying users as of the end of 2019

- Generated RMB 369.8 million (USD 53.1 million) in the fourth quarter of 2019, according to Momo’s earnings report

3. Momo

Momo, launched in 2011, has evolved from a simple location-based dating app to a general social platform that, in addition to its original features, also includes group chats, livestreaming, short-video, and casual games.

The company went public on Nasdaq in December 2014, the first and only Chinese dating app to do so, three years after its founding, with nearly 70 million monthly active users. Its early investors include Matrix Partners China, Sequoia Capital, Alibaba, and Tiger Global Management.

Momo Features

After registering with their personal information, users are able to follow others nearby and send private messages to people you want to know.

There are sections for audio and video livestreaming in different categories, including music, outdoors, talk shows, and gaming. Users can send virtual gifts to streamers, traded through Momo coin (seven Momo coins equal one yuan). The platform offers a couple of hyper-casual games as well.

Momo’s VIP membership is RMB 12 (USD 1.7)per month, which allows users to set more filters to find friends, visit people in other cities and use a larger database of stickers in conversation.

Momo Stats

- 11th on the iOS store for social apps

- 5 million MAU as of December 2019

- 8 million paying users in Q4 2019

- Total net revenues of Momo were RMB 4.7 billion (USD 673.4 million) in Q4 2019

4. Soul

Soul was launched in 2015 by Shanghai-based Renyimen Technology. It matches users based on a personality test, targeting young users. Soul has closed a Series C round of an undisclosed sum last year, with backers including GGV Capital, Morningside Venture Capital.

The app, like many other dating apps in China, underwent a wave of strict regulation in 2019 but made a comeback after clean-ups. In March, two employees of Soul were arrested after posting pornography on a competitor’s platform, Uki, KrASIA reported.

Soul Features

Soul requires users to take a personality test before using it. Questions include: What kind of person would friends say you are; do you like spending some time alone when you feel upset; and how do you usually make yourself happy?

Users can choose to go on a voice date, a video date, a location-based date, or a text chat date. The matches are all recommended by the system based on the results of the personality test. The video speed date includes virtual masks hiding the true identities of both users. On the “Square” section, users can browse others’ posts and start conversations with them.

A monthly premium service costs RMB 20 (USD 2.8), which allows a user to post longer videos, set filters for matches, and enjoy more virtual decorations.

Soul Stats

- 12th on the iOS social app list

- Nearly 600 million DAUs as of May 2019

- More than 50 million users

5. Jimu

The social app Jimu, or “Hitup” in English, was released in late 2016 by Shenzhen Blueberry Season Tech Company. The app melds features of dating apps with youth social networking functions, targeting urban residents who like art, fashion, and music.

The company bagged in “tens of millions of yuan” in June last year from a Series B round led by Bluerun Ventures and Sequoia Capital. In July 2019, Hong Kong-listed Chinese livestreaming firm Inke bought Jimu for USD 85 million in efforts to diversify its business.

Jimu Features

Jimu, while still a niche player, combines a raft of features in a single app.

Users can enjoy a Tinder-like swipe interface, or focus on its lifestyle-sharing feed where users post photos of live events, food, pets, and selfies, showing appreciation to others by clicking “follow” or “like.” The app can also arrange digital speed dates based on users’ interests.

A membership, which costs RMB 28 (USD 3.9) per month, allows users to send out “superlikes,” find people they have swiped left on, and expand the radius of potential matches.

Jimu Stats

- 26th on the iOS social app list

- 80% of users are under the age of 25

- Nearly 1 million DAUs in 2019

6. Zhenai

Zhenai, founded as early as 2005, is one of the oldest and well-known matchmaking websites in China, which also offers offline services.

The app, which was released in 2012, offers a more traditional service to singles—through a matchmaker middle person. Unlike Yidui’s matchmaking, which is free, Zhenai charges a hefty sum for its professional service. However, Zhenai has made several updates to its app in a bid to reach younger users as well, adding features including personal assessments, livestreaming, and a status-posting section.

Zhenai Features

Users are asked to complete a 25-question test before starting the romance-seeking journey to allow the system to understand their preferences. Out of all dating apps in China, its approach is significantly more personal. Its main page is a location-based recommendation system and users can swipe right to like or swipe left to skip.

Users can filter search results by age, body type, height, occupation, educational background, and more. Zhenai also touts its livestreaming feature, which allows the direct virtual face-to-face chat to facilitate potential relationships. If one seeks help from a professional matchmaker, the six-month service is priced at RMB 4,999 (USD 706).

Zhenai Stats

- 28th on the iOS social app list

- 200 million users as of November 2019, according to its official website

- 5000 professional matchmakers

- 53 physical locations in China, selling offline matchmaking services

7. Hezi

Voice-based social app Hezi was launched at the beginning of 2019 by Hainan Miaoka Network Technology, founded by two senior executives from Momo, Lei Xiaoliang, and Wang Li. Besides Hezi, the company also released a slew of new apps in social and photo-editing categories. The move was considered by many as Momo’s effort to create the next hit app by tapping the younger generation as its target user group.

Hezi Features

Besides a profile photo, Hezi users are asked to upload a voice recording, which is posted to the main page with audio messages from other users. Users can initiate conversations by liking these messages. There are also other voice-centric social features including audio broadcasting, real-time speed voice dating, and online karaoke.

Hezi Stats

- 31st on the iOS social app list

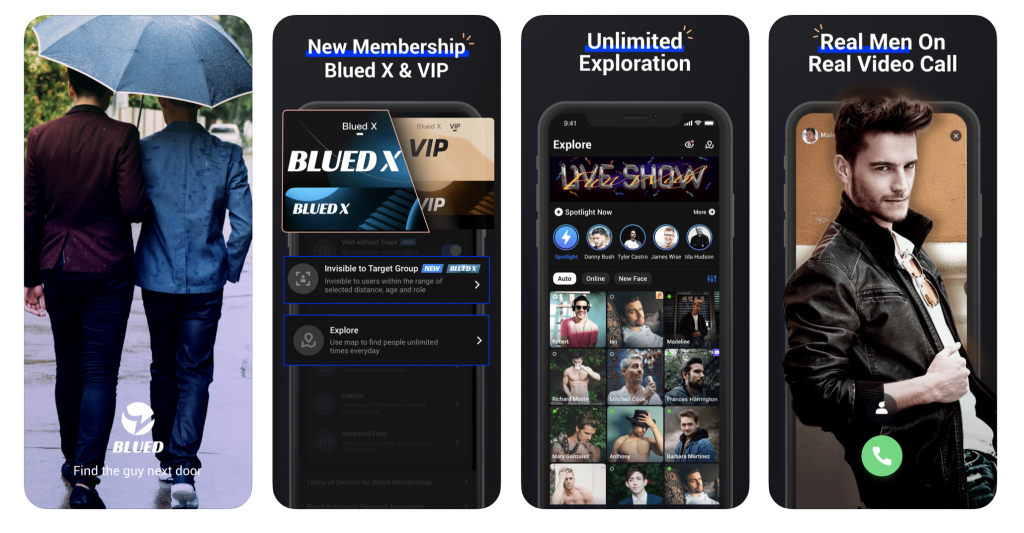

8. Blued

Launched in 2012 by the Chinese LGBTQ community website Danlan, Blued is the top gay dating app in China. With the slogan “Advocate for healthy lifestyles on Blued,” it also runs HIV-testing offices with the nation’s Center for Disease Control and Prevention (CDC) in Beijing. It also provides an online databank that connects users with other testing centers nationwide.

The company has raised more than USD 130 million from investors including Crystal Stream and DCM and intends to expand its business overseas. Blued is seeking a US initial public offering that could raise around USD 200 million and value the company at around USD 1 billion, Bloomberg reported in August 2019.

Blued Features

Blued functions much like Momo except for its demographic target.

Users can find people nearby, enter livestreaming rooms, share a glimpse of their life, and consume sex education content. Blued says it puts prioritizes users’ privacy and has disabled all screenshot and recording functions.

A membership costing RMB 30 (USD 4) will enable premium services including ad-free usage, visiting others’ profiles in private, and the option to be seen by certain users.

Blued Stats

- 55th on the iOS social app list

- 40 million users globally

- 28 million users in China

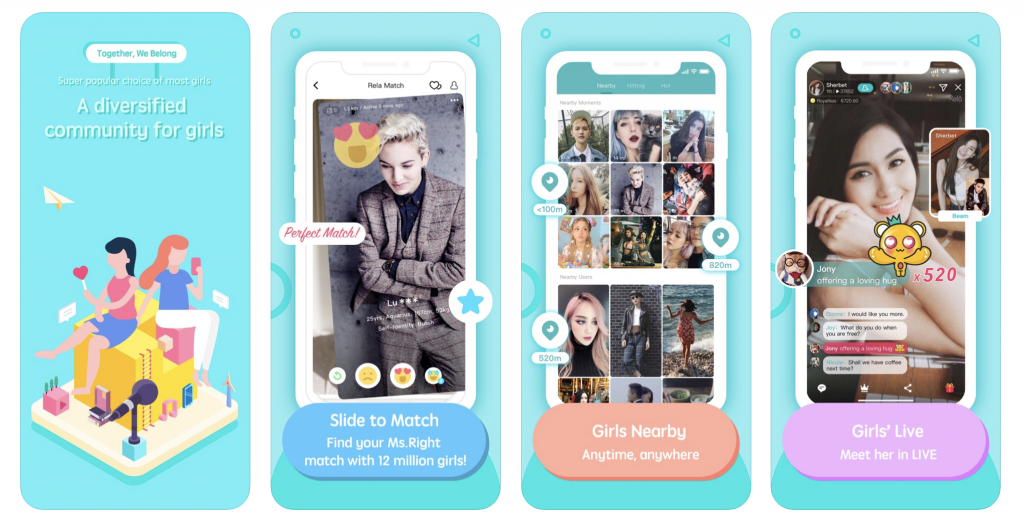

8. Rela

Rela, founded in 2012, is the first location-based dating app for queer women in China. Instead of being an app only for dates and relationships, Rela focuses on fostering an online community bringing people together, says the company.

In May 2017, then boasting 5 million users, the app was reportedly shut down by regulators, with the exact reason never officially specified. The app returned a year later, launched with the same Chinese name by Hangzhou Re Lan Network Technology.

In March 2019, Rela exposed millions of users’ data including nicknames, birthdays, physical information, and their posts, due to a server issue, TechCrunch reported.

Rela Features

Rela’s main page shares similarities with microblogging sites—users can post pictures of their daily life, share thoughts, and follow people they find interesting. Meanwhile, the app also supports location-based social networking, swipe-based matching, and speed dating. Audio and video livestreaming are both available.

The monthly membership subscription fee is RMB 27, which will provide services including unlimited “superlikes” and exploring users beyond their dating-radius.

Rela Stats

- 189th on the iOS app stores for social apps

- 12 million users around the world

*Rankings are based on real-time iOS app store downloads per third-party app data tracker Chandashi.

Update: An earlier version of the story stated that TanTan and Soul were invested by DST Global. DST Global approached us claiming they never invested in them. We’ve updated the story to reflect that claim.