China’s electric vehicle manufacturers have been locked in a fierce price war. But now, many are pulling back, turning to hybrid models to drive sales and secure survival. Tesla, meanwhile, is moving full throttle in the opposite direction, doubling down on autonomous driving with the launch of a driverless taxi service.

On the night of October 10, to kick off Tesla’s event, CEO Elon Musk climbed into a sleek, futuristic car. No steering wheel, no brakes, no driver—just full self-driving capability.

Video of Tesla CEO Elon Musk stepping into Tesla’s first-ever robotaxi, the Cybercab, riding it to reach the main stage at Tesla’s October 10 event. Video source: Tesla via YouTube.

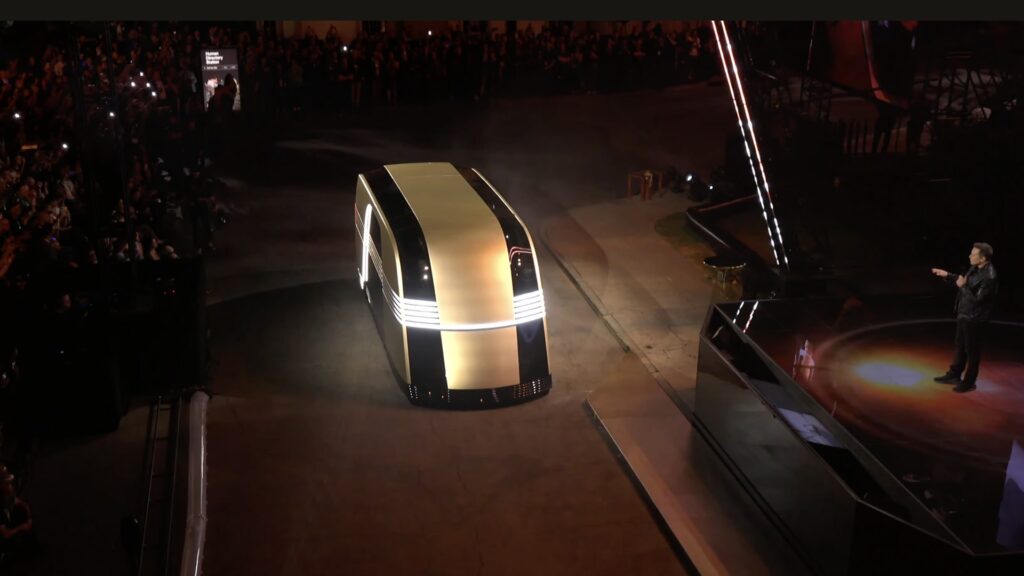

The car Musk was sitting in stole the spotlight: Cybercab, Tesla’s first autonomous taxi. Alongside it, Tesla also unveiled Robovan, an autonomous van aimed at transforming both passenger and cargo transport.

View this post on Instagram

During the event, Tesla revealed plans to launch its unsupervised Full Self-Driving (FSD) technology in California and Texas by 2025, starting with the Model 3, Model Y, and Cybertruck.

FSD—Tesla’s flagship autonomous driving system—has long been the cornerstone of Musk’s vision. The company’s goal is to fully remove the driver from the equation, transforming how people hail rides.

Musk has his sights set on the future. He said that, by 2026 or 2027, Cybercab will enter mass production and hit the streets in large numbers.

He also took the opportunity to set expectations for Cybercab’s pricing. “The cost of Cybercab […] is probably going to be around USD 0.20 per mile,” Musk said, noting that this would be a fraction of current ride-hailing fares, which typically hover around USD 1 per mile.

Meanwhile, in a corner of the event space, Tesla’s humanoid robots, Optimus, entertained the audience with a dance performance.

Video of Optimus humanoid robots moving to the beat during Tesla’s October 10 event. Video source: Tesla via YouTube.

“It’ll basically do anything you want, so it can be a teacher, babysit your kids, it can walk your dog, mow your lawn, get the groceries, just be your friend, serve drinks. Whatever you can think of, it will do,” Musk said, describing Tesla’s Optimus humanoid robot. He added that, once in mass production, each Optimus unit could be priced between USD 20,000–30,000.

The choice of Hollywood as the event venue was no accident, symbolizing the transformation of sci-fi dreams into reality.

However, despite all the excitement, Musk didn’t dive deep into the details. The event lasted just 30 minutes. He glossed over the technical specifics of Tesla’s FSD software and left unanswered questions about how the company plans to tackle regulatory challenges for its robotaxi service.

Tesla is sticking to its guns when it comes to using a vision-based autonomous driving system, shunning light detection and ranging (LiDAR) technology—something that, until recently, set it apart from its competitors. But the journey from assisted driving to full autonomy is fraught with challenges. Aside from the technical roadblocks, running an autonomous taxi fleet brings a host of issues including regulatory compliance, fleet management, pricing models, software glitches, and liability concerns.

For Tesla, the journey toward realizing unsupervised FSD and robotaxis is still in its infancy, and Musk has yet to provide a clear answer on how he plans to turn around Tesla’s slowing sales.

Elon Musk’s robotaxi dream

In 2016, Musk boldly claimed that a Tesla would soon be able to drive from Los Angeles to New York without anyone needing to touch the steering wheel. Tap a button on your phone, and the car will come to you.

He quickly pushed his engineers to design a version of the car without a steering wheel, accelerator, or brake pedal.

At the time, the idea was unthinkable, given the technology available. But Musk never gave up on the robotaxi dream. As recounted in Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future, he relentlessly reminded employees that it would be a historic, revolutionary product, one that could transform Tesla into a USD 10 trillion company.

At the October 10 event, Musk appeared to inch closer to that vision. The Cybercab features a distinctly futuristic design—no mirrors, pedals, or steering wheel, and even equipped with scissor doors.

But Musk’s robotaxi ambitions extend beyond just Cybercab. He pointed out that most cars are only used 10–100 hours a week. With full autonomy, each car’s value could increase five to tenfold.

While Musk hasn’t fully outlined how the robotaxi service will operate, it’s clear that private cars could be part of the equation.

As for costs, Musk is betting that autonomous driving will be incredibly cheap. “Cybercab fares could drop to USD 0.20 per mile, compared to USD 1 per mile today. The vehicle itself will cost under USD 30,000,” he said.

And the timeline? Musk projects mass production by 2026 or 2027, though he admits his timelines tend to be optimistic.

Tesla also showcased a patent for self-cleaning robots that vacuum debris from the seats and clean screens, along with Cybercab’s wireless charging technology, though few details were provided.

Tesla’s autonomous van, Robovan, also made its debut. Musk likened it to something straight out of Star Wars. The van can carry up to 20 passengers or transport goods. According to Musk, its future operating costs could be as low as USD 0.10 per mile—a potential game changer for the industry.

For comparison, Waymo’s robotaxi service charges USD 13.30 per mile, making Tesla’s goal of USD 0.20 per mile a bold proposition. In addition, despite recently surpassing 100,000 paid rides per week, Waymo has yet to achieve significant profitability.

Tesla, however, could leverage its large-scale manufacturing capabilities to lower the Cybercab’s price to USD 30,000, improving the financial viability of its robotaxi operations.

Tesla’s self-driving tech faces a bumpy ride to profitability

Musk is confident that FSD will eventually be ten times safer than human drivers—and he’s counting on the revenue it will generate.

Tesla envisions two main revenue streams for FSD: subscription services, similar to Apple’s iPhone model, and integration into robotaxi fleets, which could reduce labor costs and disrupt the ride-hailing market. However, both approaches face significant challenges.

Take the subscription model: Apple’s hardware margins are typically around 40%, while its services—such as the iOS App Store and iCloud—yield margins over 70%. In Q3, Apple generated USD 61.6 billion in hardware sales, with services contributing USD 24.2 billion.

Tesla, meanwhile, has claimed a gross margin of 90% for FSD. Since 2021, Tesla vehicles equipped with HW3.0 hardware have been eligible for FSD subscriptions.

Since then, Tesla has delivered over 5.35 million vehicles. With a subscription priced at USD 99 per month, even a 10% subscription rate could yield USD 140 million in quarterly profits.

FSD is already available in the US and Canada, and Musk recently announced plans to seek regulatory approval for a supervised version in Europe, China, and other regions by the end of the year.

Musk also revealed that fully unsupervised FSD will roll out next year in California and Texas, beginning with the Model 3, Model Y, and Cybertruck.

However, the growth of FSD subscriptions hinges heavily on both product experience and technological advancements.

Industry experts acknowledge Tesla’s significant progress, driven by its end-to-end intelligence, extensive data collection, and advanced cloud-based training systems. “The technology ceiling is higher than traditional autonomous driving systems,” one expert said.

Yet, a gap remains between FSD’s potential and its real-world performance. Data shows that drivers still need to intervene frequently. According to AMCI Testing, Tesla’s FSD version 12.5 requires human intervention approximately once every 13 miles (21 kilometers). Similarly, tests by the Chinese autonomous driving company Pony.ai, conducted in California’s busy Bay Area, found that human intervention was needed every 10 kilometers.

One FSD user told 36Kr that his current version, V12.5.4, often requires manual intervention in construction zones with complex lane markings. “Humans figure it out quickly, but the car struggles,” he said.

Compared to fully mature robotaxi systems, Tesla’s FSD still falls behind. Data from the California Department of Motor Vehicles (DMV) in 2023 indicates that Waymo vehicles required human intervention only once every 27,900 kilometers.

Tesla’s leap from Level 2 to Level 4 autonomy faces significant challenges. Pony.ai executive Zhang Ning told 36Kr that, while Tesla’s FSD performs well in Level 2 assisted driving, it falls short of the technical and safety standards required for Level 4.

“Tesla’s use of pure vision sensors and low reliance on maps have led to good human-like driving experiences in North America and elsewhere. But in some areas, FSD’s capabilities fall short of public expectations,” Zhang said.

Ahead of Tesla’s event, Cruise CEO Kyle Vogt outlined 15 critical challenges for robotaxi deployment, including issues such as traffic congestion, collision detection, AI limitations, and regulatory hurdles:

Tesla won’t be immune to these challenges.

Simply put, whether the company monetizes FSD through subscriptions or robotaxi operations, significant profits in the short term seem unlikely.

For now, selling cars remains Tesla’s primary revenue driver.

A rocky road lies ahead for Tesla’s new Model Y

Despite ongoing rumors, Tesla’s low-cost Model Q has yet to make an appearance. Until it does, the company’s sales and profits will continue to rely on the Model Y.

Sources told 36Kr that the updated Model Y is set to launch in Q1 2025, offering about 10% more range and a larger battery capacity. Thanks to Tesla’s platform development strategy, these battery upgrades will also extend the range of the Model 3.

“The new Model Y will feature a major redesign, a more comfortable chassis, and lower energy consumption. Its interior will resemble the revamped Model 3,” one insider said.

Tesla is also planning to introduce a six-seat version of the Model Y for the Chinese market, though this will essentially be the current Model Y with an additional seat. The third row will be a small bench, meaning the vehicle’s interior space will lack strong competitiveness.

The Model Y has been Tesla’s top seller. In 2023, it overtook the Toyota Corolla as the world’s bestselling car, with over 1.23 million units sold. At Tesla delivery centers, a new vehicle is delivered every six seconds during the workweek.

However, in 2024, Tesla’s sales growth began to slow, with the first two quarters showing year-over-year declines. Although Q3 saw some improvement, it still fell short of market expectations.

As sales decline, so do profits. In Q2, Tesla’s operating profit fell to USD 1.61 billion, a YoY drop of USD 790 million, while net profit plunged to USD 1.48 billion—a 45% decrease.

In the first half of 2024, Tesla’s net profit was nearly half of what it was in 2023 and 2022, with its gross margin slipping to 17.6%.

Meanwhile, new competitors are closing in on Tesla’s market share. Huawei-backed Luxeed, Nio’s Onvo L60, the Zeekr 7X, and Xiaomi’s upcoming SUV are all slated to launch next year. These brands are directly targeting the Model Y in their marketing campaigns and have already secured tens of thousands of preorders, putting mounting pressure on Tesla’s bestseller.

Industry sources told 36Kr that Tesla’s Shanghai factory is expected to produce 528,000 Model Y units in 2025, averaging 44,000 units per month—a relatively conservative target. For comparison, the Model Y sold approximately 456,300 units in China in 2023, with 48,000 units sold in September alone.

Tesla’s core markets remain the US, EU, and China, the three largest hubs for EV production and sales:

- In the US, Tesla’s August sales reached 53,000 units, maintaining a market share of roughly 35%.

- In contrast, the European EV market has slumped, with August sales dropping 33% YoY—the lowest monthly level since January 2023. Tesla’s sales in the region were hit hard, falling by 43.2%.

- Globally, EV sales are slowing, with China being the sole exception. In August, Chinese EV sales grew by 42%, reaching 1.02 million units, while market penetration hit 53.9%.

Securing a foothold in China is critical for Tesla to maintain its market position, but the challenge is fiercer than ever.

Artificial intelligence has become a major focus globally, and China’s automotive industry is no exception. Companies like Huawei, BYD, Nio, Xiaomi, and Xpeng Motors have all made AI central to their strategies. Unlike Tesla, however, these companies appear to have clearer long-term plans for the automotive market.

Facing delayed product launches and intensifying competition, Tesla has placed big bets on AI, focusing heavily on FSD subscriptions, autonomous taxis, and household robots. It feels like an all-or-nothing gamble.

Will Musk’s moment of reversal come? It could be the turning point for Tesla—and for the global automotive industry.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Han Yongchang and Li Anqi for 36Kr.