Temu officially launched in Thailand on July 29, entering its third Southeast Asian market a year after expanding into Malaysia and the Philippines. Temu’s global growth has been phenomenal. Its GMV reached USD 20 billion in the first half of 2024, surpassing its total sales for 2023. As of July, Temu operates in over 70 countries and regions worldwide.

However, Temu is adopting a more cautious strategy in Southeast Asia. Data from a Momentum Works report released in July indicates that Temu’s GMV in Southeast Asia was less than USD 100 million in 2023, significantly lower than TikTok Shop’s USD 16.3 billion.

Temu’s slower pace in Southeast Asia may seem illogical but makes sense given the circumstances. Low-priced goods have a vast market in Southeast Asia, where Temu competes fiercely with Shopee, Lazada, and TikTok Shop. As a latecomer, Temu does not have a significant price advantage over these platforms. Southeast Asia’s young population and relatively low e-commerce penetration have led several platforms to establish an early presence. The uneven economic levels and logistics infrastructure across Southeast Asian countries also necessitate tailored operational strategies.

It’s not just about discounts

Although Temu’s progress is slow, its discounting efforts remain strong. At the initial launch of its Thailand site, Temu offered up to 90% off as a grand opening discount. The website currently offers a variety of cross-border goods, with global reviews and ratings for popular items.

Momentum Works’ July report shows Thailand as the second largest e-commerce market in Southeast Asia after Indonesia, with a growth rate second only to Vietnam, increasing by 34.1% year-on-year. Meanwhile, Indonesia remains the largest e-commerce market in Southeast Asia, contributing 46.9% of the region’s GMV. Temu has yet to enter Indonesia, and given the competitive landscape, there is limited space for Temu in the Thai market. In 2023, the Thai e-commerce market was dominated by Shopee, Lazada, and TikTok Shop, holding a 49%, 30%, and 21% market share, respectively.

To address these challenges, Temu developed its logistics system to fulfill orders from various locations. Sellers can transport goods by truck from Guangzhou to Bangkok, reducing delivery time to under five days, shorter than sea shipping but slightly more expensive. The five-day delivery cycle is a significant efficiency improvement for Temu. However, established platforms like Shopee and Lazada, with their longstanding presence in Southeast Asia, have significantly enhanced their logistics efficiency with in-house systems.

Southeast Asian countries have varying address systems, road planning, and transportation modes. Indonesia, with its 17,508 islands, and the Philippines face interisland shipping challenges. Vietnam and Thailand experience severe urban traffic congestion. Moreover, inadequate infrastructure, such as roads and railways, and low efficiency of last-mile delivery personnel add to the logistics challenges. Established e-commerce platforms have only made limited improvements over the years, and Temu, which primarily uses international logistics for small packages, will face numerous challenges in further expanding its presence in Southeast Asia.

Payment issues are another challenge for Temu. Its primary payment methods include international credit cards and PayPal, but Southeast Asia has lower credit card penetration rates compared to regions like China, Japan, South Korea, and North America. According to a TikTok white paper on global consumer trends in Southeast Asia, cash on delivery accounted for 2% of global e-commerce transactions in 2023. Southeast Asian countries have a higher proportion of cash on delivery as a payment method than the global average, with Indonesia at 11%, the Philippines at 14%, and Vietnam as high as 17%.

Low prices alone isn’t enough

Relying on low prices and targeting lower-tier markets, Pinduoduo and Temu have swept across China and the West. However, in Southeast Asia, these strategies seem less effective. Keeping prices low remains a sharp strategy, but it is no longer novel in the region.

A 2024 Shopify report on Southeast Asian retail trends shows that, with the rapid development of e-commerce in Southeast Asia, price has become one of the primary considerations for consumers when shopping. With inflation reducing consumer discretionary spending, 83% of Southeast Asians are cutting unnecessary expenses while 39% plan to choose cheaper goods when making purchases.

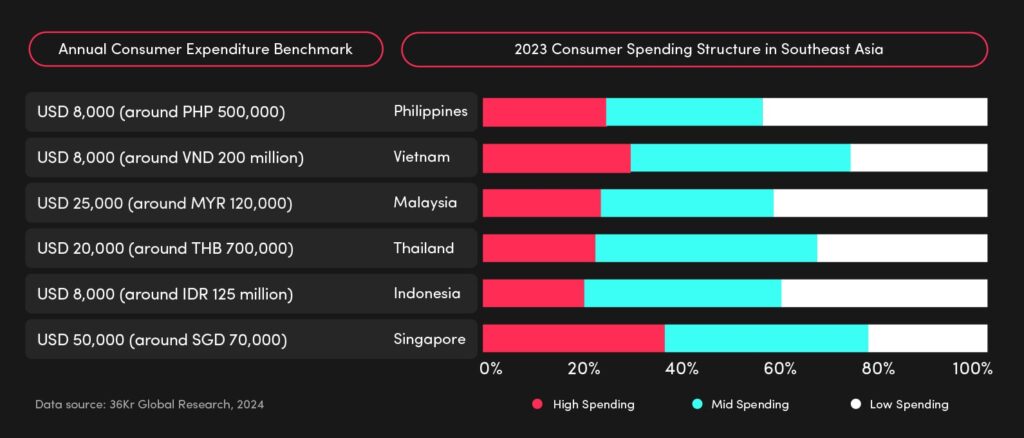

Due to the higher growth potential of per capita GDP in most Southeast Asian countries compared to developed countries like those in the West, coupled with the impact of inflation, Southeast Asian consumers are increasingly focused on the cost-effectiveness of goods, with high price sensitivity.

Lazada, positioned similarly to JD.com and Tmall in Southeast Asia, adapted early by introducing the first fully managed model for e-commerce platforms in the region, focusing on highly cost-effective goods. Unlike platforms like TikTok and Temu, Lazada’s fully managed model includes both cross-border and local sellers, allowing sellers to choose between running operations themselves or delegating the process completely for cost-effective, high-volume products.

Shopee also runs various discount activities, continually lowering product prices. Shopee Philippines offers free shipping on many women’s clothing items with a minimum spend of just PHP 1 (USD 0.017). Even for non-promotional items, prices rarely exceed PHP 120 (USD 2.1). Similar items on Temu range from PHP 160–200 (USD 2.8–3.5), offering less competitive pricing. For Southeast Asian consumers, there are simply too many choices for low-priced goods on e-commerce platforms. Temu’s low prices are lost in a barrage of options.

The current Southeast Asian e-commerce landscape is highly competitive, with TikTok Shop quickly gaining ground and Shopee holding a significant market share, putting Temu at a considerable disadvantage. According to Momentum Works’ report, the total gross merchandise value (GMV) of e-commerce platforms in Southeast Asia reached USD 114.6 billion, with Shopee holding a 48% market share, followed by Lazada at 16.4%, and TikTok and Tokopedia each holding 14.2%, ranking third.

Additionally, TikTok acquired a majority stake in Indonesian e-commerce platform Tokopedia last year, bringing their combined market share to 28.4%, making TikTok Shop effectively the second largest player in Southeast Asia. Beyond market share growth, Southeast Asia’s young demographic has led to high social media penetration, with a strong acceptance of live and social commerce, and significant influence from key opinion leaders (KOLs).

Data from Statista shows that social media has become a primary shopping channel for Southeast Asian consumers, with only 4% of Vietnamese consumers not using social media networks for shopping. TikTok has a natural advantage in Southeast Asia’s e-commerce landscape. Moreover, traditional e-commerce platforms like Shopee and Lazada are also adapting to the trend by incorporating live commerce, presenting further challenges for Temu.

Temu’s primary focus remains on the European and American markets. Last year, it vigorously promoted the fully managed model, and this year, it has been pushing the semi-managed model, aiming to continuously increase its market share in the West and acquire more customers.

Furthermore, Temu’s return policies and low-price strategies in the European and American markets have already dissatisfied many sellers. After entering the Southeast Asian market, it is uncertain how many sellers will be willing and able to participate.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Leslie Zhang for 36Kr.