“200 million [users] are only a start. Gotta mark this,” reads a widely-circulated screenshot on social media, from a post on WeChat’s Moments by Allen Zhang, the man who built the ubiquitous Chinese messaging app WeChat from the ground up.

He is talking about “Channels”, the short-video section of WeChat—still in beta mode—that is considered by many as Tencent’s last shot to compete against ByteDance’s Douyin (known overseas as TikTok), as short-video content is proving to be such a money-spinner in China’s online industry.

During the Chinese New Year festive period (January 24 to February 2), the average daily active users (DAUs) of short-video applications reached 574 million in China, according to a report from research firm Questmobile, as citizens spent more time on these apps due the COVID-19 pandemic. The market is currently dominated by ByteDance’s Douyin and Tencent-backed Kuaishou, with over 400 million DAUs and 300 million DAUs, respectively.

Zhang announced the rollout of Channels, or “Shiping Hao,” in Chinese meaning “Video Account”, at WeChat’s flagship annual conference held in Guangzhou, the app’s birthplace, in January. He said WeChat would soon allow users to “create short-form content,” in a keynote address delivered via video conference.

At the time, Zhang pointed out that WeChat has done two things wrong. Firstly, it initially only allowed its creators to edit content from a PC, and secondly, the current text-based form of WeChat public accounts limited the use of other multimedia formats.

On the contrary, short-video platforms like Douyin and Kuaishou, born in the era of mobile internet, are more flexible. Creators can simply film, edit, and upload videos by phone, while tools, templates, and filters provided by platforms further enhance accessibility for video creators.

A couple of weeks after the conference, WeChat started to beta test Channels. Zhang’s Moments post marks a decent debut for this feature, although the “200 million” is relatively vague and does not specify whether that number is DAU or monthly active users (MAU). Other than Zhang’s announcement, WeChat hasn’t promoted Channels, keeping a low-profile about its short-video attempt.

However, will Channels be able to engage and retain users? After all, compared to other standalone apps, Channels is backed by WeChat’s 1.2 billion active users. Some of them, perhaps just unintentionally, clicked into the section instead of becoming dedicated users of the function, putting some doubt over the 200 million users milestone.

Read more: The top Chinese short-video apps in 2020 vying to grab your attention with fast content

How is WeChat introducing short-video content?

WeChat’s users can easily find access to Channels on the Discover tab, just under Moments. The “red spot” notifies users of your friends’ new activities and pops up every now and then.

The short-video section looks totally different from Douyin. Unlike ByteDance’s app’s full-screen display, Channels’ interface is less eye-catching. Videos, either square, horizontal or vertical, take up less space.

In addition to allowing videos under 60 seconds, creators can also post up to nine photos (a function similar to Moments). This short-form content is open to comments, likes, and forwards. In the latest version of WeChat, comments are displayed like a news ticker at the bottom of videos.

There are four ways for users to navigate Channels—”following”, “friends”, “hot”, and “nearby”—which distinguishes its recommendation mechanism from Douyin’s. The system recommends content that a user’s friends liked or commented on.

On one hand, underpinned by WeChat’s strong network effect, content on Channels could be easily spread among one’s WeChat contacts. On the other hand, some users shy away from the feature because all activities will be exposed to their WeChat’s contacts, who are not only friends and family members but may also be work colleagues or clients.

Currently, not everyone can be a Channels creator. KrASIA learned that the first batch of users allowed to post short-videos consists of WeChat public account owners, brands, and multi-channel networks (MCNs). Under the current testing mode, the platform has been gradually opening the function to more users.

“Short-form content is what we will work on going forward. After all, expression is everyone’s natural need,” said Allen Zhang at the WeChat conference in January. He hopes WeChat can build “a platform where everyone can create”, so the pool of creators will likely be enlarged.

Actually, as early as 2018, WeChat first introduced a short-video function, dubbed “Time Capsules”, resembling Instagram’s Stories, where users can post short videos that will disappear after 24 hours. However, the public response to this feature has been lukewarm. I have more than 1,000 contacts on WeChat but only two of them used the function in the past 24 hours.

Back to Channels, scrolling through its feed, users can already find a wide range of content on topics including pets, English learning, state-owned media content, yoga tutorials, and K-pop stars’ music videos, among others.

Can WeChat become a viable rival in the short-video race?

The new WeChat feature has its pros and cons. While just in its early stage, some content creators couldn’t wait to get their hands on Channels and give it a shot, while some are still hesitant to make a move on Tencent’s platform.

“We adopted a wait-and-see approach and haven’t put too much effort in Channels so far,” said Pang, who is an operation manager at a top multi-channel network (MCN) in China. Pang preferred to not reveal her full name for this interview.

The core business of Pang’s MCN is managing internet influencers’ content distribution and monetizing that traffic through product promotions and sales of third-party goods.

“Our revenues are mainly from Douyin and Kuaishou, via short-videos and livestreaming. WeChat Channels is only one place for us to post some identical content in order to increase exposure,” she said, adding that Channels is still niche compared to Douyin, while its monetization strategy is not clear yet. That’s why most MCN industry insiders are not actively using Channels, Pang said.

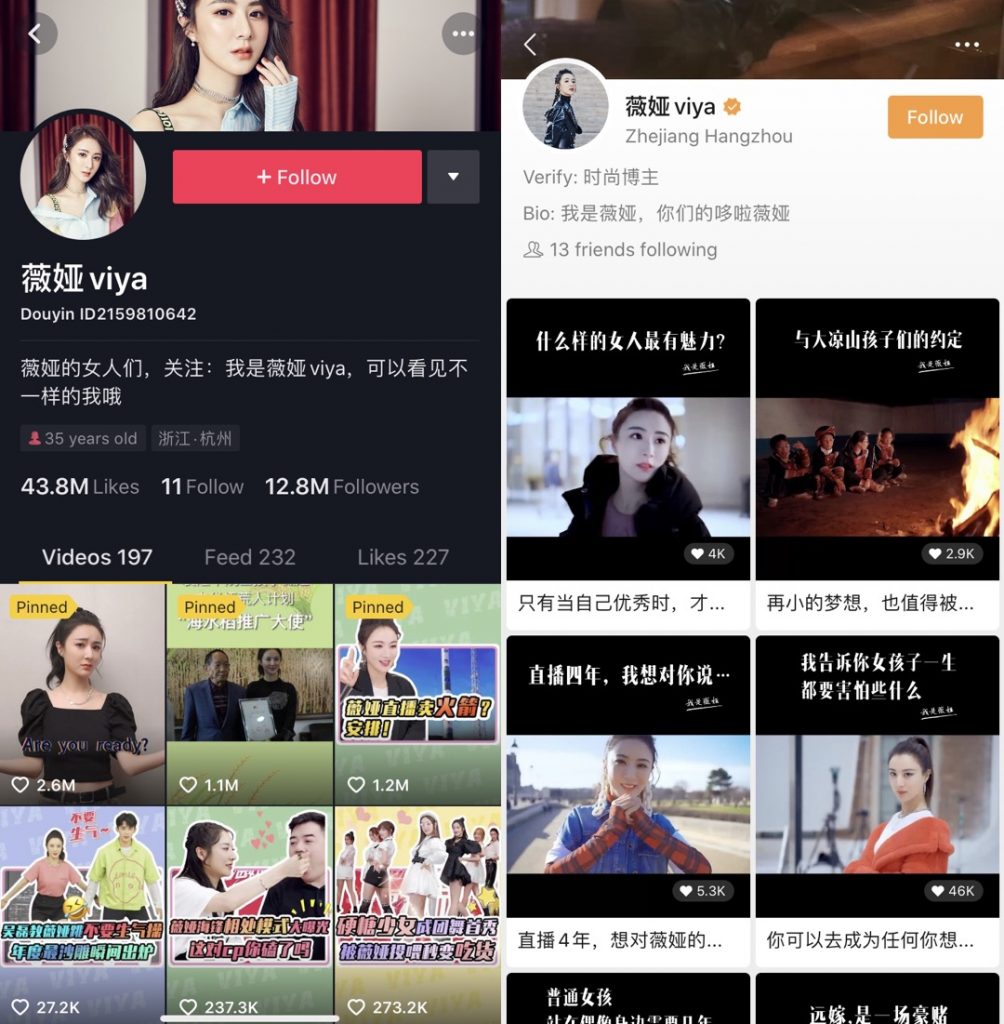

Take Viya Huang Wei as an example. She is one of the most influential Taobao e-commerce livestreamers, with over 28 million followers on Alibaba’s online marketplace. She also has a Douyin account with 12.8 million followers, where she posts clips of her advertising and livestreaming.

While her content on Douyin can usually garner more than 100,000 likes, she only had four videos collecting more than 100,000 likes on Channels, out of 30 total videos posted. Her latest three videos on WeChat attracted just 3,700, 2,900, and 5,200 likes, respectively. Yet, it is still early to draw conclusions about Channels, as more users need to get used to the feature, while their interaction with short-videos on Channels could be different compared to Douyin and Kuaishou.

However, the current lack of a clear monetization strategy might hurt Channels’ growth, while the feature also cannot include links for users to buy goods directly from the platform, an essential function for livestreamers. Notably, the total number of followers is not public on Channels. Users can only see how many of their friends are following an account.

Although for some users, WeChat’s new short-video platform looks promising. “For us, ordinary people, Channels is the only short-video platform we could use to gain fame as short-video newbies,” said Echo Yujia Du, a full-time real-estate investor who started to post content on Channels a couple of months ago.

She posts vlogs and good-recommendation videos on her channel “Wada”, which has gained her more than 1,000 followers. She launched the channel recently when many of her business trips and plans were shelved due to the COVID-19 pandemic.

She noted that as Douyin and Kuaishou both have swathes of top-tier influencers, the space left to “ordinary people” in search of success is limited, but the newly-launched Channels opened a window. “Channels is a less entertaining platform compared to Douyin. Still, my channel now also serves as a kind of business card for me,” she said.

Looking forward, Du doesn’t think monetization will be a priority anytime soon, but she thinks Channels has the potential to build a business-friendly environment, since WeChat has all the “infrastructure”, including the mature content ecosystem on public accounts, e-commerce stores powered by WeChat mini-programs, and its own payment method via WeChat Pay.

Undoubtedly, WeChat will continue to refine Channels and add more functions to it. Yet, the super app will have to find a balance between its messaging function and the short-video section.

Riding on the popularity of Douyin and the global success of TikTok, ByteDance has expanded into a fully-fledged internet giant with businesses in gaming, online education, e-commerce, and cloud computing, directly stepping on social media giant Tencent’s toes. Many see Tencent’s introduction of Channels as a way to fight back. WeChat’s Channels, along with Tencent-backed Kuaishou, will spur intense competition with Douyin for dominance in China’s hottest online content segment with promising monetization potential.