The race is on for companies in Southeast Asia to develop their own versions of regional super apps. Several internet firms are expanding beyond their core business to offer services like on-demand transportation, food delivery, and telehealth. The objective is to keep users in their app for as many minutes as possible throughout each day, in turning racking up more transactions.

Indonesian travel tech platform Traveloka now offers a taxi-hailing service in partnership with Blue Bird, the country’s leading taxi operator. Called QuickRide, the service was officially launched on January 19. It is currently available in 16 cities, including Jakarta, Bandung, Semarang, and Denpasar.

Before Traveloka, Shopee had established a similar partnership with Blue Bird in December 2021. In recent years, both companies have expanded their consumer offerings beyond their core services—online hotel and flight bookings for Traveloka, and e-commerce for Shopee. Also, both companies have fintech arms: Traveloka introduced its PayLater feature in 2018, and ShopeePay went live in 2019.

The two companies share even more parallel tracks. Last year, Traveloka and Shopee each rolled out a food delivery service, called Eats Delivery and ShopeeFood. Due to its aggressive marketing and execution, ShopeeFood took a bite out of the market shares of GrabFood and Gojek’s GoFood in its first year of operation, even though it still has a long way to catch up to the frontrunners. In 2021, GrabFood was the leader in Indonesia’s food delivery sector, controlling 49% of the market. It was followed by GoFood with 43%, and ShopeeFood held 8% market share, according to Momentum Works.

Traveloka is also venturing into telehealth. It recently introduced a feature that allows users to consult doctors online, book COVID-19 tests, and make appointments for medical check-ups, including at a number of lab facilities.

These developments suggest the region’s major consumer apps are following the same path of utilizing their sizable user bases to offer multiple services—ride-hailing, fintech, online commerce, and meal delivery. Grab calls itself Southeast Asia’s first super app, and the term has since become a sought-after label for platforms that offer the same set of consumer services.

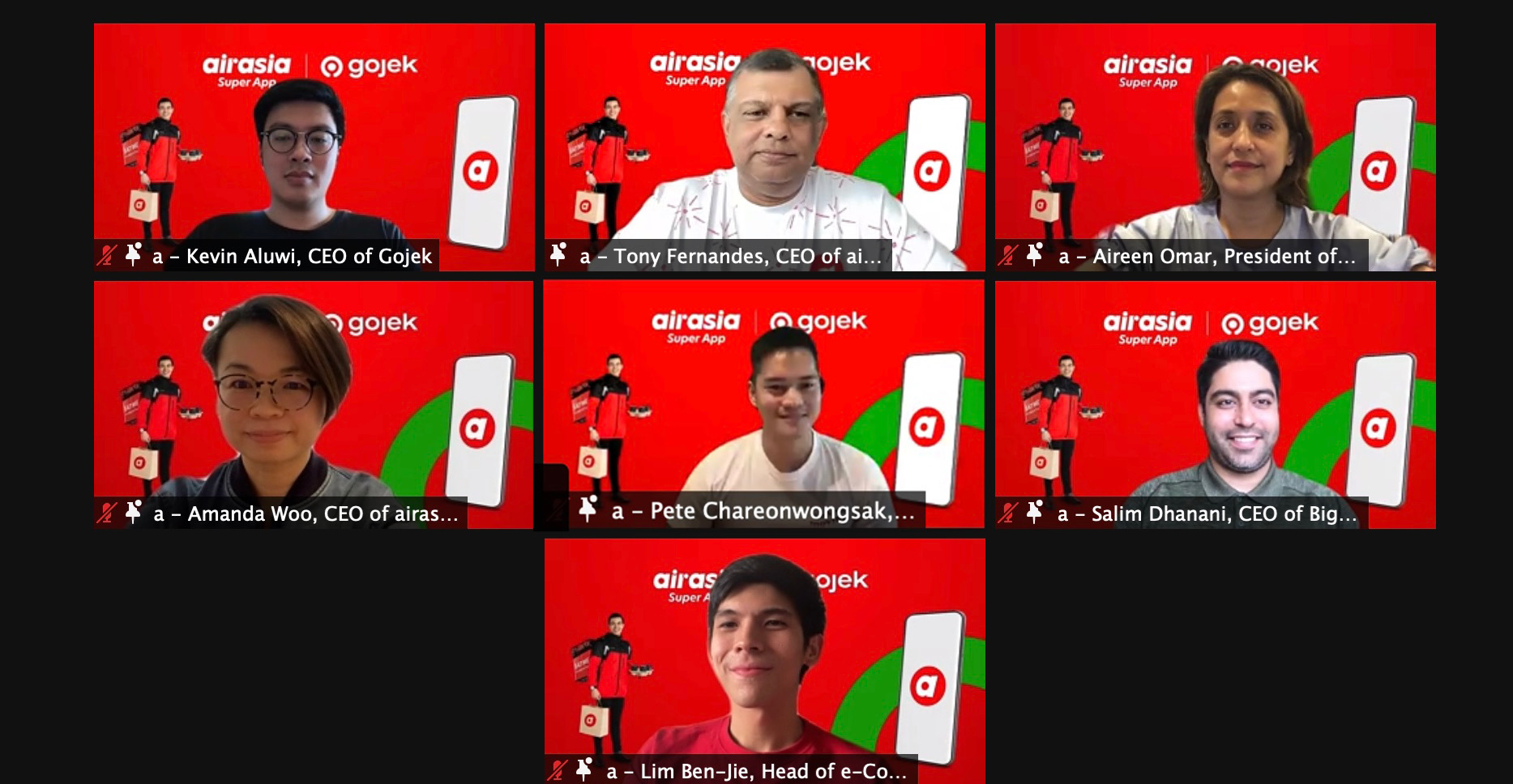

Grab and Gojek are the two biggest super app developers in the region. Now, more players are entering the ring. In 2020, Malaysian-headquartered budget airline AirAsia introduced its self-styled “ASEAN super app for everyone.” AirAsia will soon launch ride-hailing, grocery delivery, and express parcel delivery in Indonesia. Its taxi-hailing and food delivery services are already online in Malaysia and Singapore.

The term “super app” was first used to describe WeChat, a ubiquitous application that is used by 1.2 billion people, most of whom are in China. WeChat combines messaging, payments, e-commerce, and much more through its mini programs, making it indispensable for many people in China. Companies like Facebook have tried to build similar applications users outside of China, but few have succeeded in their endeavors. In Southeast Asia, Grab and Gojek lack many of the features that WeChat offers even though they take on the “super app” designation.

“Super apps usually start as a messaging platform. Examples are WeChat in China and Kakao Talk in South Korea, which are the dominant companies in their respective countries. Meanwhile, Indonesia has strict regulation regarding messaging applications, making it difficult for technology companies to develop messaging features,” said Bhima Yudhistira Adhinegara, director of the Jakarta-based Center of Economic and Law Studies (CELIOS). However, apart from the communication element, the trajectories of development for super apps in Southeast Asia are similar to those in China, he said.

Adhinegara believes that the race to develop more super apps could benefit users, who may no longer need to download dozens of apps to address their daily needs. At the same time, users can take advantage of cross-promotions or discounts offered by the platforms.

However, there are downsides too. Widely used apps with multiple services store a huge amount of personal data that could be exploited, such as for targeted ads. And if the platform’s data security is compromised, users could become the victims of data breaches. This happened to Tokopedia in 2020, when 91 million users’ data was stolen and shared by hackers.

More competitions means more choices for consumers, said Adhinegara. However, Grab and Gojek will likely remain as the frontrunners of the super app race for now, as they command the ride-hailing and food delivery markets. For now, Shopee, Traveloka, and AirAsia still have a long way to go before they can earn the “super app” moniker.