As dusk falls, the intensity of sports competitions stirs emotions, drawing waves of cheers. For many in Latin and South America, tuning into live broadcasts on television has become an everyday ritual.

Despite cultural differences, South American audiences remain enthusiastic about using televisions to watch sports events or streaming content—a stark contrast to the diminished role of household televisions in China.

According to Conviva, a streaming analytics company, streaming viewership time in LATAM surged by 70% in the second quarter of 2022, underscoring a growing appetite for TV-based entertainment.

As user activity rises, TV manufacturers worldwide have established a strong presence in countries like Mexico and Brazil. Samsung began its Latin and South American expansion in the 1980s, solidifying its position in the premium market. TCL followed in 2002, building its sales network across the region. By 2023, TCL ranked third in TV sales in Brazil, according to Omdia.

Beyond hardware, the growing adoption of smart TVs has created a demand for TV browsers. Samsung, an early innovator, developed the proprietary Tizen operating system over two decades ago, embedding it into its TV devices. Today, brands like TCL, Sony, and Skyworth, along with Google Chrome, have introduced TV browsers tailored to LATAM users.

Ffalcon, a subsidiary of TCL, identified a gap in the overseas TV browser market in late 2021, noting significant user experience challenges. To address this, the company developed its proprietary browser, BrowseHere. Without significant promotional efforts, BrowseHere has expanded to LATAM, Southeast Asia, and Eastern Europe. Revenue in the first three quarters of 2023 increased more than eightfold year-on-year. To date, BrowseHere has been downloaded over 14 million times globally, with millions of active monthly users in Brazil and elsewhere, 70% of whom use non-TCL devices.

In recent years, smart TVs have increasingly penetrated emerging markets like LATAM, driving demand for software services such as TV browsers.

AVC Revo, a consulting agency, reported that smart TV shipments in LATAM reached 10.5 million units in the first half of 2023, an 11.4% year-on-year increase. This growth outpaced markets in Europe, the US, and China.

As TV shipments rise, TCL has established a presence across the entirety of LATAM and multiple South American countries, ranking in the top five in core markets.

Li Hongwei, vice president of TCL Industries and CEO of Ffalcon, told 36Kr that leveraging TCL’s large-scale operations enabled Ffalcon to confirm the early-stage development of TV browsers in the region, validating their market potential.

Prior to 2021, only a handful of multinational giants like Samsung and LG developed proprietary browsers for their smart TV products. Most browsers available at the time offered subpar web interactions.

Chen Zhichao, senior product manager at Ffalcon, said that, before BrowseHere entered LATAM, users typically relied on Google Chrome, often purchasing additional mice to operate it, which increased costs and complexity.

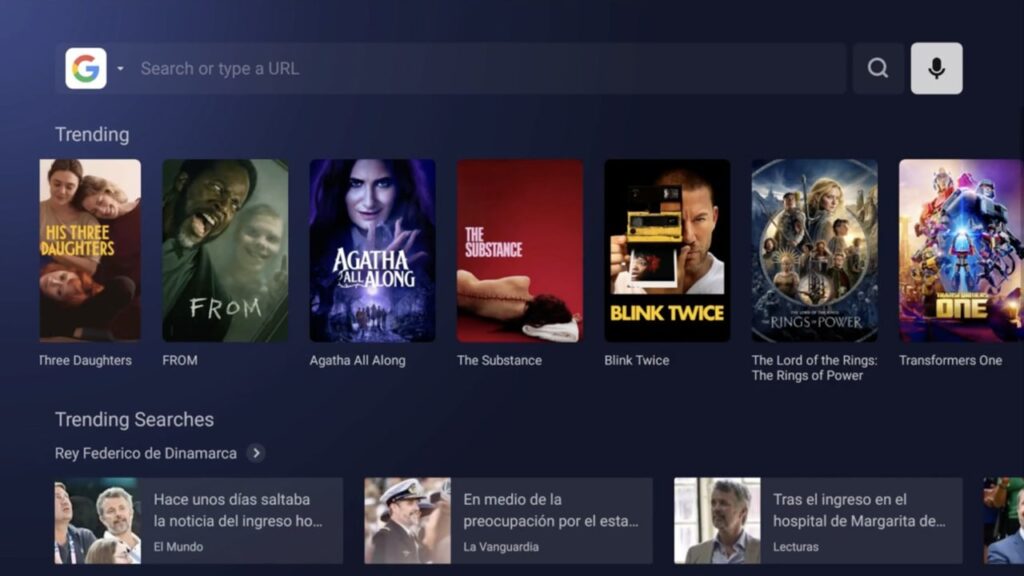

During its development, BrowseHere focused on web search as its core feature, enabling users to browse movies and live streams directly from their smart TVs. To simplify operations and reduce costs, its R&D team spent over two and a half years optimizing remote control navigation, eliminating the need for a mouse.

BrowseHere also introduced localized features for search input. In countries like Mexico, Brazil, and Argentina, users input keywords in Spanish or Portuguese, which often required lengthy entries due to linguistic intricacies, negatively impacting the user experience. Over six months, the team developed localized autocomplete functionality, integrating data from global media departments and local popular shows. This reduced input requirements, making searches quicker and easier.

After users view content from specific sites, BrowseHere displays the link on the homepage for easier future access. Over time, the browser aggregates search results, prioritizes high-quality content, and offers recommendations for related materials.

BrowseHere’s rapid iteration stems from consistent user feedback. In its user community of over a thousand members, nearly half are from Latin and South America, actively discussing product features and content.

Chen noted that user engagement peaks during major sports broadcasts. Community members frequently share live stream links and highlights.

Countries like Brazil and Argentina often host thousands of national football matches annually. Basketball and baseball are also popular across the region. Watching these events on TV has become a cultural mainstay.

BrowseHere’s data reveals that 4 to 7 p.m. marks peak viewing hours for LATAM users. Every average session lasts about 50 minutes, with many opting to watch just one half of a match. To accommodate this behavior, BrowseHere offers recommendations for other ongoing matches during halftime, allowing seamless content switching.

Beyond sports, local users also enjoy US blockbusters and talk shows. However, they prefer localized subtitles and dubbing, which often delays content availability due to lengthy post-production processes.

To address this, BrowseHere introduced automatic subtitle detection and translation. Once users open a media resource, the browser delivers native playback with a claimed decoding accuracy exceeding 99%.

Given that many smart TVs in Latin and South America fall within the USD 200–500 range, with limited hard drive storage of around 8–16 gigabytes, BrowseHere reduced its app size to about one-tenth that of competitors like Chrome, ensuring accessibility for lower-end devices. Some features are embedded directly into TCL hardware to further reduce the app’s footprint.

While BrowseHere initially benefited from TCL’s market presence, it now boasts over 70% of users from non-TCL devices like Xiaomi and Hisense. Its free access and small size are major attractions for LATAM users, who often download the app independently from online forums.

With a rapidly expanding user base, LATAM users remain BrowseHere’s largest demographic. To better meet their needs, the company plans to introduce features like shared bookmarks, enabling users to exchange book and music lists online.

While China’s smart TV market has reached saturation, the iterative demand in emerging markets ensures that applications like BrowseHere continue to explore new opportunities abroad.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Hu Yiting for 36Kr.