Sea, one of Southeast Asia’s leading consumer Internet companies that went IPO in 2017, released its third quarter earnings on Tuesday night, posting a total adjusted revenue of USD 763.3 million. In particular, e-commerce accounted for USD 257.2 million, or about one-third of the total. The group expects that revenue for its e-commerce business will fall between USD 880 million and USD 920 million for 2019.

With higher expenses for sales and marketing in the third quarter, Shopee has enjoyed healthy growth rates across markets. It is ranked number one in the Shopping category by average monthly active users and by downloads in both Southeast Asia and Taiwan, according to App Annie. Statistics from iPrice for the third quarter also show that Shopee has surpassed Lazada in terms of web traffic in Southeast Asia.

KrASIA caught up with Shopee CCO Zhou Junjie in Singapore to talk about e-commerce as the sale season accelerates across the region and competition to get users to buy online has never been fiercer here.

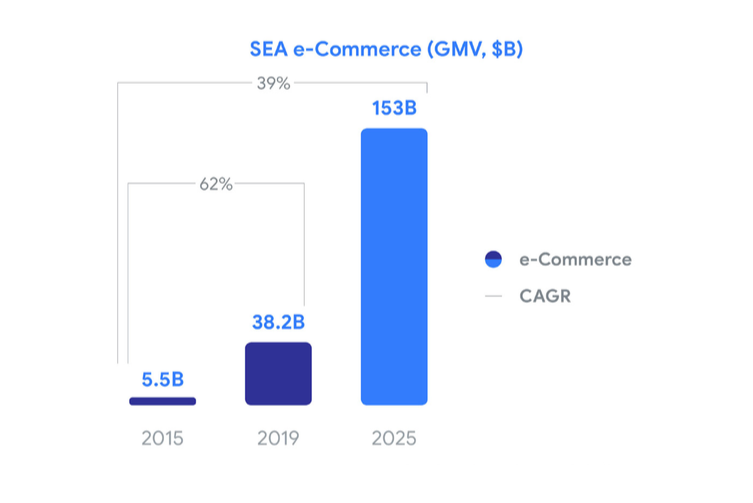

KrASIA (Kr): The latest e-Conomy SEA report by Google, Temasek, and Bain & Company now pegs Southeast Asia’s digital economy at USD 300 billion by 2025 and it’s not a surprise that e-commerce and ride-hailing continue to be the top performers. E-commerce is valued at USD 38 billion as compared to just USD 5.5 billion in 2015. Shopee also started in 2015 and has solidified its position across the region. What do you think have been the key factors for Shopee to become one of the leading players in Southeast Asia?

Zhou Junjie (ZJ): When we first started in 2015, there were already big e-commerce players in the region. At the time, we saw there was a clear trend of people going mobile. Previously, a lot of people were accessing the internet on desktop computers. Smartphone ownership and infrastructure roll-out for 3G and 4G certainly helped a lot. And when we first started, in fact we only had mobile. Of course now we do have the PC version.

We believed early on that mobile was the coming trend and we focused very much on optimizing users’ experiences or engagement through mobile, whether it had to do with product design or new feature roll-outs. I think that has proven to be one of the very important strategies for us.

For us, across the region, more than 95% of our orders are placed on mobile. Our mindset is always mobile-first. We believe that’s the right way to optimize our resources. We made lots of effort to do seven apps in seven different markets. That means seven different versions to maintain and when you roll out something, you have to do seven releases. I believe that we are in a very good position to grow faster and capture the bulk of the e-commerce market.

Kr: Amazon launched its online store for Singapore in October. And of course, you also have to compete with Alibaba-backed Lazada. Where do you see the strongest competition coming from—the global players, or local ones in different countries like Vietnam’s Tiki and Sendo, or Tokopedia and Bukalapak in Indonesia?

ZJ: I don’t think it’s right for us to comment on others’ strategies. For us, looking back at our starting point four years ago, we basically started much smaller compared to existing players back then. A lot of them are still operating now. Over the past four years, we have been growing much faster than the rest. We have become a market leader in this region and we are very much focusing on executing our strategy well to capture users in this region.

Having competition and more players interested in the region is not a bad thing. It helps build up an ecosystem of buyers and sellers and create more awareness of e-commerce in general. It also helps shift users’ behavior. We can see from the Google-Temasek-Bain report that there is still much potential for growth in the next five to ten years.

Kr: There has been lots of talk about ride-hailing companies burning money to acquire more users. For e-commerce players, is the race also a war of discounts?

ZJ: It’s obvious that users have lots of choices. We have to do a lot more on the engagement front as well. People come online to look for goods but also we want to engage them better, through things such as social games. Shopee can be part of your social activity. And you can always be connected to us even if you’re not buying.

We want shoppers to feel entertained and have a lot of interactions with us on the platform, as well as with friends and sellers. We are also investing in the behind-the-scenes capabilities such as data science to do that better and to make better personalized recommendations. On the merchants’ side, it’s about providing them with an easy-to-use platform and tools for them to engage with buyers. Some sellers are more sophisticated than others and have different needs across different countries.

Shopee was one of the first platforms in the region to launch both the chat function (called Shopee Chat now) and live-streaming (Shopee Live). For Shopee Live, sellers can instantly launch streams where they can demo products, answer buyer questions, and get real-time feedback from their target consumers, strengthening the trust between users of our platform.

Kr: In China, e-commerce giants are tapping into rural areas. In Southeast Asia, we can say that has been relatively unexplored. Does Shopee have some kind of strategy to capture consumers outside big cities?

ZJ: Southeast Asia has several of the largest and most densely populated urban areas in Asia. There is a disproportionate influence of metro centers for the region’s internet economy. And in areas beyond the metros, the internet economy is projected to grow fourfold between 2019 and 2025, twice as fast as in metro areas.

In many markets where we operate, there’s a high percentage of users outside major cities. In Indonesia, we have quite a big chunk of users outside the Jakarta region. We work with logistics companies to reach out to different places to connect local sellers and buyers. Sometimes, far away, there’s a closer community where if users have good shopping experiences on Shopee, they will spread it through word of mouth. Of course, the infrastructure, user base, logistics, and payment all make it harder to access rural areas, but also make these areas much less penetrated compared to Tier-1 cities. That means there are a lot of opportunities for us to grow there.

Kr: Singles’ Day is definitely the goldmine for all e-commerce players, but some have argued that it does not reflect consumer confidence and it’s only about marketing. What are your thoughts on this?

ZJ: Singles’ Day is still definitely very relevant for Shopee. Consumers have been increasingly look forward to it—discounts, events, and so on. Every year, we break the previous year’s record. I think it’s just getting more and more popular.

This interview has been edited for length and clarity.