For years, an informal credit market shaped by loan sharks has plagued Vietnam’s economically vulnerable citizens, whose status prevents them from accessing formal channels to borrow money. Borrowers have to bear extremely high interest rates and violent harassment if they are unable to pay back their short-term loans on time.

With high internet penetration and a boom in mobile phone ownership in the country, it’s inevitable that “black credit” has moved online. Earlier this month, the Ministry of Public Security issued an official warning regarding the dangerous proliferation of lending apps that charge up to 1,600% per annum in interest rates and use illegal, violent means to intimidate borrowers, at times even seizing borrowers’ property. Under pressure from loan sharks, some borrowers have even resorted to attempting suicide.

P2P lenders offer an alternate mode to obtain credit. But without a legal framework to regulate this new business model in Vietnam, analysts say things can backfire, exposing consumers to even more risks as they are unable to differentiate reliable service providers from those that use dubious lending schemes or even commit outright fraud.

The inevitable rise of P2P lending

About 70% of Vietnam’s population does not have bank accounts, according to the World Bank Global Index 2017. And even among those who have their savings in banks, many do not qualify for loans from conventional financial service providers.

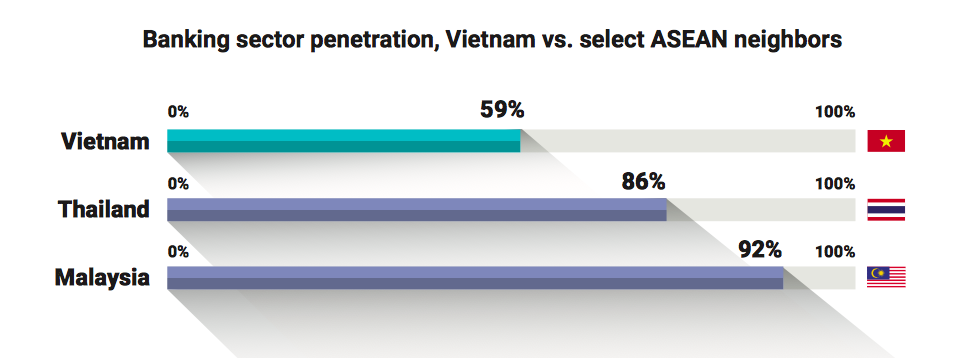

Asia-focused consulting firm YCP Solidance believes that the number of Vietnam’s unbanked population has dropped, and the country still lags behind some of its ASEAN neighbors when it comes to banking penetration.

The firm also estimates that Vietnam’s overall fintech market could process USD 7.8 billion in transactions by 2020. That development has been largely driven by the growth of digital payments.

The State Bank of Vietnam (SBV) estimates that there are about 150 fintech companies in Vietnam, 40 of which are operating in the lending segment.

Players have been drawn to the lucrative business potential in Vietnam’s micro-consumer lending sector due to elements such as “favorable demographics, rising consumerism and a large underserved and unbanked population,” according to Fitch Ratings’ “Consumer Lending in Vietnam” report.

However, micro-consumer loans, including those that are provided by P2P lenders, are inherently of higher risk because the borrowers generally fall outside the target of conventional financial institutions or consumer finance providers, largely due to their lack of formal credit records.

Legal loophole

Without a legal framework for P2P business in place, most companies generally can act as a connecting platform to connect borrowers and lenders, according to a Vietnam peer-to-peer lending report published by law firm Allens.

This, however, comes at the risk of having no legal protection for both borrowers and lenders. A legal loophole also hinders the development of the sector as a whole, as lending companies may become involved in “banking activities” that should not be performed by non-credit institutions.

Well-known P2P platforms like VayMuon or Tima, the latter which raised USD 3 million in Series B funding last year, are often mentioned as notable players in Vietnam’s fintech ecosystem. However, a quick browse on the App Store in the country indicates a litany of other unrecognizable lending apps.

In July, SBV warned domestic credit institutions and branches of foreign banks in Vietnam to be cautious about partnering with P2P lenders. According to the bank, some local P2P lending companies have misled investors and consumers into assuming that their activities are protected under current regulations and insured against risks.

Taking into account the recent warning from the Ministry of Public Security as well as delayed regulations, social trust for the P2P lending sector is definitely not high.

Concerns due to Chinese crackdown

Founded in 2017 by Trang Dao as part of NextTech Group, P2P lender VayMuon, consider to be one of the most popular platforms of its kind in the country, claims 2 million users. The company has already expanded its services to Myanmar and Cambodia.

VayMuon caters to individuals—such as office or factory workers—looking for quick, short-term loans but do not meet banks’ requirements for credit. Their loans are under VND 10 million (USD 430) and approved based on data gathered by the startup and its partners, like the applicant’s salary records, proof of income, and existing debts.

Interest rates are not set by lenders, and instead are capped by VayMuon at 1.5% per month or 18% per annum. It’s looking to raise its Series A round soon and plans to use the cash to diversify products and target other customer segments.

Trang said VayMuon has managed to build a reputable brand, but agrees that constant negative news about fraud committed by other platforms can potentially hinder the growth of the sector in the long run.

“We are very transparent in terms of announcing the interest rates and fees, but we hope that a comprehensive legal framework will ‘purify’ the market, differentiating the good ones from the bad ones,” she said.

Like other industry insiders, Trang also acknowledged increased concerns about the sector as China’s regulatory crackdown of P2P lenders might have caused many players from the country to flee to neighboring markets, including Vietnam.

In April, Chinese state financial news outlet Securities Times suggested in a report that roughly a quarter of the 40 existing lending platforms in Vietnam were originally from China, and only airlifted their operations due to stricter regulations back home.

China started cracking down on the sector in 2016. That year, a platform named Ezubao were accused of running a Ponzi scheme in China, with company founders being arrested and put on trial. The high-profile case exposed the risks present in China’s online lending sector.

Before 2016, lending platforms in China attracted large numbers of investors. However, with many of those platforms engaging in malpractice, like fraud and misappropriation of funds, a clampdown was inevitable.

Unofficial statistics in China show that the number of platforms in China dropped to fewer than 600 from nearly 6,000 in 2015. At least three provinces—Hunan, Shandong, and Chongqing—have banned lending platforms outright.

Nguyen Hoa Binh, chairman of NextTech Group, which owns VayMuon, estimates that the number of P2P lending platforms in Vietnam that originated from China could be much higher, falling somewhere between 60 and 70.

Binh said Vietnam should speed up the process of implementing a framework for P2P lending sandbox regulation, and prevent dubious Chinese lenders from planting roots in the country to avoid potential “social instability.”

Vietnam should take note of quick actions in Indonesia, he said, referencing its Financial Services Authority that identified and banned 297 illegal P2P lending platforms earlier this month.

Regulatory sandbox

At a recent discussion on developing a regulatory sandbox to spur technological and business innovations in Vietnam, Ngo Van Duc, an official from SBV’s Payment Department, said the bank has proposed to allow fintech players to participate in the sandbox for up to two years under a limited scope defined by operational geographical locations, transaction limits, and the number of customers.

SBV has submitted its proposal for regulating fintech to the government. Industry stakeholders and government officials hope that a decree to guide the sandbox’s fintech-related activities will be developed in 2020.

If all goes to plan, investors may breathe a sigh of relief.

In a previous interview with KrASIA, Vy Le, general partner at ESP Capital, an early-stage venture fund investing in Vietnamese and Southeast Asian tech startups, also agreed that investors have been cautious toward pouring capital into P2P lending platforms in Vietnam until there are clearer official guidelines.

ESP Capital and Cento Ventures’ report on tech investments in Vietnam in the first half of 2019 also shows that most financing in the country was channeled toward payment and remittance, while financial services only take up a small chunk.

The sector’s potential, however, is still colossal.

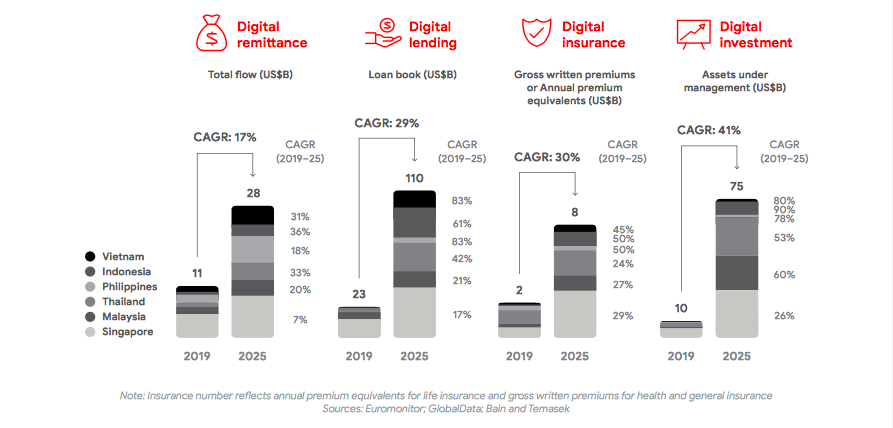

According to Google, Temasek, and Bain & Company’s recent report on Southeast Asia’s digital financial services, the sector may be valued at USD 60 billion by 2025. While digital payments and remittance are at an inflection point, digital lending is projected to grow at a much faster rate, especially in Vietnam.

The report also suggests that supportive and consistent regulations and government policies will be “the biggest swing factor in the development of digital financial services throughout the region.”

Michael Sieburg, partner from Solidance, said interest from companies in China and Southeast Asia to explore or enter this market has been growing in recent months. To unlock the market’s full potential, he believes that consumer protection should be at the heart of the much-anticipated P2P lending regulations.

“Consumers have to be protected against fraudulent behaviors, and from certain lending rates that get very high, very quickly,” he said. “All it would take is a couple of high-profile issues of consumers being defrauded for people to lose trust in the market.”

With additional research by Ben Jiang in Beijing, China.