China’s e-commerce conglomerate Alibaba has just made a significant step forward in its global expansion. Ant Financial, the company’s financial arm, has struck a partnership with ASX-listed Cabcharge, an Australian taxi payments service, to allow Chinese tourists and business travelers to pay their fare with Alipay.

Cabcharge payments are accepted by 22,000 vehicles, accounting for around 97% of taxis in Australia.

“Cabcharge is an early adopter of Alipay in Australia and they understand that better servicing Chinese customers in market can lead to revenue growth. This technology will help Australian taxi drivers break-down language and currency barriers and limit anxieties that that may have stopped Chinese tourists from using taxis in the past,” said Alipay Australia and New Zealand country manager George Lawson in a statement.

Global presence

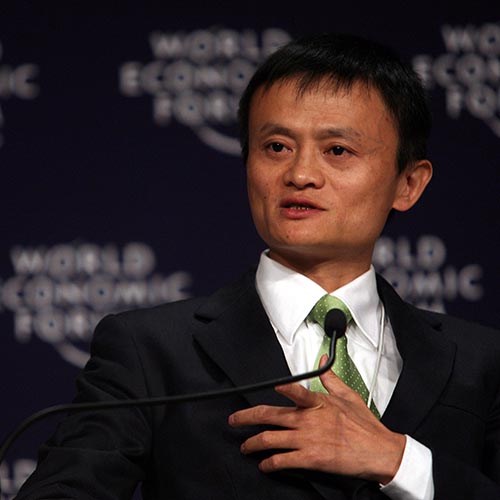

Jack Ma is ambitious in building up a digital payment empire. After conquering over 520 million users and over 200 financial institution partners, Ant Financial seeks to serve more people across the world. Its in-store mobile payment has branched out into more than 36 countries and regions across the world, accepting 27 currencies.

In many parts of the world, the company has leveraged taxi-hailing services to promote its mobile payment. According to 36Kr, a Chinese biztech news service, Alipay is accepted in tens of thousands of cabs across more than 11 countries and regions. Before the latest deal with Cabcharge, two Finnish taxi-hailing companies, have adopted Alipay in more than 1250 cabs in the country. In Taiwan and Hong Kong, there are respectively 30% and 20% cabs that allow users to pay with Alipay.

While in Asia, a region that at the top of Ant Financial’s target market list, Ant Financial plays differently. Starting from November 2016, Ant Financial has partnered with regional fintech companies through a series of investments, partnership and acquisition. Currently, its partners include Singapore-based CCPay and HelloPay, Malaysia’s Touch’n Go, Ascend Money in Thailand, Mynt in the Philippines, EMTEK in Indonesia and Paytm in India.

Great minds think and act alike. If Jack Ma is dogged about expand his empire globally, then Pony Ma, founder and CEO of Alibaba’s archrival Tencent, was also seeking to introduce his WeChat Pay to other markets outside of China. For example, the social networking and game conglomerate has applied for an e-payment license in Malaysia and claimed to have made a breakthrough and is planning for a launch in 2018.