36Kr PowerOn has learned from multiple informed sources that the first model of Alps, Nio’s sub-brand, codenamed “DOM,” is slated for trial production in July this year, with mass production and delivery expected to commence in the second half of 2024.

Trial production serves as the final checkpoint before mass production, aimed at verifying whether production equipment, manufacturing systems, quality control, the supply chain, and other aspects can meet production targets and ensure the stability of individual components and assemblies. In general, vehicles enter the start of production (SOP) phase around three months after trial production commences, becoming available for delivery to users.

If all goes according to plan, DOM is expected to officially launch in October this year.

However, insiders revealed that, while the delivery window for DOM is narrow, Nio has set an aggressive delivery target, expecting to fulfill tens of thousands of deliveries this year.

Alps, a sub-brand of Nio, differs from its parent company’s focus on electric vehicles priced above RMB 300,000 (USD 41,720), instead targeting the market for new energy vehicles priced between RMB 200,000–300,000 (USD 27,810–41,720). All models in the lineup will be developed based on NT3, Nio’s third-generation technology platform.

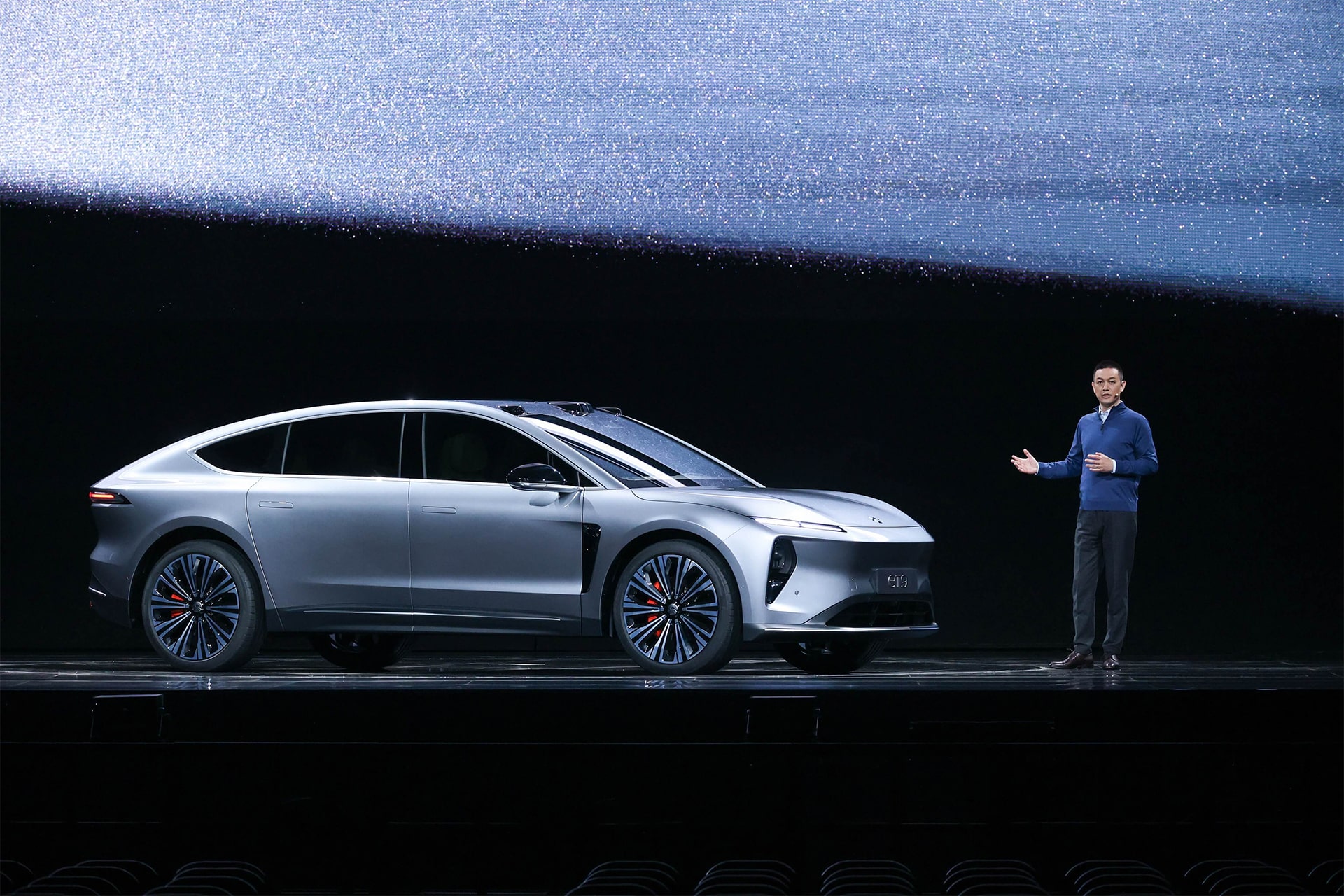

William Li, CEO of Nio, has stated before that the Alps brand will encompass three models, with DOM, the first model, aimed at competing head-to-head with Tesla’s Model Y.

The production of DOM’s prototype is said to have recently concluded. During Nio Day 2023, Li emphasized that continuous product optimization would ensure the competitiveness of the inaugural Alps model upon launch.

Nio’s confidence in Alps is further reflected in its sales projections. At a media briefing Nio conducted in December 2023, Li estimated that monthly sales of a single Alps model could reach between 50,000–60,000 units. This forecast is significantly higher than the monthly delivery figures that Nio has hitherto achieved for models under its main brand.

The automotive industry is entering a phase of intense competition, focusing on scale and cost efficiency. Nio’s goal is to establish a foothold in the high-end market. Previously, 36Kr reported that Nio’s 2024 sales target exceeds 230,000 units, surpassing its total sales of 160,038 units for the entirety of 2023 by around 70,000 units. Sub-brands like Alps clearly play a crucial role in solidifying Nio’s foundation.

The success of Tesla’s Model Y highlights the robust market demand for pure electric SUVs. According to Tesla’s 2023 financial report, over 1.2 million units of the Model Y were delivered last year, with an average monthly delivery of about 100,000 units, making it one of the bestselling models globally.

DOM represents the first mass-produced EV model to incorporate Nio’s NT3 platform, incorporating some of the Chinese automaker’s latest technologies to enhance product competitiveness:

- DOM will be offered in two versions, equipped with a 60 kWh and 90 kWh battery pack, respectively. The new battery packs will be thinner, freeing up more space in the vehicle cabin.

- The new vehicle model will utilize Nio’s self-developed and self-produced new-generation electric motors to optimize size and cost.

- An insider also informed 36Kr that DOM will also be equipped with 4D millimeter-wave radar. In addition to detecting horizontal objects, 4D millimeter-wave radar also has the capability to detect object height and was previously installed in models that were priced around RMB 300,000.

The launch of multiple brand products like Alps is a key factor in Nio’s efforts to reduce losses. During Nio Day 2023, Li said that different brands could share technology and resources, resulting in significant cost and scale advantages.

Nio’s financial report for Q3 2023 showed revenue of RMB 190.666 billion (USD 26.5 billion) and a loss of RMB 48.439 billion (USD 6.73 billion), with a net loss of RMB 45.567 billion (USD 6.33 billion), an increase of 9.8% year-on-year. In the third quarter of 2021, this figure was RMB 8.353 billion (USD 1.16 billion). The sales of the first Alps product will impact whether Nio can reduce long-term losses.

In 2024, companies like Li Auto and Xpeng Motors will also be launching new models priced around RMB 200,000 to seize the low- to mid-end market. For Nio, which has no plans to release new models in 2024, the first product from its sub-brand Alps could be perceived as a defensive move against competitors.

Notably, Tesla recently announced the launch of an upgraded version of Model Y in China, equipped with the new-generation HW4.0 autonomous driving hardware, featuring stronger perception and chip processing capabilities, while maintaining the same product price.

Introducing more models in different price ranges is Nio’s top priority, with multiple brands targeting similar markets. The birth of the first product from Alps is destined to be anything but quiet.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Li Anqi for 36Kr.