After four years of planning, the self-developed chips of China’s carmakers have finally entered the tapeout phase, with their integration into vehicles now on the cards.

36Kr has exclusively reported that Nio’s intelligent driving chip, Shenji NX9031, has reached the tapeout phase and is currently being tested.

Tapeout marks the transition from chip design to actual manufacturing—a critical precondition for mass production and commercialization. The Shenji chip will first be deployed in Nio’s flagship sedan, the ET9, in the first quarter of 2025.

Meanwhile, 36Kr has learned that Xpeng Motors’ self-developed intelligent driving chip has also been sent for tapeout and is expected to return in August.

Li Auto’s own intelligent driving chip, codenamed “Schumacher,” will likely complete tapeout within the year as well, despite commencing development later than the other automakers.

Nio, Xpeng, and Li Auto, all declined to comment when 36Kr sought confirmation regarding the updates.

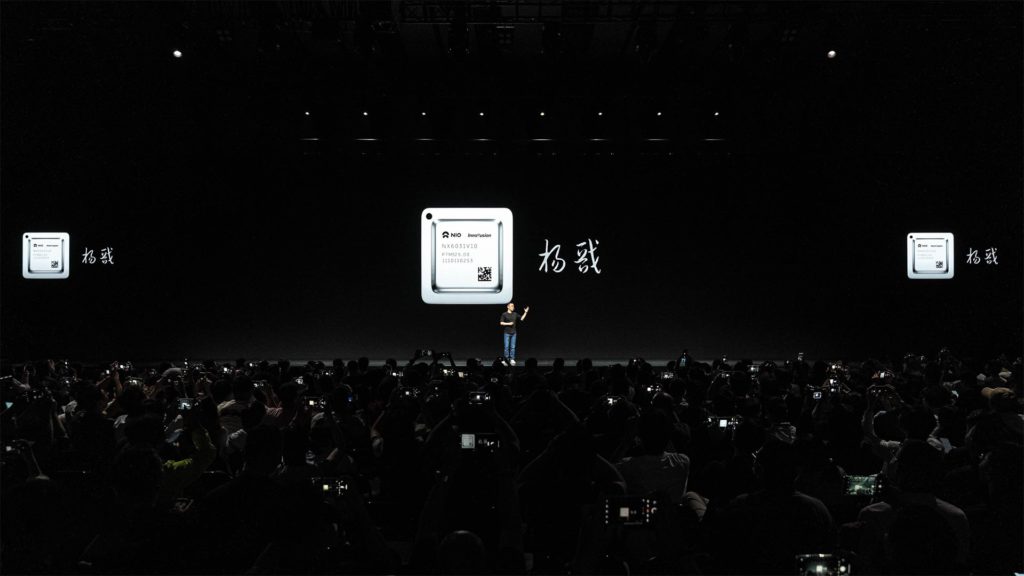

Nio’s Shenji chip moves closer to mass production

Shenji NX9031 is an intelligent driving chip developed in-house and released by Nio in September 2023. It utilizes a 5-nanometer fabrication process and is said to contain over 50 billion transistors. Nio claims that the chip’s neural processing unit (NPU) can efficiently run various artificial intelligence algorithms.

However, Nio has yet to disclose the Shenji chip’s computing power. William Li, CEO of Nio, said that the company’s goal is to achieve the performance of four industry-leading chips with just one of its own chips.

The industry-leading chip that Li alluded to is likely Nvidia’s Orin, which offers 254 TOPS of computing power per chip. Accordingly, Nio’s Shenji chip would need to offer at least over 1,000 TOPS of computing power. TOPS, short for tera operations per second, is a metric used to gauge the performance of chips by measuring the number of computing operations they can handle each second.

According to 36Kr, Nio has been gradually building a chip development team of over 800 people since 2020, simultaneously working on Shenji NX9031 and another light detection and ranging (LiDAR) chip, Yangjian. Development of both chips is being headed by a former executive from Huawei’s HiSilicon business, reporting to Bai Jian, vice president of hardware at Nio.

Limited options for chip foundries

Currently, only TSMC and Samsung can manufacture 5-nanometer chips globally. However, due to a large number of orders, TSMC’s 3- and 5-nanometer chip production facilities are operating at near capacity, leading to a supply shortage.

In contrast, Samsung’s 5-nanometer chip orders are fewer, making its production capacity relatively more available. “Under the same conditions, Samsung’s costs are 30% cheaper than TSMC’s,” an industry insider said. But this also leaves buyers with limited options when selecting chip foundries.

From tapeout to commercialization, chips need to undergo a series of complex processes, including performance and stability testing, and further verification of mass production feasibility through small-scale production before they can truly enter the commercialization stage.

How competition is shaping up

Besides Nio, Xpeng and Li Auto are also making significant strides in developing their own intelligent driving chips.

Xpeng began building its chip development team in 2020. Initially, the company partnered with US chip design firm Marvell, but faced collaboration challenges. For instance, some customized services that Xpeng wanted to add were not aligned with Marvell’s expectations, leading to a substantial compensation payout after the collaboration was canceled. In 2022, Xpeng switched to Socionext for backend design. Industry insiders told 36Kr that Xpeng’s tapeout schedule for intelligent driving chips is similar to Nio’s.

Li Auto has seen relatively significant changes. Previously focusing more on power semiconductors, Li Auto has been recruiting numerous chip talents since last year. Currently, there are around 200 employees in its intelligent driving chip development team. According to 36Kr, Luo Min, head of Li Auto’s computing unit, is currently leading the company’s chip projects, reporting to CTO Xie Yan. Qin Dong, a former vice president at Biren Technology, has joined to oversee the system-on-chip (SoC) department, reporting to Luo.

Li Auto has also partnered with a chip design company. An industry insider said that Li Auto buys the IP and electronic design automation (EDA) toolchain, relying on the partner primarily for manpower. This approach reportedly saves considerable costs compared to a more comprehensive collaboration with chip design companies.

However, chipmaking is ultimately a volume business. Even within Nio, Xpeng, and Li Auto, some employees are skeptical about the idea of developing intelligent driving chips in-house. Yet, automakers often decide to develop their own chips after considering cost and performance.

When Nio and Xpeng started developing their own chips in 2020, they were relatively affluent, with sales gradually increasing. Li Auto accelerated its chip project in 2023, also amid soaring sales. Automakers hoped that their vision of millions of units sold could help spread the hefty chip development costs across each vehicle.

However, they may have jumped the gun, as most are still grappling with sales growth challenges. Without strong sales support, in-house chips might not be a cost-effective investment. Even Li Auto, which has outperformed the market, is cautious about taking a more aggressive stance on chip self-development.

On the other hand, in-house chip development offers automakers the opportunity to achieve higher software and hardware integration through their algorithms. For example, Tesla’s HW3.0 chip, released in 2019, has a computing power of only 144 TOPS but its design remains compatible with the company’s latest end-to-end solutions. Meanwhile, the actual efficiency of general-purpose chips like Nvidia’s Orin is estimated to be only about 30%. This explains Nio, Xpeng, and Li Auto’s reluctance to abandon their ambitions for chip self-development.

Moreover, recent developments suggest the industry may be approaching an inflection point. Chinese tech giant Huawei has been reducing its collaborations with automakers to achieve tech self-sufficiency, while Nvidia is driving growth by expanding its development of a comprehensive computing platform for autonomous vehicles. Companies like Momenta are also venturing into chip manufacturing. In-house chip development remains one of the few less contested areas for innovation and could be the decisive factor in determining who comes out on top.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Li Anqi for 36Kr.