Contrary to the popular belief, online shoppers living in smaller Indian cities—popularly known as Bharat—are likely to drive the growth of India’s USD 29 billion e-commerce industry, over the next five years.

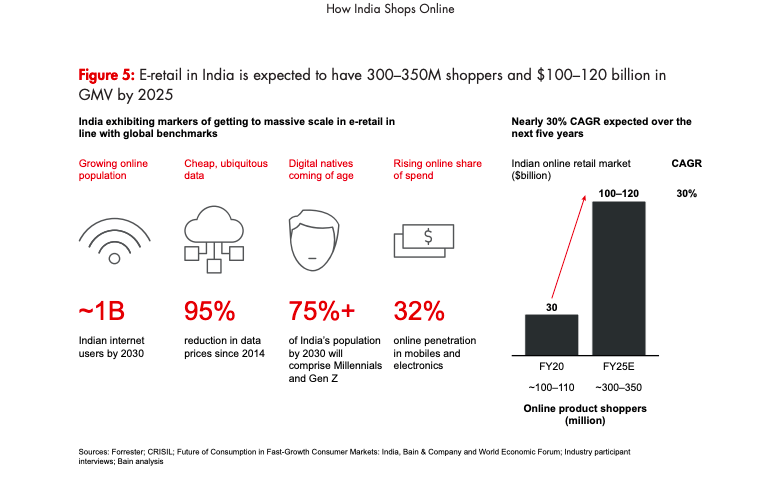

A joint report by research and consultancy firm Bain & Company and Indian e-tailer Flipkart, predicts India to have a total of 300 to 350 million online shoppers by 2025, up from the current 100 to 110 million. It said the online gross merchandise value would reach USD 100 billion to USD 120 billion in these five years.

A significant portion of the 200-250 million new users, the report said, would come from tier 2, tier 3, and cities beyond these regions.

For the last couple of years, major consumer tech companies including Amazon and Walmart-owned-Flipkart have been eyeing the next 100-150 million aspirational netizens based in smaller towns. These are the people who are already online and are expected to start spending money as well. Many consumer and payment tech firms have adopted regional languages’ interfaces to expand their reach beyond the English speaking users, estimated to be about 10% of the total population.

Currently, the report said, online shoppers from tier 2 and smaller cities make up nearly half of all the e-commerce user base and contribute to three out of every five orders for leading e-retail platforms. At present, online retail constitutes a meager 3.4% of the country’s USD 850 billion retail market.

Researchers at Bain & Company believe that India’s e-retail market is at a point of inflection with a steep drop in data prices in the past few years. They pointed out that China had similar levels of shopper penetration as India, eight years ago, which grew from 8% to 40% triggered by a drop in data prices and improvement in e-retail infrastructure.

With the compound annual growth rate of 30% over the next five years, they expect India to follow the same path.

The researchers also found that e-retailers are already investing across four key areas to win the next wave of shoppers–strengthening their voice and local language capabilities; visuals and videos; social shopping; and multiple digitally-led ecosystems.

The report expects over 500 million local language speakers to come online by 2021, versus current 200 million English speaking internet user base. It also said video consumption in tier 2 and smaller towns in India grew 4x in the last year, while 50-plus private equity and venture capital investments in social commerce were closed in the last five years.

Kalyan Krishnamurthy, CEO of Flipkart Group, in a recent interview with local media Economic Times (ET), said, around 50-60% of new users who come into the consumer internet funnel each year in India make their first transaction through a video platform.

As India comes out of the lockdown and opens up its economy, consumer spending is expected to gradually grow over the next six to nine months. “Even if the [coronavirus] cases go down in the next couple of months, a lot of purchases are going to shift online. So whenever people start spending again, e-commerce will be the first to benefit from it,” Satish Meena, senior forecast analyst at Forrester, told KrASIA in a recent interview.

“There is a window of six to nine months for consumer spending to come back. This time will allow e-commerce companies to add more customers, who are likely to experiment with more categories.”

The report found that 30 out of every 100 existing online shoppers increased their spending in categories they had already shopped for during the pandemic, thanks to the lockdown that forced millions of Indians to stay indoors over the last two months.

Moreover, it added that 16% of online shoppers explored new categories that they had never bought online before, while around 11% of online shoppers were first-time buyers during the pandemic.