On December 21, the 35th edition of the Africa Cup of Nations (AFCON) officially kicked off in Rabat, Morocco’s capital.

Amid the tournament’s color and spectacle, one logo is especially visible in blue and white: Tecno, a smartphone brand under Transsion Holdings. As the official global partner of both the 35th and 36th AFCON tournaments, Tecno has secured a prominent presence at one of Africa’s most widely followed sporting events.

The partnership continues Tecno’s involvement with AFCON, following its role as exclusive smartphone partner and official event phone at the 34th tournament.

High-profile sponsorships are rarely the result of funding alone. They reflect a mutual calculation: organizers seek financial backing and commercial alignment, while brands look for platforms that reinforce credibility and reach. For a Chinese company operating thousands of kilometers from Africa, achieving this level of presence is no small feat.

Why, then, were Tecno and Transsion selected again?

From recognition to trust

Transsion has sometimes been referred to colloquially as the “king of Africa,” a label that reflects its market position rather than an official designation. Data from IDC shows that in 2024, Transsion accounted for more than 40% of Africa’s smartphone market, extending a lead it has held for several years. In the third quarter of 2025, its global smartphone shipments reached 29.2 million units, giving it a 9% worldwide market share and placing it fourth globally.

As one of the earliest Chinese smartphone makers to enter African markets, Transsion did not simply replicate its domestic playbook. Instead, it built operations around local usage patterns. Product design, distribution, and branding were shaped by country-level conditions, an approach that has underpinned its growth across the continent.

Audio features illustrate this strategy. Music is central to everyday life in many African cities and towns, and for many users, a smartphone is the primary music device. Transsion identified demand for louder speakers early on and prioritized higher output and durability, design choices that directly reflected user behavior.

Infrastructure constraints shaped other decisions. In markets where power outages are common, battery life became a baseline requirement rather than a premium feature. Fragmented carrier coverage across countries also made dual SIM functionality essential. Transsion’s work in battery optimization, power management, and signal tuning responded to these conditions rather than abstract performance benchmarks.

Imaging has been another area of focus. Many camera algorithms were historically trained on lighter skin tones, often producing inconsistent results for darker complexions in low-light settings. Transsion developed a 3D imaging database based on diverse skin tones and lighting conditions across Africa, then adjusted its algorithms accordingly. The goal was functional accuracy rather than stylistic enhancement, allowing images to render skin tones more consistently.

These changes were incremental rather than radical, but they were grounded in daily use. Over time, they contributed to a perception of reliability. Rather than positioning itself as a frontier technology brand, Transsion emphasized practical utility.

As artificial intelligence became more widely adopted, the company applied a similar logic. Africa is home to more than 800 languages, many of which remain unsupported by mainstream digital assistants. Transsion invested in speech recognition and natural language processing for less commonly served languages, launching a mobile AI assistant designed for African users. The assistant supports offline interaction in more than 100 languages, including Niger-Congo and Afro-Asiatic languages, alongside Austronesian and Indo-European languages spoken in parts of Asia.

Long-term investment in niche or underserved needs does not always generate immediate returns, but it can reinforce user trust. Transsion has extended this approach beyond products into social initiatives, including football field renovations, education programs, and community libraries. These efforts position the company not only as a device maker but as a recurring presence in local communities.

Reframing emerging markets

Emerging markets have often been treated as synonymous with low-cost demand. Many manufacturers have approached them as environments defined by lower specifications and slower upgrade cycles.

Recent data suggests a more complex picture. According to Omdia, in the third quarter of 2025, smartphone shipments priced below USD 100 in Africa grew 57% year-on-year, while devices priced above USD 500 grew 52%. Entry-level and premium segments expanded in parallel, indicating both broader access and rising expectations.

Transsion anticipated this shift by running parallel product strategies. Technology introduced at the high end was gradually adapted across lower price tiers. In Tecno’s lineup, the Camon series focuses on imaging improvements through algorithm optimization and hardware tuning, while the Phantom foldable and Slim models experiment with form factor, materials, and industrial design.

Demand for advanced features in emerging markets was never absent. What was often missing were brands willing to tailor those features to local contexts.

AI has become a central part of this effort. Rather than emphasizing model size or benchmark scores, Transsion’s AI development focuses on use cases such as image processing across varied skin tones, voice interaction for multilingual users, and translation tools for cross-language communication. These functions are designed for frequent, everyday use.

Through collaboration with Google Cloud, the company has extended AI features beyond smartphones to PCs and smart glasses, creating a broader service ecosystem. Over time, these tools may function less as standalone features and more as underlying digital infrastructure.

As access improves, emerging markets are increasingly participating in global technology cycles rather than observing from the margins. Transsion’s commercial expansion has coincided with this shift, suggesting that localization and scale are not mutually exclusive.

Think globally, act locally

Africa may be Transsion’s starting point, but it’s far from its endpoint. Having served hundreds of millions of users there, the company has built an efficient and adaptive market model, one it can now apply to other regions.

The data supports this expansion. In 2024, Transsion held 14% of the global smartphone market, briefly ranking among the top three. By the third quarter of 2025, it continued gaining share across Southeast Asia and the Middle East, taking leading positions in key markets such as Indonesia and the Philippines.

Internally, Transsion often repeats a guiding phrase: think globally, act locally. While market conditions vary, the process remains consistent: understand local users, design accordingly, then build brand relevance.

Indonesia offers one example. With a young population and high social media penetration, the market has proven receptive to midrange gaming phones. Transsion emphasized e-commerce channels over traditional retail and built awareness through esports events, local influencers, and online communities. Growth has been gradual but sustained in a competitive segment.

Trust in emerging markets is typically built over time, through consistent delivery rather than one-off campaigns. That perspective also shapes Transsion’s sports partnerships.

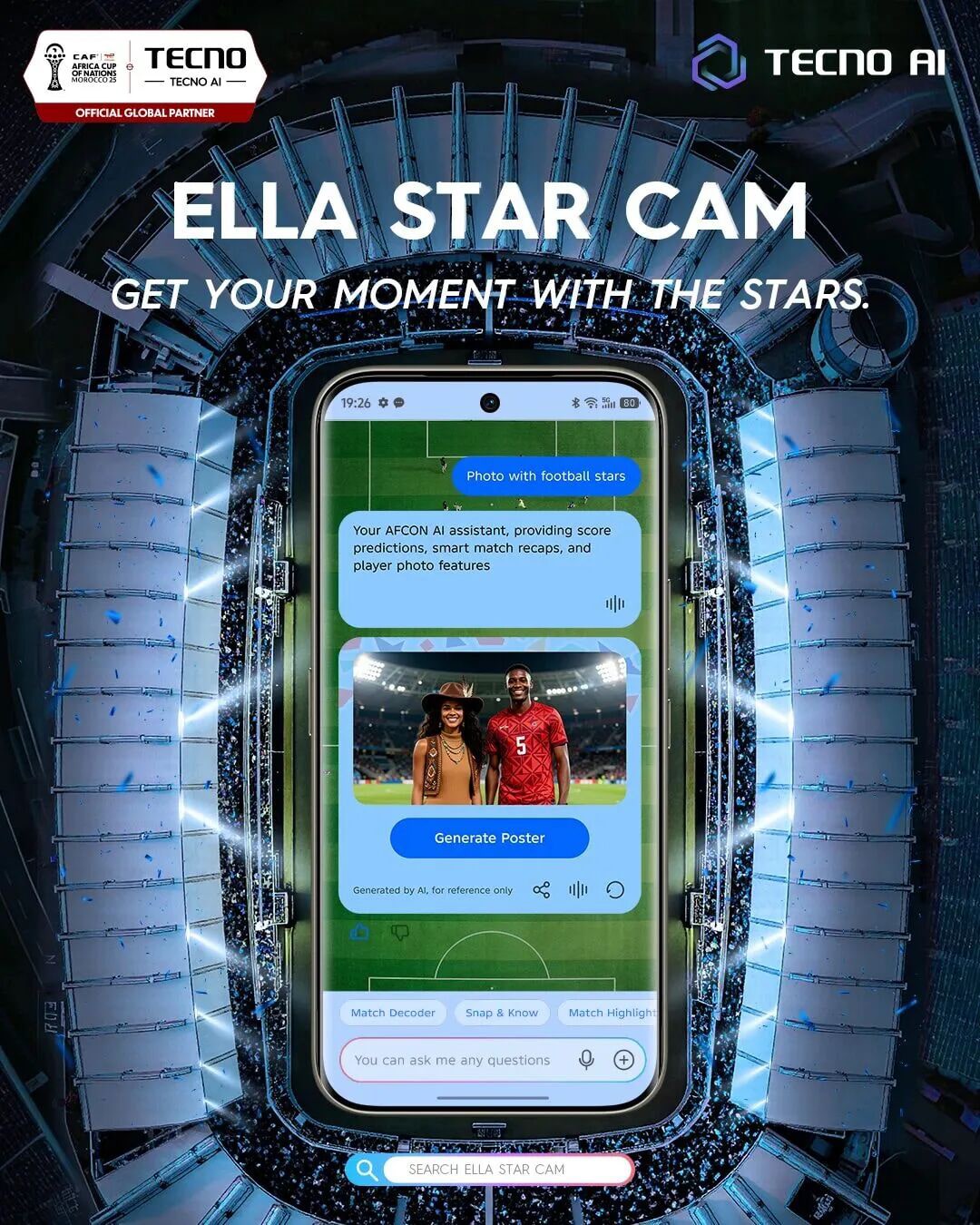

AFCON sponsorships, for many global brands, are primarily about visibility. Transsion’s approach has leaned toward integration. For AFCON 2025, Tecno introduced AI features that function alongside match viewing, allowing users to identify players, review tactics, generate highlights, and interact with match content through its assistant. These tools are designed to complement, rather than replace, the viewing experience.

Football in Africa is more than entertainment. It functions as a shared cultural language, closely linked to community life, identity, and social cohesion. Transsion’s AFCON partnership reflects its emphasis on locally driven innovation, using technology in ways that align with everyday experiences rather than abstract use cases.

By committing to a long-term partnership with the Confederation of African Football and supporting community football projects, Transsion is not simply buying visibility. It is positioning its brand within a broader social context. The return on that investment is unlikely to appear immediately in sales figures, but a gradual strengthening of brand recognition and trust is a plausible outcome.

More broadly, Transsion’s competitiveness cannot be reduced to a single metric. It is neither only a low-cost challenger nor a dominant technology leader. Its advantage lies in addressing practical problems through a combination of deep localization and inclusive design. That capability has allowed it to operate across regions and market cycles without frequent shifts in strategy.

Against that backdrop, Tecno’s presence at AFCON signals more than sponsorship. It reflects a long-term approach built on patience and adaptation, one that may be replicable across markets.

That, in turn, points to a working definition of a global brand: one that balances commercial objectives with durable trust, and maintains consistency amid changing global conditions.

KrASIA Connection features translated and adapted content that was originally published by 36Kr. This article was written by Xiao Xi for 36Kr.