Inke, one of China’s top live-streaming platforms, filed on Monday with HKEX for an initial public offering in a bid to fuel its growth in the brutal competition among Chinese live-streaming platforms.

Launched in May 2015, Inke App has 25.18 million monthly active users (MAU) and 652k monthly paying users (MPUs) in Q4 last year, down respectively 16% and 74% compared with the same period in 2016. It has a total of 194.5 million registered users as of the end of 2017.

In stark contrast, in December 2017, Inke’s major competitor, Momo has seen its MAUs grow to a record high 99.1 million and its MPUs stands at 4.3 million, which are significantly higher.

Inke’s prospectus, citing consulting firm Frost & Sullivan, claims that it is the largest live-streaming platform in China by number of active live streaming performers and the second-largest in terms of paying users.

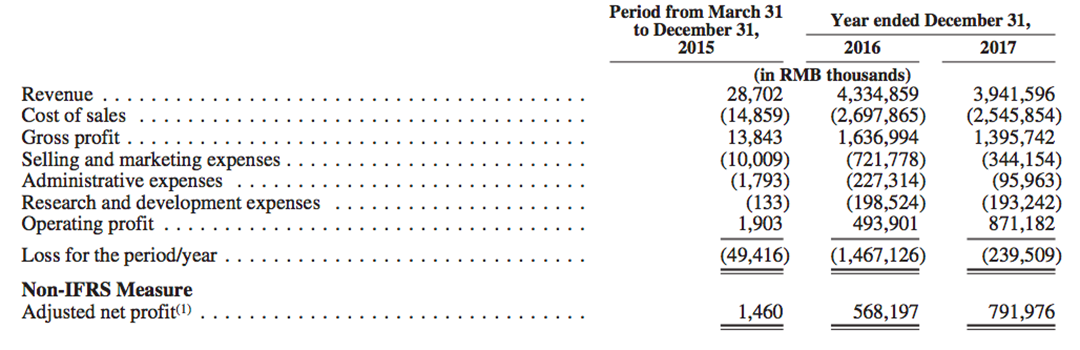

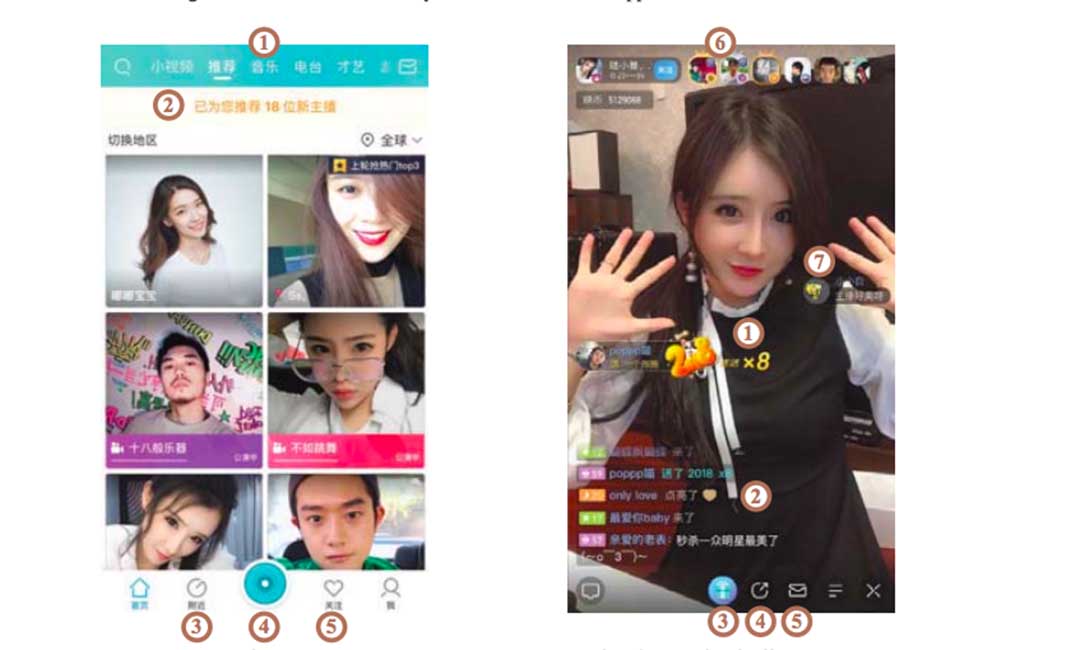

On the Inke app, users can buy virtual gifts to tip performers. Live streaming platforms take a cut of the tips to make money. In 2017, 99.4% of Inke’s revenue comes from live-streaming, while online advertisements account for a mere 0.6%. The company’s revenue shrunk 9% from RMB 4.3 billion (approx. $688 million) in 2016 to RMB 3.9 billion (approx. $624.7 million) in 2017, however, its adjusted profit was RMB 792 billion (approx. $126.8 million), up almost 40%.

Inke claims it has a 15.3% market share in China’s live-streaming space.

China is the world’s largest market for live-streaming. According to Frost & Sullivan, the MAU of mobile live-streaming in China was 176 million in 2017 and is expected to grow to 501.3 million in 2022. The market in 2017 was worth RMB 25.7 billion (approx. $4.1 billion) and is likely to reach RMB 97.8 billion (approx. $ 15.7 billion) by 2022.

2015 and 2016 were two rosy years for Inke-like platforms. Over 200 live-streaming services sprang up out of thin air. But as the frenzy cools off, many small platforms have bitten the dust. A few survivors have deep-pocket tech giants behind them, Douyu is back by Tencent and Huya itself is a subsidiary of US-listed YY. Inke differs in not taking sides. Tencent’s Huya and Douyu are all eyeing to list this year.

Apart from the intensive competition, Inke faces hurdles including the increasingly strict regulations on the space. China banned some of the most famous streamers and introduced rules to regulate content and streamers’ behaviors.

Historically, Inke has been fined twice by the authorities for displaying inappropriate content on its platform.

In June last year, A-share listed marketing agency Shunya International, announced a plan to buy half of Inke’s parent, but the deal went sore. Inke’s investors include SAIF Partners, Kunlun, PurpleSky Capital, as well as GSJ Ventures, the investor of Didi Chuxing and Ofo.

Read more: US-Listed YY Spins off Game Streaming Unit Huya for IPO to Fuel Expansion