As a result of soaring demand for online medical consultations, SoftBank-backed Ping An Healthcare and Technology Co. (HKEX:1833), better known as Ping An Good Doctor, saw its stock price rise 75% in less a month to reach a total market capitalization of USD 1.7 billion on April 27.

During the COVID-19 outbreak, Ping An Good Doctor, as well as many other medtech solution providers in China, launched free online medical consultation services and provided professional medical information to help users tackle the unexpected health crisis.

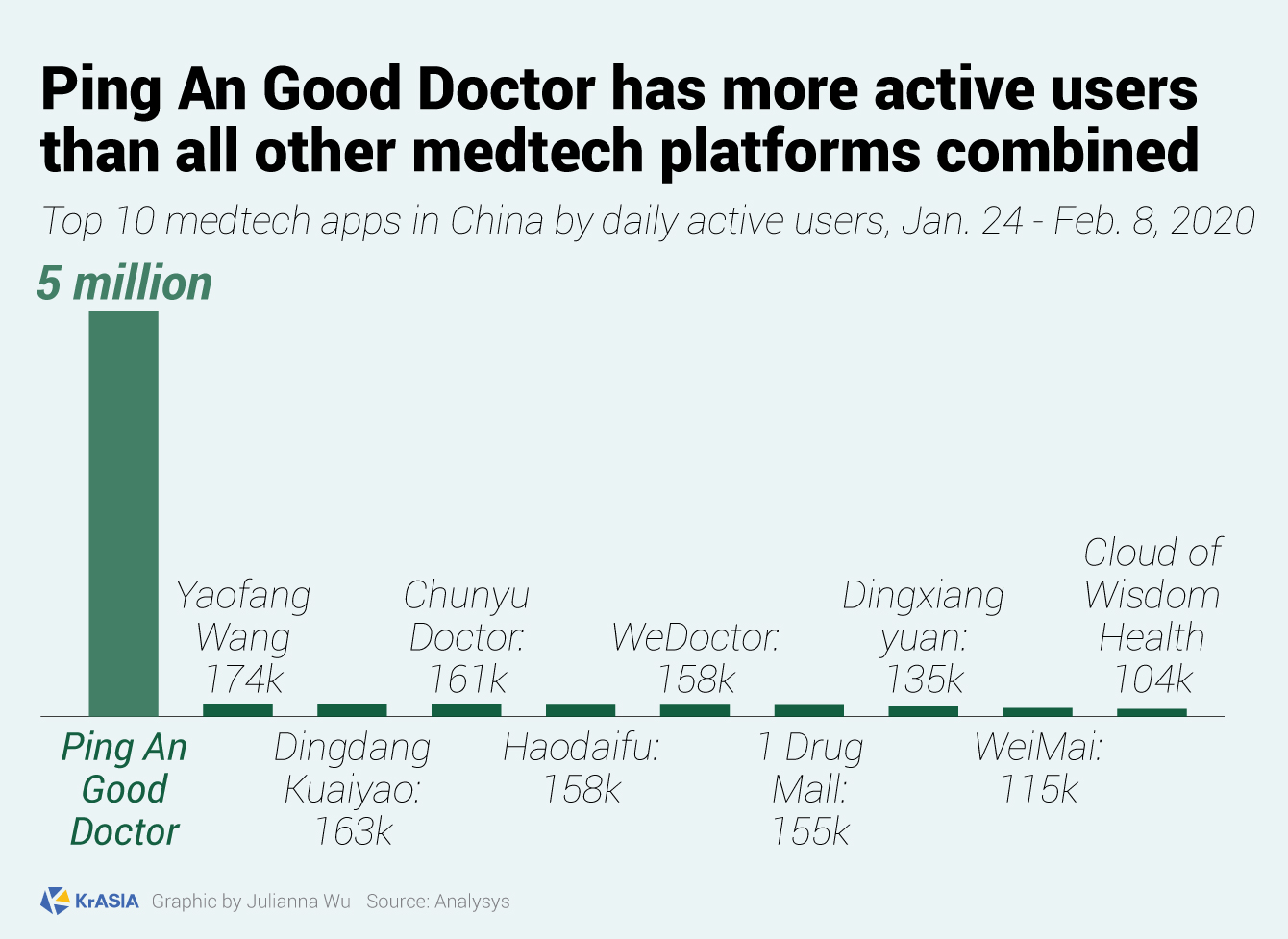

As of April 8, a total of 1.11 billion people visited Ping An Good Doctor’s platform, with the number of registered users increased tenfold. Prior to the outbreak, it was already the largest online health care platform in China with 315 million registered users as of December 31, 2019.

Ping An Good Doctor, the medtech subsidiary of Ping An Insurance Group, China’s biggest insurer by market value, offers services including personal health profiles, online medical consultations, and medicine e-commerce among others.

Due to the impact of COVID-19, which has killed 206,245 people so far worldwide, medical technology solutions are receiving extra attention from investors.

Besides Ping An, Ali Health, the medtech unit of China’s e-commerce giant Alibaba, also experienced a 110% jump in its stock price this year. Ali Health’s share price reached a peak after the company announced on April 21 that its users can buy COVID-19 test kits on its platform and have the results delivered within 24 hours.

While China’s venture capital market experienced its most inactive first-quarter in almost a decade, a narrow window of opportunity remains in a few sectors including medical and health, which completed USD 292 million worth of deals in 2020 Q1, KrASIA reported.