China’s venture capital market has seen its most inactive first-quarter in almost a decade, as the coronavirus outbreak has halted business across the country, leaving a narrow window of opportunity to few sectors including online education, IT & digitalization, and medical & health, according to research firm CVinfo’s latest report obtained by KrASIA.

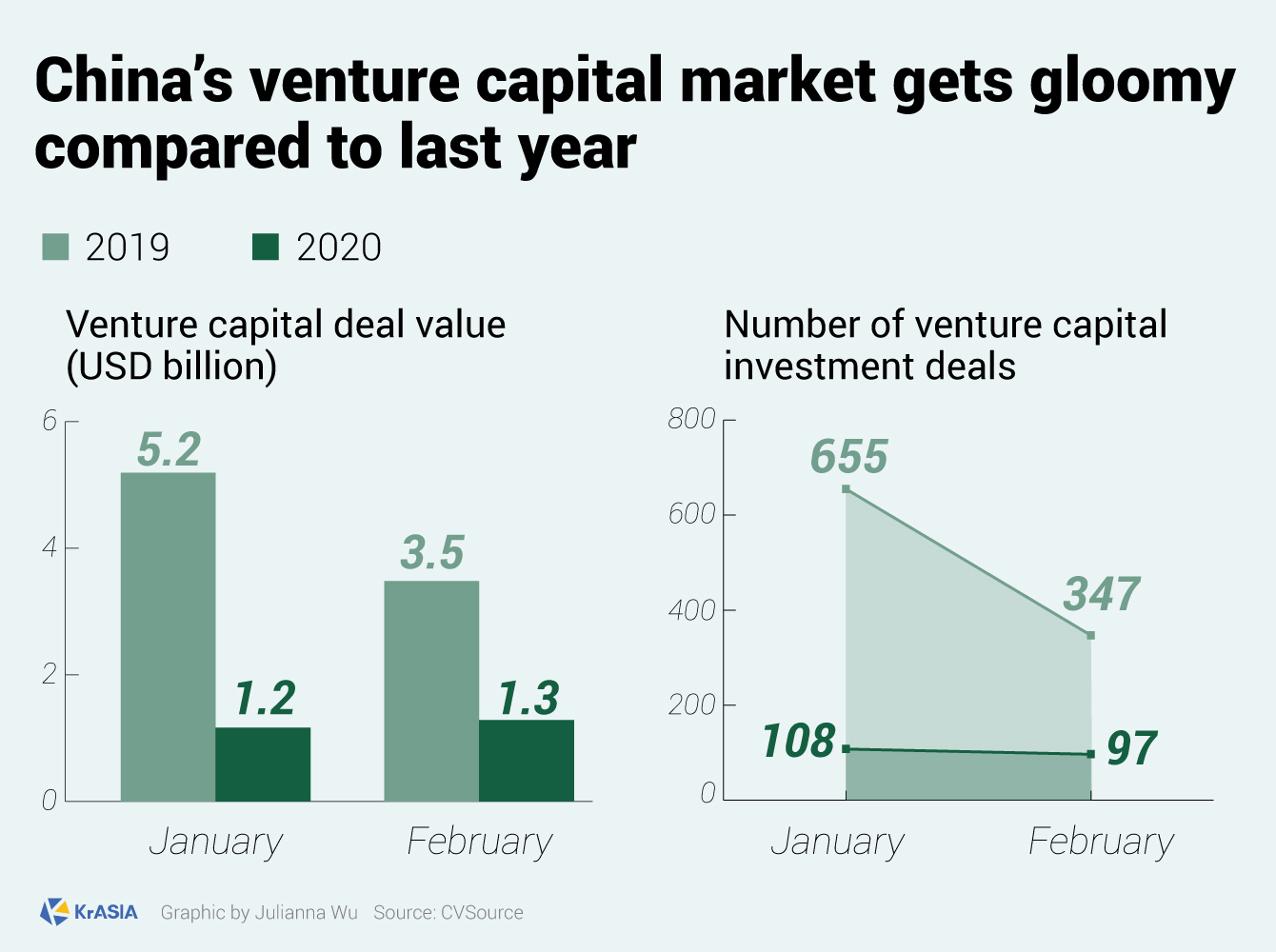

The transaction volume of China’s venture capital (VC) deals in February 2020 experienced a 63% year-on-year drop, also recording 3.6 times fewer deals completed in the same period, according to CVinfo.

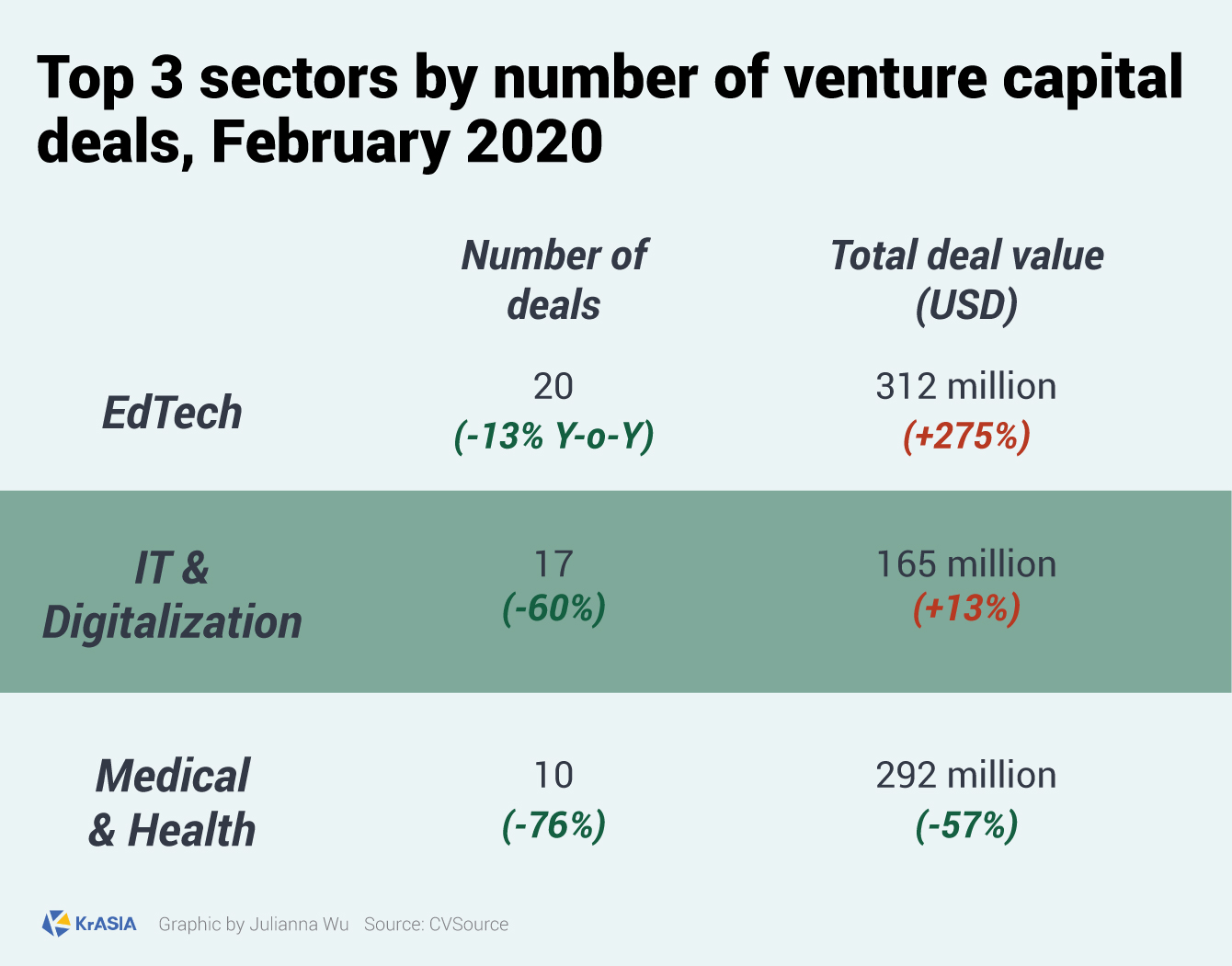

Amid a dim investment environment, online education has the smallest fluctuation in venture capital investment volume, said CVinfo.

Instead, as the demand for study from home surged during what has been considered the largest quarantine in human history, edtech saw a 275% leap in investment during February 2020, compared to last year.

Last week, online tutoring platform Yuanfudao closed China’s largest-ever edtech fundraising deal with a USD 1 billion injection from investors like Hillhouse Capital, KrASIA reported.

Other than that, IT & digitalization, one of Chinese VC’s 2019 favorites, and medical & health, which received great attention amongst the COVID-19 public health crisis, are among the top 3 sectors with the most VC deals in February.

To date, 2019’s “capital winter” appears to have spilled over into 2020. Investors are getting more and more cautious than in previous years when making investment judgments.

However, financing data provider PitchBook believes that “dealmaking in China is mounting a comeback following a slowdown prompted by the coronavirus outbreak,” as Chinese firms recorded 66 venture capital deals in the week of March 23, the highest number of weekly deals accounted in 2020, although, still short when compared to the same period from last year.