Chinese e-commerce platform JD.com’s (NASDAQ:JD) shares surged as much as 7.7% in early trading on Wednesday, hitting a record high of USD 65.9, marking the first time the stock has topped USD 100 billion in market cap.

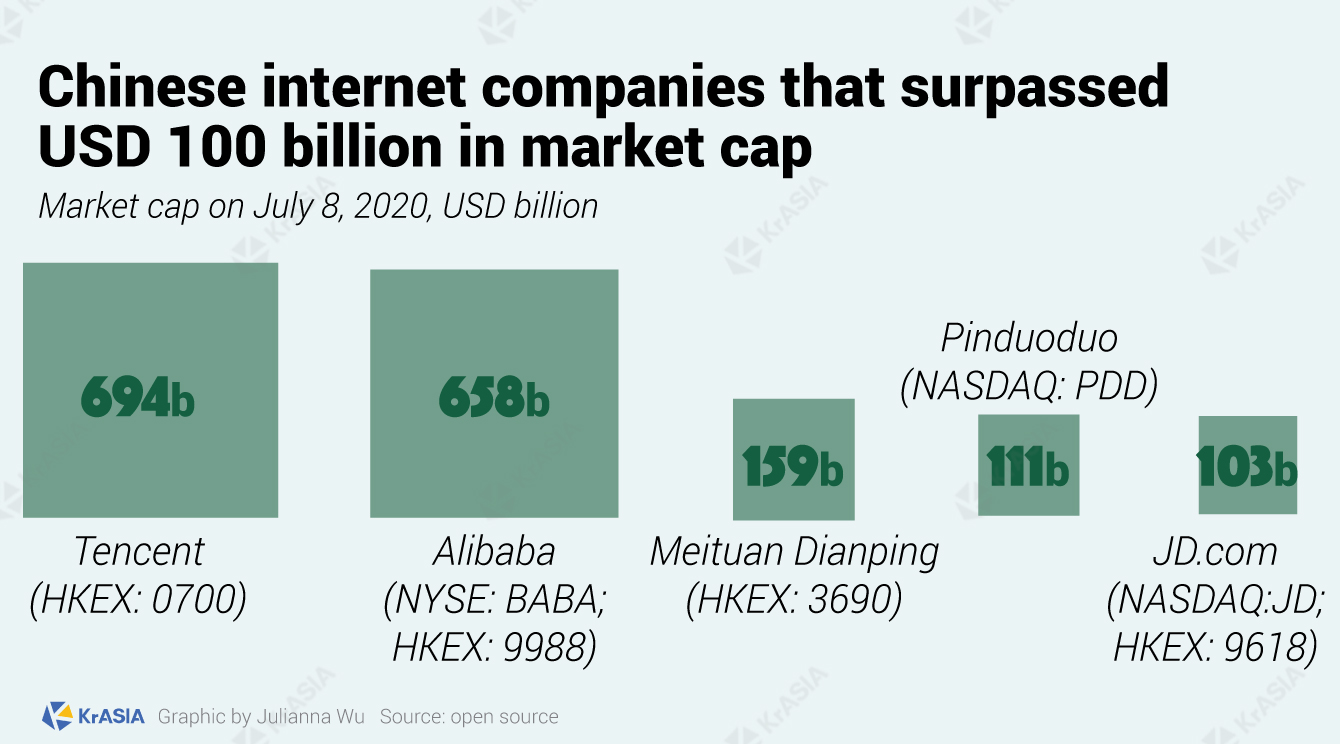

Beijing-based JD.com now is the fifth Chinese internet company to reach the benchmark of USD 100 billion in market capitalization after Alibaba (NYSE: BABA; HKEX: 9988), Tencent (HKG: 0700), Meituan-Dianping (HKEX: 3690), and Pinduoduo (NASDAQ: PDD).

Beyond just JD.com, Chinese companies saw a universal share price surge on Wednesday, following a strong domestic stock market performance, hinting at solid post-COVID-19 economy recovery: China’s stock market has entered the “bull” territory since July, as the Shanghai Composite index closed almost 6% higher on Monday and rose for the eighth trading day in a row.

Alibaba, which operates China’s biggest online retail platforms Taobao and Tmall, saw its share price rise 9%, increasing its market cap by USD 60 billion to USD 690 billion overnight.

Meanwhile, New York-listed edtech firm GSX (NYSE: GSX), which has been a frequent target of short attacks in the past few months, saw its stock price jump 13%.

Pinduoduo (NASDAQ: PDD), another major e-retailer in China pioneering a social e-commerce business model, only saw its stock price grow by 1.4% increase despite a strong performance in 2020 as its market cap has more than doubled during the year, and surpassed that of JD.com’s in mid-June, KrASIA reported.

The “bull” market regarding US-listed Chinese internet companies could also be stem from the recent wave of secondary listings in Hong Kong or Shanghai, as enterprises find themselves less welcome in overseas capital markets due to tightening regulations and increased scrutiny.

JD.com and NetEase bagged USD 3.9 billion and 3.1 billion respectively from their IPOs on the Hong Kong Stock Exchange, KrASIA reported.

Earlier this week, JD Digital Technology Holding Co, JD.com’s fintech subsidiary, was rumored to be pursuing an IPO on Shanghai’s Star Market, 36Kr reported. On June 26, JD.com announced that it had reached an agreement to acquire an additional 36.8% of the fintech unicorn with an additional investment of USD 250 million.