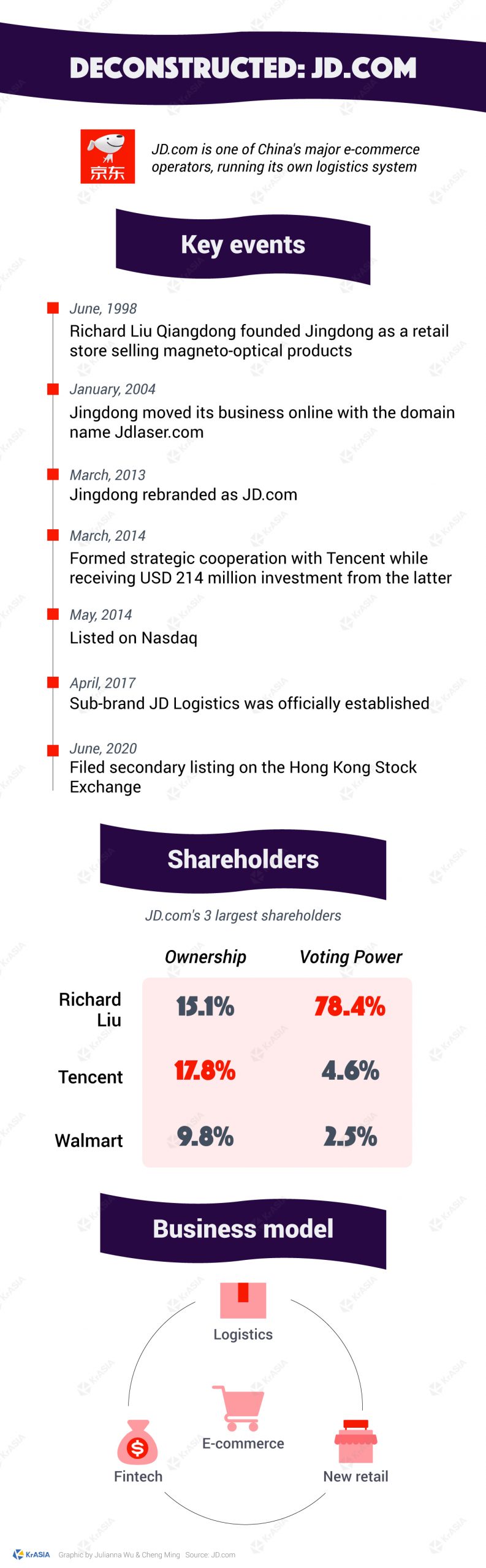

Chinese e-retailer JD.com has made a series of global headlines in the week past thanks to its whopping USD 3.9 billion Hong Kong secondary listing and the breaking of its own sales record during the mid-year “618” online shopping festival it conceived when it sold USD 38 billion worth of goods.

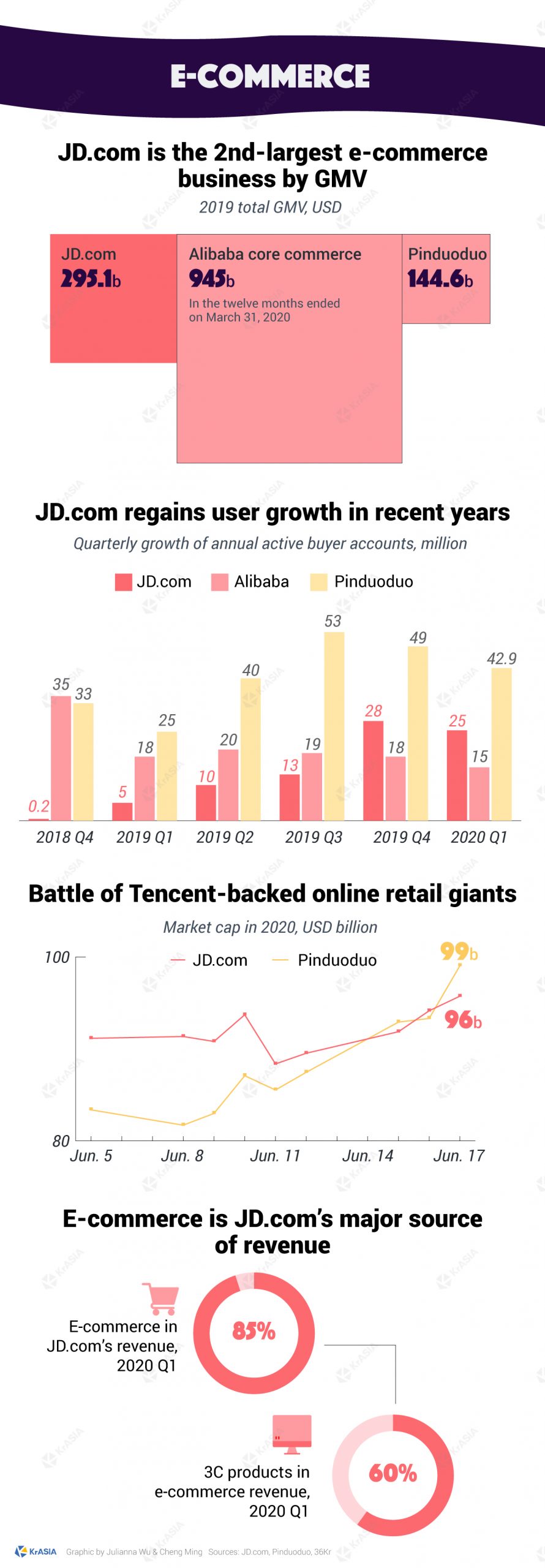

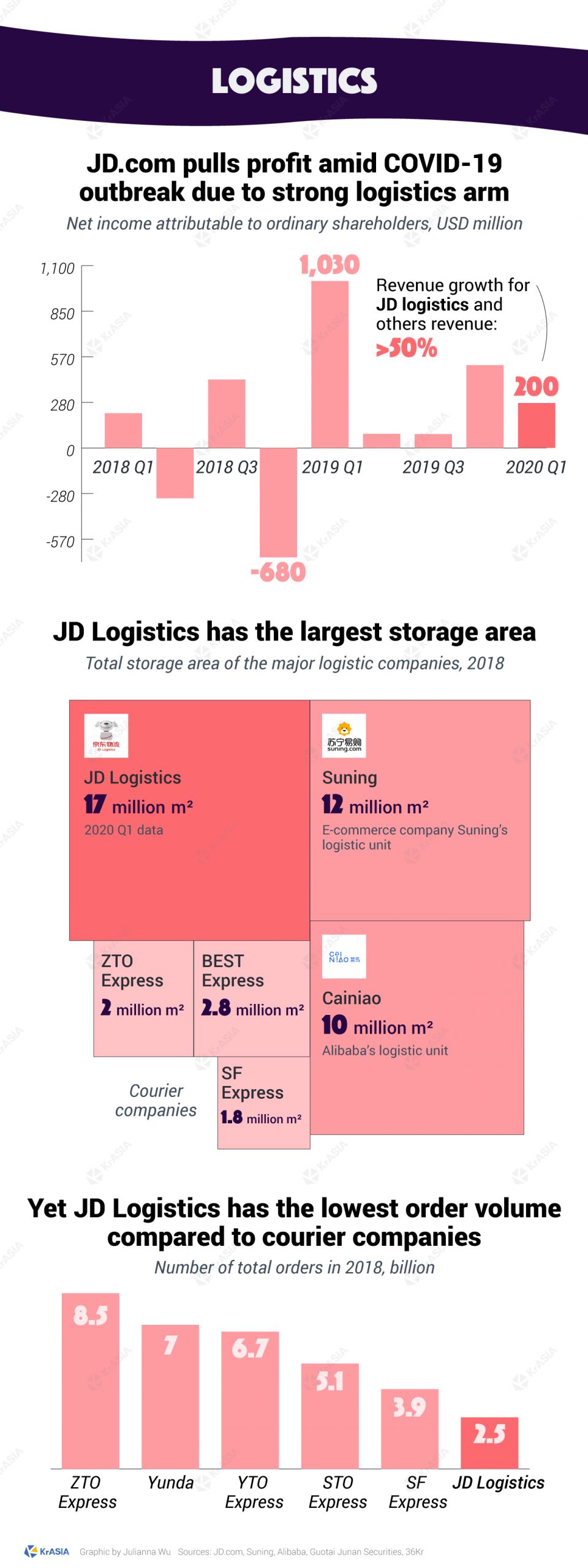

Starting as an e-shop focusing on 3C products (computers, communications, and consumer electronics) for young elites in big cities in the 2000s, JD has turned itself into a store for everything and transformed into a “leading supply-chain based technology and services company” in the process. The Beijing-headquartered company did so through years of heavy asset investments in its logistics which, years later, has turned out to serve it well amid the COVID-19 outbreak.

At the height of the outbreak’s rampant spread in China, which ground the country to a halt, most delivery services were suspended. JD Logistics, together with China Post, SF Express, and Sunning Logistics, were the only four courier operators that remained operational. In the past financial quarter, JD Logistics and other services generated a revenue of USD 930 million, a 53.6% year-on-year increase.

Thanks to its visionary bets on logistics, JD.com has emerged as the least affected e-commerce platform from the coronavirus pandemic, while many others were forced to deal with the intermittent halt in business.

Now, with better-than-expected latest quarterly results and new growth momentum in customers, it seems that, after several years’ of deceleration, the company is gradually getting back on its feet. However, the future sees new challengers on the horizon.

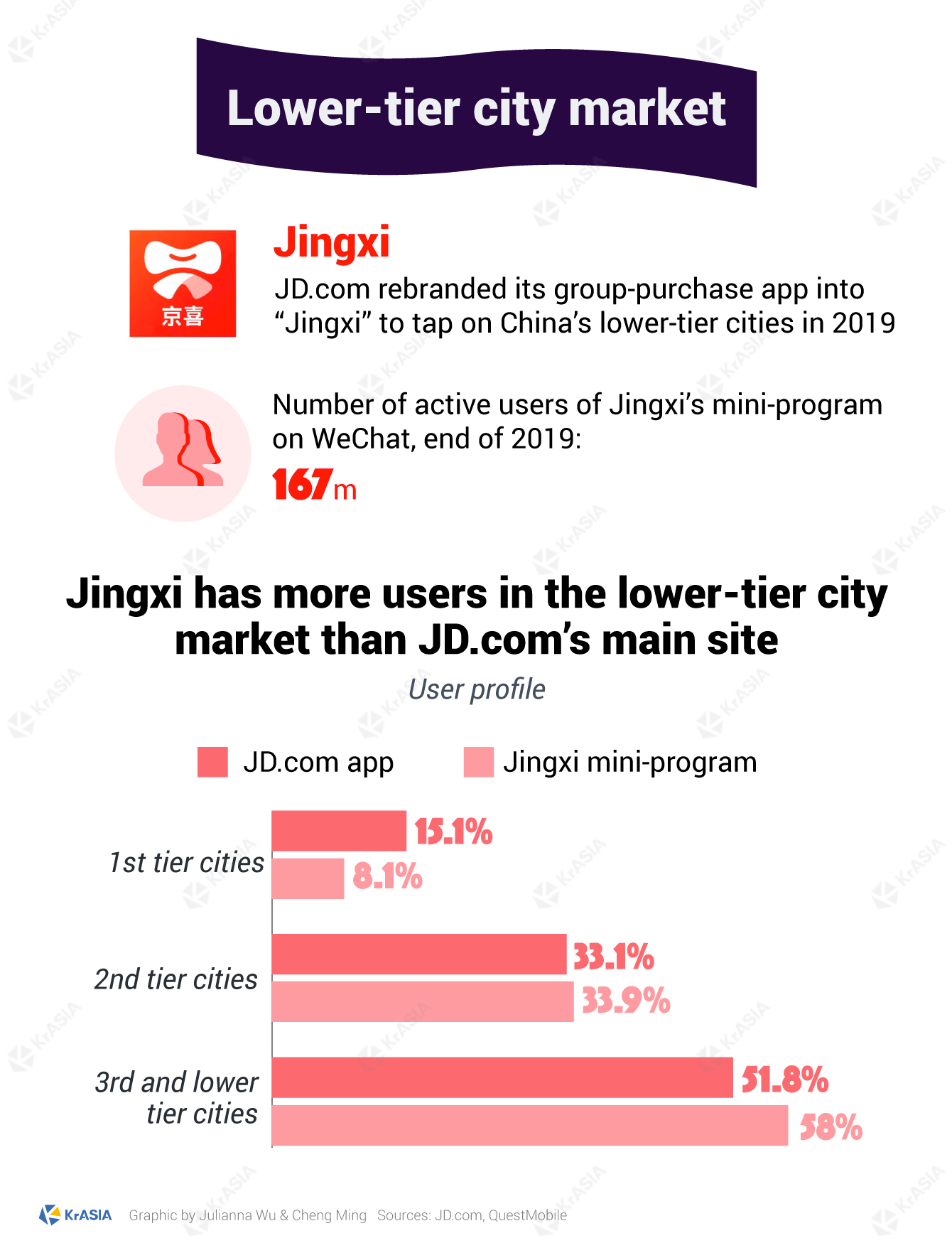

Not long ago, rival Pinduoduo (NASDAQ: PDD), backed by Tencent, has surpassed JD in market cap just before its secondary listing in Hong Kong. Meanwhile, Tmall of Alibaba (NYSE: BABA; HKEX: 9988), stole the thunder in the “618” shopping fest which JD conceived, with a gross merchandise volume (GMV) more than double JD’s sales.

To tap into China’s mass lower-tier cities market, JD released a Pinduoduo-like service dubbed “Jingxi” in 2019. In Q4 alone, Jingxi helped gain 28 million new users, mostly from smaller cities and towns, marking the largest quarterly user gain in the past three years.