One year after its inauguration, China’s Nasdaq-like Shanghai Stock Exchange Science and Technology Innovation Board, commonly referred to as the Star Market, has raised approximately USD 18 billion for its 110 listed companies, with a total market cap of USD 242 billion as of June 12.

Conceived as a modern fundraising channel for the country’s rising technology startups, the Star Market allows greater trading volatility and the public listing of loss-making firms in sectors including artificial intelligence (AI), cloud computing, biotech, and green energy.

Recently, semiconductor manufacturer SMIC’s (HKEX: 981) application for a Star Market IPO was approved in 18 days, speaking to the efficiency of the Star board. Kingsoft Office (CH:688111), at which Xiaomi (HKEX: 1810)’s founder and CEO Lei Jun started his career and still chaired, raised USD 630 million last November in a Star Market IPO.

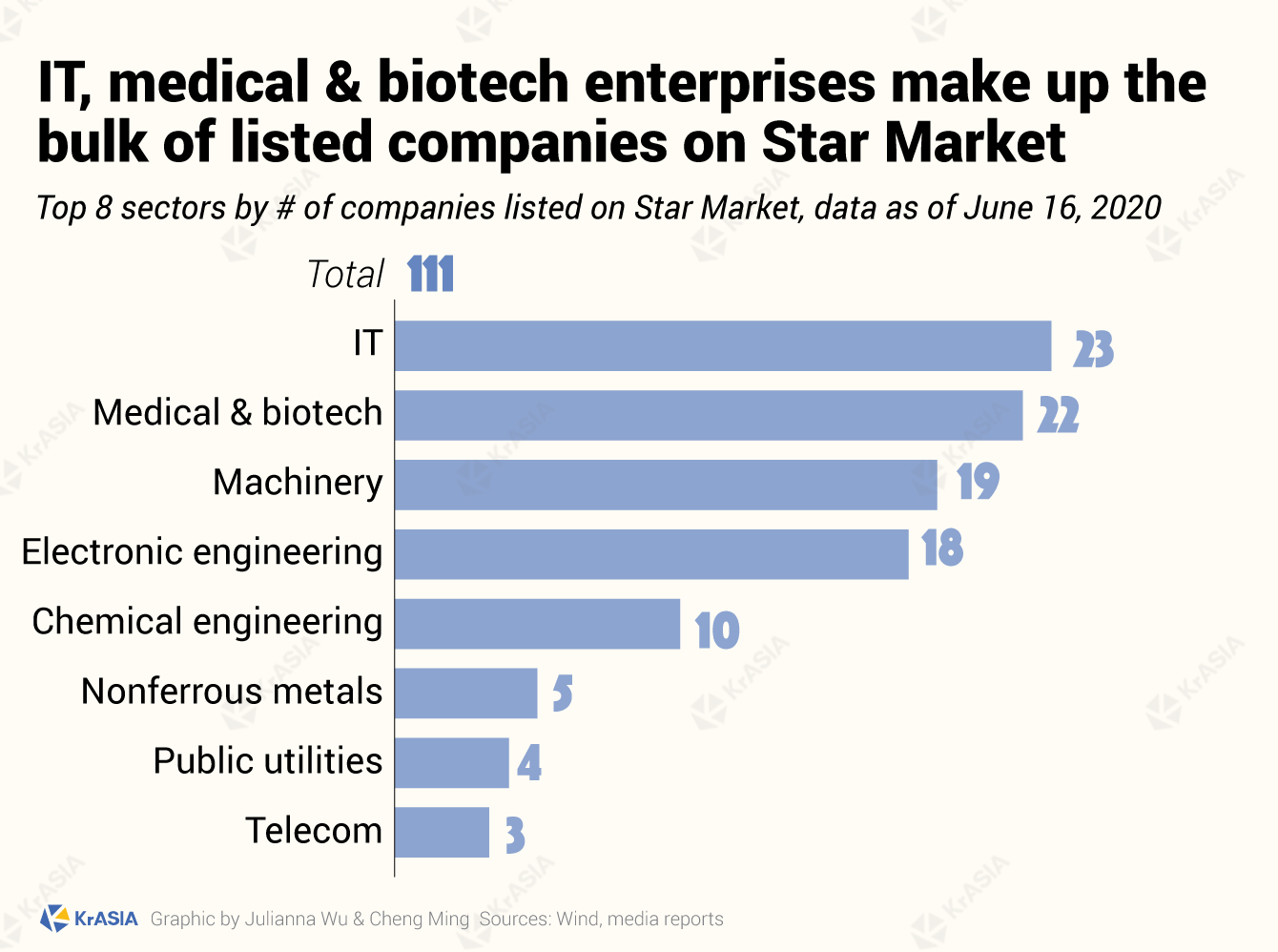

Currently, nearly 60% of the enterprises listed on the board are in information technology, medical and biotech, data from ITjuzi and Wind showed.

While the Chinese government lowered the barrier to entry for companies to list on the Star Market to encourage tech startups, investors warned that the performance of the stocks on the exchange is polarized.

In the twelve-month period ended June 16, 2020, only 49 enterprises, 45% of the total, saw their stock price climb, while nearly a third of them lost more than 20% since their IPO, said China Venture’s report.

Yet the bourse outperformed other Chinese exchanges in the first quarter of 2020 amid the COVID-19 outbreak: its companies generated RMB 2.2 billion in net profit, a 14% increase compared to the same period in 2019, KrASIA reported.

At the same time, half of China’s 51 IPOs in the quarter past were on the Star Market, while the rest was split by the main board of Shanghai Stock Exchange, Shenzhen Stock Exchange, and the ChiNext Board of Shenzhen, another startup-focused market, said a Deloitte report.

Shanghai Stock Exchange emerges as the No.1 in terms of number and amount of capital raised from IPOs in the first half of 2020, among all the exchanges globally, thanks to the popularity of the Star board, said an Ernst & Young report.