Chinese entertainment platform iQiyi (NASDAQ: IQ) plans to offer USD 800 million in convertible notes and 40 million American Depositary Shares (ADSs) to raise funds for new content offerings, to strengthen its technology, and replenish working capital, according to a press release on Tuesday. The firm is granting underwriters an option to purchase up to an additional USD 100 million in notes and 6 million shares.

While the company has not priced the shares, it could raise about USD 1.9 billion in total. iQiyi’s stocks dived 8.2% in after-hours trading, following the announcement.

“The size of the offering shows that the the company expects the need for capital to be fairly significant,” commented Brock Silvers, chief investment officer of Kaiyuan Capital, when contacted by KrASIA on Wednesday. “There’s perhaps a sense of moving quickly due to favorable market conditions.” Given the global economic situation, as well as the uncertain US-Sino relationship, there would be no guarantee that the window of opportunity remains open throughout the coming year, he added.

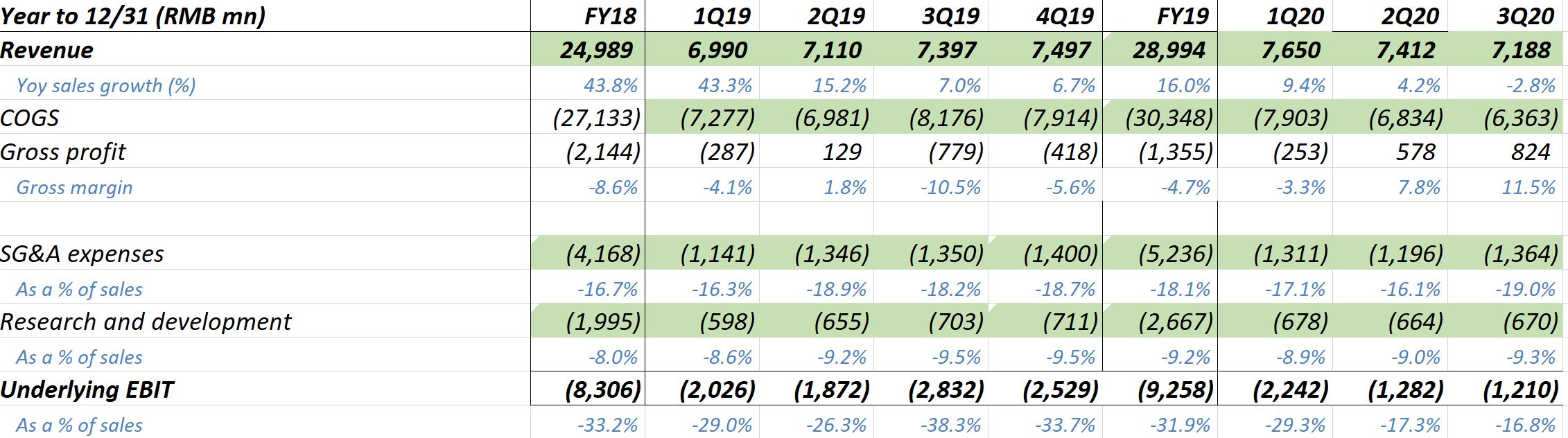

The capital injection comes after sales slowed in the third quarter and a reduced cash position. The company’s revenue decreased 2.8% year-on-year (YoY) to about RMB 7.2 billion (USD 1.1 billion), compared with a 4.2% YoY increase in the second quarter.

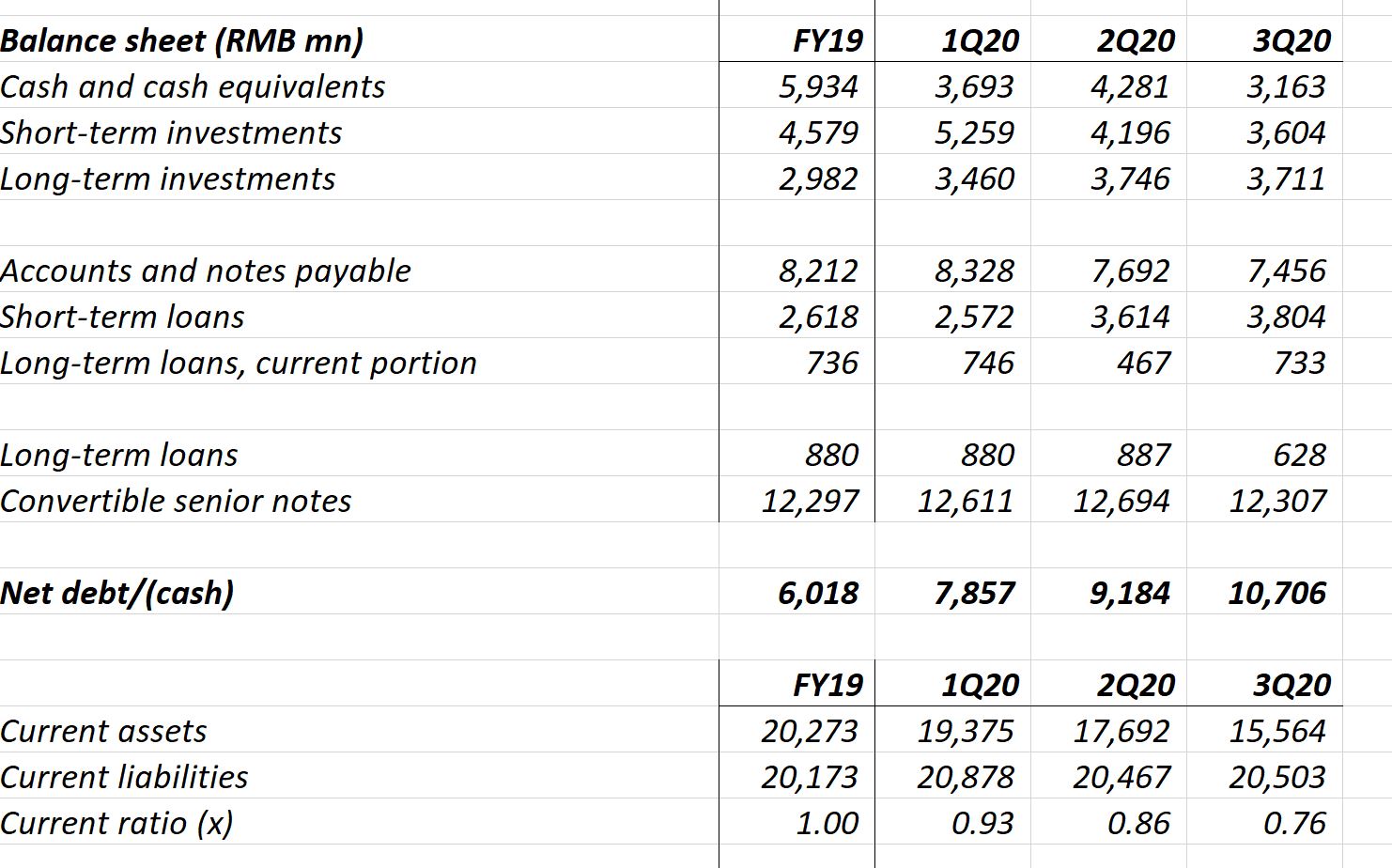

Its cash and cash equivalents decreased from about RMB 3.7 billion (USD 564 million) in the first quarter to RMB 3.2 billion in Q2, while short-term investments, which could be sold for cash relatively easily, dropped from RMB 5.3 billion (USD 810 million) to RMB 3.6 billion over the same time frame.

iQiyi’s balance sheet remains stretched. The company burned RMB 1.6 billion (USD 245 million) in cash in the third quarter, draining its short-term liquidity, according to Global Equity Research’s Rickin Thakrar.