A slew of internet-first brands (IFB), popularly known as direct-to-consumer (D2C) brands, are giving traditional incumbents across segments a run for their money in the world’s second-most populous country.

An IFB or D2C brand bypasses the conventional method of multiple supply chain partners by marketing and selling products directly to the consumer. A new report by Praxis Global Alliance (PGA) Labs and Knowledge Capital, said the IFB market in India is evolving rapidly. These D2C brands operate in categories like food and beverages, clothing and apparel, personal care, electronics, appliances, and home and furnishings.

Some of the new IFBs which have gained consumers’ mindshare include online meat seller Licious, baby product sellers Hopscotch, personal care companies like Sugar and Wow Skin Science, electronics appliance retailer BoAt, coffee seller Sleepy Owl, and home furnishing provider Wakefit. Several IFBs have even crossed the revenue of INR 1 billion (USD 14 million) in India.

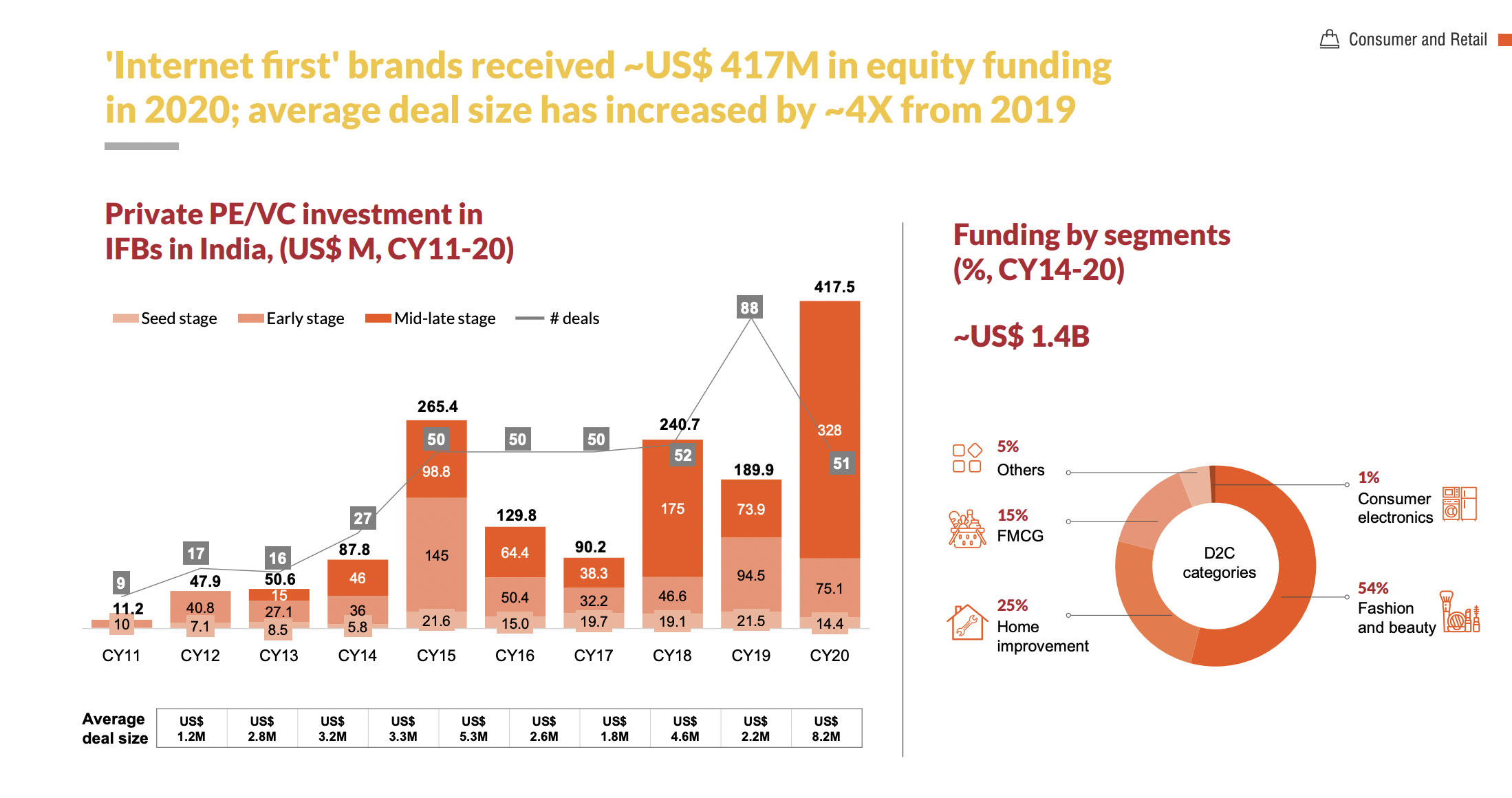

Investors have also begun to take note of these internet-first companies. This sector has witnessed an investment of about USD 417 million in 2020, as compared to USD 190 million a year ago. There has also been a 4x increase in average deal size which is over USD 8 million as compared to 2019, the report noted. Overall, almost USD 1.4 billion has been pumped into the IFBs between 2014 and 2020, with beauty and fashion accounting for over 50% of this funding.

The factors that are contributing toward IFBs’ rapid growth in the country include burgeoning online marketplaces and customer desire to try new brands and willingness to pay a premium for quality products.

The e-commerce market in India is growing at 25% CAGR and is expected to reach USD 67 billion by 2024. India is also likely to add 200 million online shoppers in the next five years to the current base of about 150 million.

According to the PGA researchers, IFBs have several advantages over traditional brands. While incumbent brands typically take nine to 12 months to launch new products, IFBs have been successful in launching products quickly, in three to four months since they have a deep understanding of online customers, they said.

“IFBs also have a high-focus on positive user experience as they control factors like delivery and packaging also, creating strong differentiation from incumbents,” they added. “Content plays a critical role in driving engagement.”

For these new-age brands, websites are the main channels for sensitization, engaging with the community, and brand development. They primarily use blogs, polls, tools, guides, and articles to engage continuously with customers.

However, increasing competition from traditional brands, limited scale, and low customer retention are challenges IFBs will have to overcome for continued success, the report added. Incumbent brands losing share to IFBs are fighting back by establishing a deeper online presence and leveraging deeper distribution capabilities

“D2C brands flourish for one major reason, their eyes and ears are continuously on what their customers want,” according to Rahul Gupta, investor, Times Internet.