Indonesian fintech startup Akulaku has raised a whopping US$70 million Series C round led by Chinese investor Finup (凡普金科) with participation from other investors including Sequoia India, BlueSky Venture Capital, and Qiming Venture Capital.

The new financing will be used towards horizontally expanding the company’s offerings as well as consolidating its positions in incumbent markets, including Indonesia, Vietnam and the Philippines — all growing rapidly in terms of online lending.

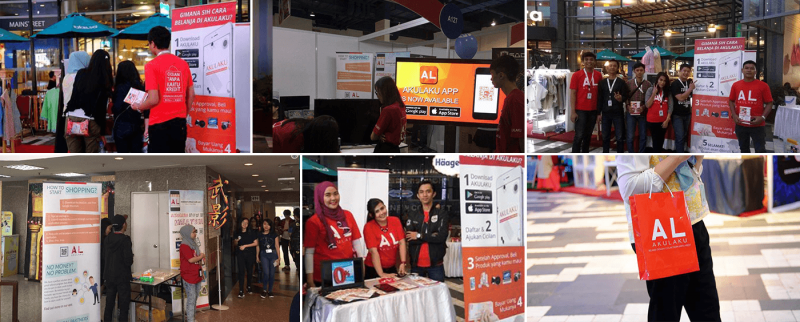

Akulaku, which means “goods sold out” in Bahasa Indonesia, was founded by Chinese national Li Wenbo in Indonesia in 2016.

Li, who used to work at Ping An Group, the country’s largest insurer, once launched a startup in Hong Kong in 2014, providing international remittance services that tap into the market of Southeast Asian house helpers working in Hong Kong in need of a cheap and reliable avenue to wire money back home.

Though Li’s remittance attempt flopped, he gained enough insights and knowhow from the experience to create the foundation of Akulaku.

“It’s very hard for local Indonesians to borrow from traditional banks as they don’t have enough to pledge, while the private institutions which are willing to lend, charge high interest rates. There is an untapped market in-between.” Li once told media in an interview.

Li’s fintech firm now provides instalment plans to consumers who do not have a credit card, so that they may buy goods online. According to its website, ‘hot products’ that consumers are buying include electronics like cameras, smartphones and gaming devices. Users can register via the app, get verified by filling up required documents, select the products they’d like to buy, give a down payment, and then receive a confirmation of the instalment plan selected. Users must pay the confirmed amount every month to avoid incurring interest charges.

The company claims to have more than 20 million downloads. It also has around 800,000 users who made transactions on its platform as of the end of 2017, and is targeting to increase the number to three million.