With the entry of global players such as Amazon India and Walmart-owned Flipkart in India’s soon-to-be USD 10.5 billion online grocery delivery market, Grofers and Bigbasket in their bid to secure their market shares saw their losses expand by 73% and 95%, respectively.

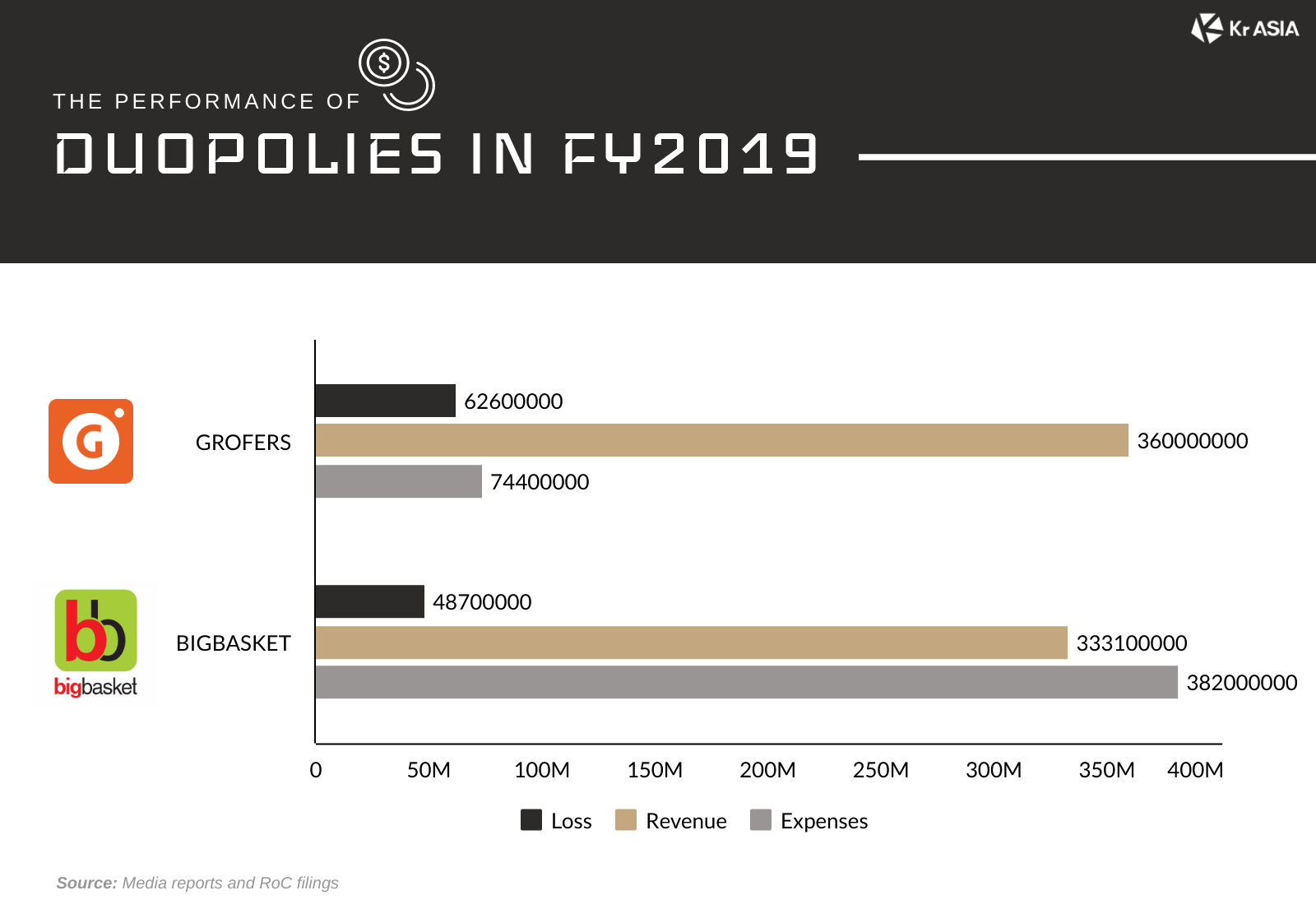

SoftBank-backed online grocery startup Grofers saw its losses surge to USD 62.6 million for the financial year ended March 2019. Revenue from operations (which primarily includes retail margin and commission from vendors) went up by 56% to USD 11.7 million from USD 7.5 million in FY18, as per the regulatory documents filed by the company. However, according to local media reports, the company clocked net sales of USD 360 million in FY19.

Meanwhile, Alibaba-backed Bigbasket’s retail unit, Innovative Retail Concepts, witnessed its losses shot up to USD 48.7 million in FY19. The Bengaluru-based company clocked a revenue of USD 333.1 million, up 69%, in the same time period.

Grofers expenses grew to USD 74.4 million in FY19 from USD 43.6 million in the previous year, while Bigbasket expenses shot up to USD 382 million in FY19 compared to USD 222.4 million in FY18.

“Grofers GMV (gross merchandise value) grew by 300% to reach INR 2,500 crores (USD 360 million) in FY 2018-19 and we are on track to double it to INR 5,000 crores (about USD 700 million) in FY 2019-20,” Grofers CEO and co-founder Albinder Dhindsa told wire service Press Trust of India.

Grofers in the past has said it is aiming for USD 1 billion in revenues (from sales) by next year. In May this year, Grofers raised USD 220 million in Series F round from SoftBank Vision Fund, Tiger Global Management, and Sequoia Capital at a valuation of around USD 800 million.

The same month, its bigger rival Bigbasket had entered the elite unicorn club after receiving USD 150 million in a financing round led by South Korea’s Mirae Asset- Naver Asia Growth Fund, UK’s CDC Group, and existing investor Alibaba.

According to media reports, Bigbasket co-founder and CEO Hari Menon said the company is currently focusing on attaining profitability and that he hopes that it would break even at the operational level in the top 10 metro cities by FY2020.

Indian online grocery market, which stood at USD 1.05 billion in 2018 contributing a mere 0.2% to the USD 525 billion worth food and grocery market, is projected to grow to USD 10.5 billion, accounting for 1.2% of the USD 880-billion total grocery market by 2023. According to Satish Meena, analyst at Forrester, grocery is one segment that guarantees high order volume and frequency of orders.

It’s a little surprise then that big companies that were nowhere near grocery segment till a few years ago, have off late entered this space due to the sheer amount of opportunity it offers. It has become the new playground for behemoths such as Amazon India, Flipkart, Swiggy, and Google-backed concierge service Dunzo. All these companies have in the recent past launched their grocery services in different capacities and with varying models but essentially they are all eyeing the same pie of the market.

Everyone is targeting grocery because ultimately, these companies want to be a part of the frequent purchasing pattern of users which happens across category in the grocery segment, Meena told KrASIA. “Grocery is certainly a volume-driven category because it has some of the lowest margins in retail, so it is going to be profitable, once enough volume is there.”