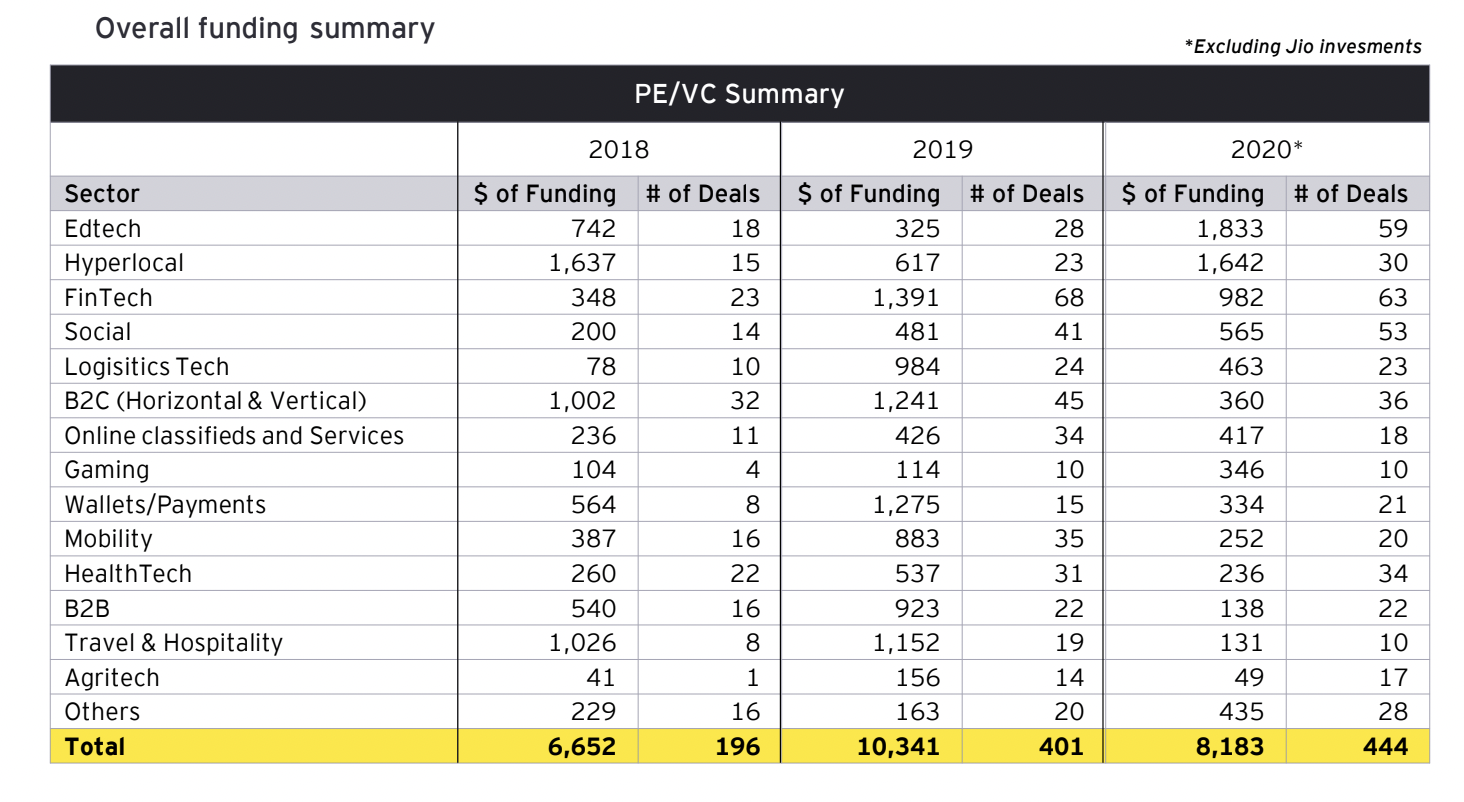

Indian e-commerce and consumer internet companies raised over USD 8 billion in private equity and venture capital across 400 plus deals in 2020, said a report released on Thursday by Ernst & Young and Indian Venture Capital Association (IVCA). Although, given the funding blip in the second quarter of 2020, these companies attracted 20% lesser than the USD 10.3 billion they raised in 2019.

The capital inflow has given rise to nine new unicorns in these segments last year including beauty retailer Nykaa, edtech firm Unacademy, used car sale platform Cars24, and omnichannel baby product and toy retailer FirstCry, among others.

A large part of the investment went into edtech and hyperlocal startups, collectively accounting for over 40% of the total money poured into these companies in 2020. Compared to 2019, online education and hyperlocal companies witnessed a 5x and 2x rise, respectively, in the funding amount they received in 2020, the report noted. Meanwhile, fintech and social commerce continued to keep investors hooked as the pandemic led to a steep rise in online transactions.

“Investment activity made a strong recovery in the second half of the year, and we witnessed greater participation from angel investors, family offices, corporate houses, current and former entrepreneurs,” Ankur Pahwa, Partner and National Leader of e-commerce and consumer internet at EY India, said in a statement.

“We are also witnessing increased participation across countries, many of them for the first-time providing credence to India’s startup growth story,” he said. “The positive investment activity showcases the global community’s confidence in India’s startups and highlights India’s ability to be a game-changer in the e-commerce and consumer internet sector.”

Interestingly, 75% of the PE and VC deals over the past two years in the Indian e-commerce segment have been small-ticket investments. This implies that there has been an increase in early-stage investments year-on-year, giving impetus to young startups, the report noted.

Pahwa believes India is at an inflection point, “with digital transformation witnessing mass adoption, bringing onboard a wave of first-time consumers and transforming the business landscape.”

Technology-enabled innovations across digital payments, on-demand services, analytics-driven customer engagement, and digital advertisements will drive growth in the e-commerce and consumer internet segments, he said.

Some key emerging trends that will play out in this space over the next few years include the rise of the direct-to-consumer model, omnichannel approach by large retailers, increasing use of deep tech, overseas expansion by homegrown e-commerce and consumer internet companies, and the emergence of super apps, the report noted.

In addition, IPO build-up, consolidation, and exits in the world’s third-largest startup ecosystem are expected to significantly boost investor activity and confidence in India.

“Lenskart, Flipkart, Delhivery, and Nykaa may launch bellwether IPOs and unleash the potential of the sector. The government is a huge enabler of this shift and is working along with the investors, startups and industry bodies like IVCA to support the growth of the sector,” Karthik Reddy, managing partner, Blume Ventures and vice-chairperson, IVCA, said in a statement.

Besides, there is a new class of angel investors comprising experienced professionals and successful entrepreneurs, who are investing alongside institutional investors, which helps investee companies source talent, gain operational and strategic benefits, the report added.

Also read: The rise of micro venture capital funds in India

Reddy believes the next phase of e-commerce will be driven by a surge of demand from tier 2 and tier 3 cities and towns in India as the country will see the next 100s of millions of consumers coming online.

“A new wave of investments in this sector in both B2B and B2C commerce are creating a huge gig economy. Several sub-sectors have emerged, and innovation is going to storefronts, local commerce, and e-commerce infra and payments,” he said.

The EY-IVCA report projects Indian e-commerce industry to be worth USD 99 billion by 2024, growing at a 27% CAGR over 2019-24, with grocery and fashion and apparel segments fuelling the incremental growth. In consumer internet space, edtech is expected to grow 3.7x in the next five years–from USD 2.8 billion in 2020 to USD 10.4 billion, while the growth of fintech during 2020-25 is projected at 22.7% CAGR.