As countries around the world shut their international and local borders to contain the spread of COVID-19, a latest CB Insights report has revealed that the technology companies this year attracted the lowest Q1 venture capital funding globally, since 2017.

The report with a focus on fintech companies, said VC-backed fintech activity in Q1 2020 dropped to USD 6.1 billion across 404 deals, the worst first quarter since 2016. The CB Insights report said, “investors pulled back on early-stage bets to focus on fortifying portfolios for a forecasted recession.”

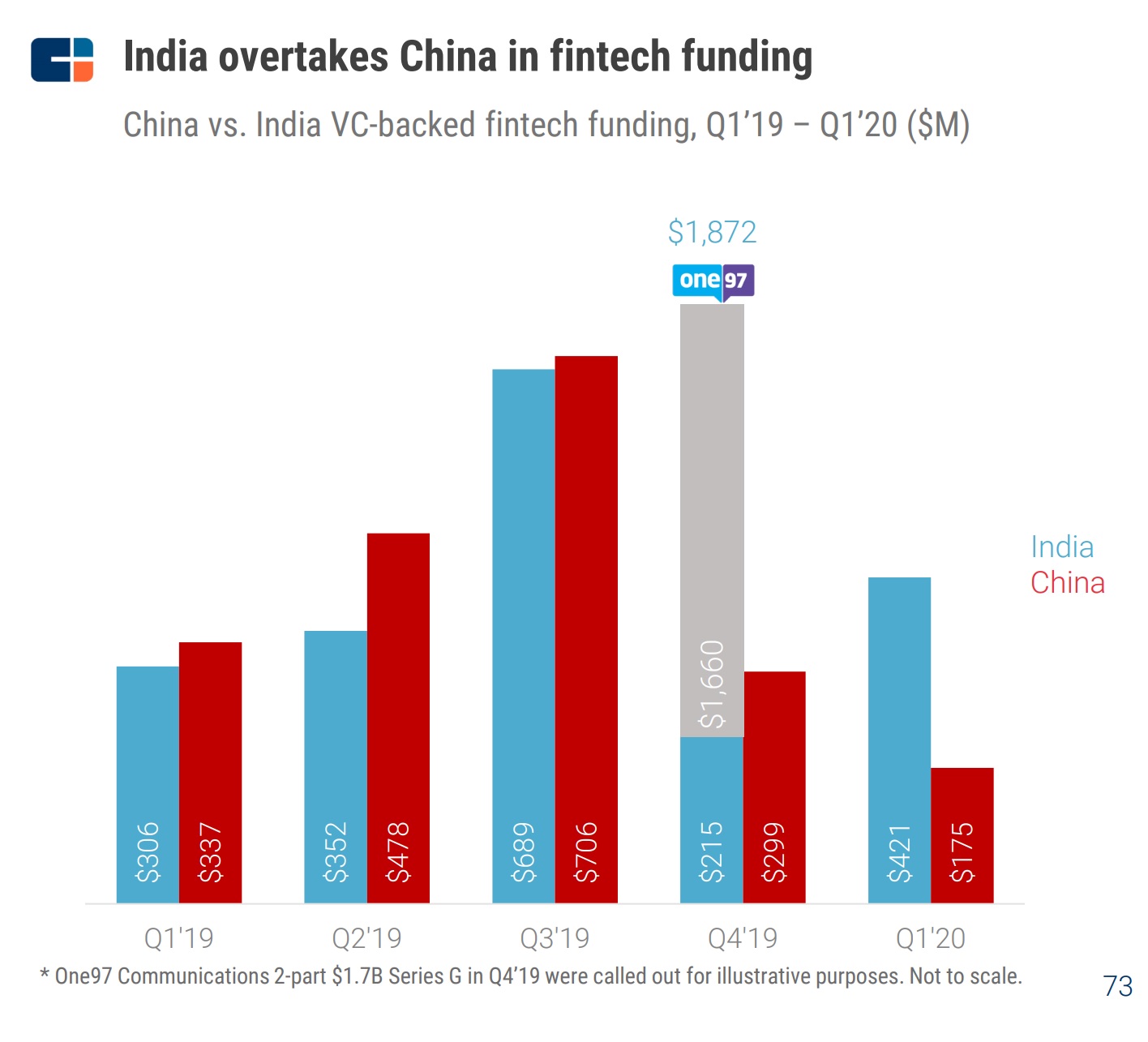

While fintech companies in Asia saw a dip of 69% in VC funding to USD 883 million, Indian fintech companies surpassed their Chinese peers and attracted more than double of what Chinese fintech startups raised. Although, both the countries saw 29 venture capital deals, Indian fintech startups raised USD 421 million compared to USD 175 million that their Chinese counterparts managed to raise in the first quarter of this year.

“Though Chinese investors were the first to feel the impact of COVID-19, resulting in a pullback on deals, the ripple effect quickly spread to other countries including India which tied with China for 29 deals,” the CB Insights report said.

None of the Indian fintech companies appeared in the top 10 mega funding rounds, which featured US, Swedish, and the UK-based companies. Earlier in March, digital payment startup FamPay landed USD 4.7 million in seed round from Y Combinator and others, GGV Capital in February, co-led a USD 60 million round in Rupeek, and BharatPe raised USD 75 million led by Ribbit Capital and Coatue Management.

According to the report, Ribbit Capital, Accel, and Sequoia Capital were among the top five most active funds who put money in Indian fintech companies from Q1 2019 to Q1 2020.

“As the first country to fight and start to recover from coronavirus, what happens in China could be a gauge of what’s ahead for fintech as the virus spreads across other regions,” the report said.

Another report by research firm Venture Intelligence said VC investment in Indian startups dipped by 22% totaling USD 1.74 billion funding in the quarter ended March 2020 across 126 deals.