India has emerged as home to the third-largest fintech ecosystem in the world. While the overall market size for Indian financial services stood at USD 500 billion last year, the fintech sector reached USD 31 billion, said a new report by Mumbai-based VC firm BLinC Investment Management.

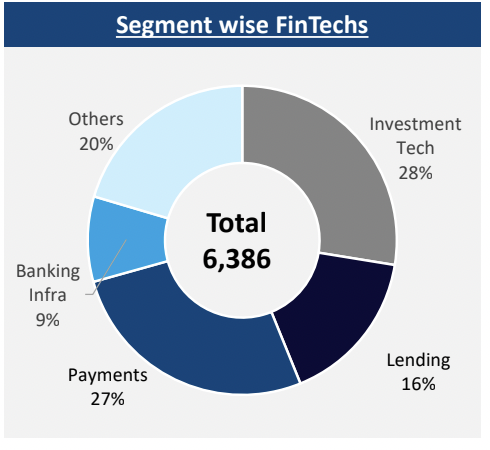

The South Asian nation has 6,386 fintech companies. Of the total, 28% are into investment tech, 27% belong to payments, 16% are into lending, as per the report. These three segments make up almost 70% of the fintech industry in India. While 9% of fintech companies provide banking infrastructure, the rest are spread across areas like insurance and neobanks.

Between 2016 and 2021, local fintech firms raised USD 16.5 billion, with 60% of the capital flowing into the country in the last three years. Overall, to date, investors have poured in about USD 24 billion across more than 1,000 companies in the financial technology sector, which has witnessed 162 exits, including 31 IPOs.

Indian fintech ecosystem has received over 25% of the total start-up funding in India and is expected to see increased traction from the investor community with the country witnessing strong digital adoption across all segments, said Amit Ratanpal, founder and managing director at BLinC Invest.

The Indian fintech sector is expected to grow at a 22% compound annual growth rate over the next five years, the report added. Aside from the mass digitization that kicked off in 2020 when millions of Indians began transacting online due to the COVID-19 outbreak, a favorable ecosystem is driving accelerated growth for fintech companies. It entails over 845 million internet users, the government initiatives to digitize public services, and expanding middle class—the country is projected to add 140 million middle-income and 21 million high-income households by 2030.

The fintech sector encompasses digital payments, lending, insurance, investment tech, neobanks, and banking infrastructure. Of all the segments, the BLinC report said digital payments in India are maturing fast and are expected to reach USD 95 trillion by 2025, driven by the adoption of Unified Payments Interface, a government-backed bank to bank payment instrument. UPI transactions in India reached 38 billion in 2021, amounting to INR 71.59 trillion.

Some high-profile digital payment companies include Paytm, Razorpay, BillDesk, Pine Labs, and BharatPe. The digital payments sector has low customer loyalty because of increased competition, the report said. Other challenges include the rising cost of customer incentives and increasing regulatory restrictions such as KYC for digital wallets and data localization.

Digital lending is projected to reach USD 350 billion by 2023. After slumping down in 2020 due to the pandemic, the segment picked up last year and is expected to grow faster despite stricter regulations. This is due to the fact that in India, only 20% of small and medium enterprises have credit access compared to 87% in the US, leading to a huge credit gap of USD 230 billion in the micro, small, and medium enterprise space.

Most investors are funding companies that are providing working capital loans, doing direct lending to consumers, or offering point of sale financing. Digital lending companies have also evolved, using consumer data to develop targeted and customized products and lower their default rates.

Meanwhile, with the rise of insurance tech companies, the country’s insurance market size is expected to reach USD 250 billion by 2025, the report said. Only 3.7% of the population avail insurance products, as compared to 11.4% in the US. Notably, smaller ticket insurance policies for high-usage products like electronics are gaining traction.

Investment tech and neobanking services are two emerging areas in the fintech market. Investment tech is projected to become USD 14 billion by 2025, with users from smaller cities beginning to explore wealth tech products. This market remains hugely untapped, as only 12% of Indians have invested in mutual funds, as opposed to 75% in the US, the report notes.

“The rise in personal wealth, adoption of digital channels, and information availability will drive retail investors,” the report added. “Many wealth tech-related models are at a nascent stage in India and are expected to grow with the need for standardization and transparency.”

Wealth tech companies that allow users to invest in mutual funds, offer expense management, and provide robo-advisory services saw the most funding from VCs.

Neobanking is expected to be a USD 15 billion market by 2026. Presently, neobanks in India currently operate by creating strategic partnerships with traditional banks and providing services on behalf of existing ones.

“Neo-banks will continue to grow by catering to the vastly underserved SME market and providing a far superior and seamless digital banking experience leading to increased levels of digitalization,” said Ratanpal.